T Spinoff of Warner Media to DISCA Sparks Selloff; Buy Stock? Sell Puts? Sell Covered Calls Options?

Cautiously trade stocks, covered calls options and cash secured puts options with me for a year. Then you should have a nice total returns trading business.

By Donald E. L. Johnson

Cautious Speculator

AT&T will spin off Warner Media to Discovery in the second quarter.

T shareholders will get .24 DISCA shares for every share they own.

T will cut its dividend to $4.44 per year from $8.42.

T puts and calls options look attractive

More AT&T dividend investors are unhappy with T’s decision to spinoff Warner Media to Discovery Warner Media (ticker DISCA to become WDB after deal closes in the second quarter). T will own 71% of DISCA’s shares.

Whether AT&T will sell its DISCA shares to raise cash, reduce its debt and buy back its shares is unknown. If it did, that probably could depress the price of DISCA’s shares, and the possibility of such a huge sale could depress DISCA’s shares for a long time.

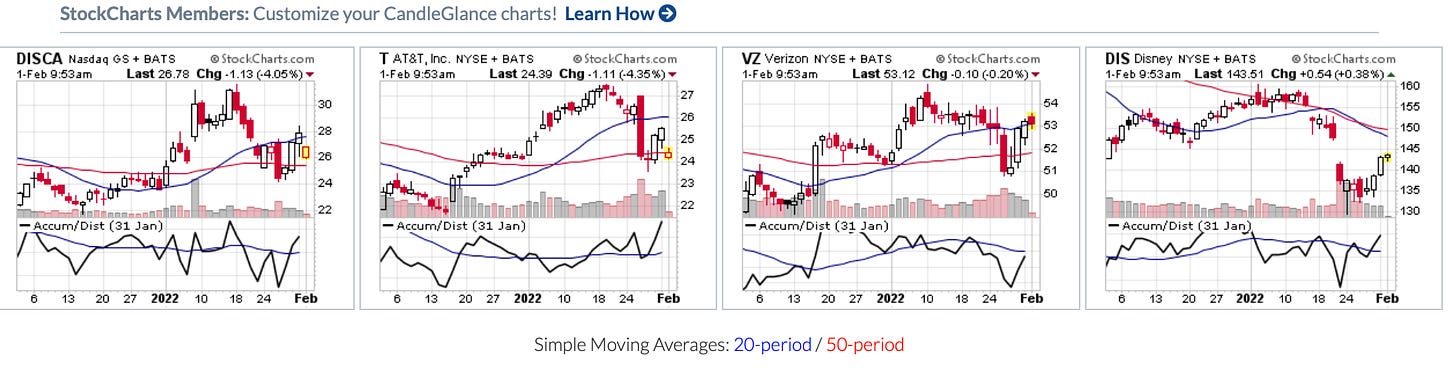

T and DISCA are sharply lower at $24.26 and $26.47 respectively. Please click on image and zoom in.

Lower stock prices and increased volatility raise premiums for speculators who decide to sell T 3.18.22 $20 strike cash secured puts. I own T and am short T 2.4.22 $22 puts, which expire Friday. If T closes below the $22 strike price and my puts are assigned to me, I’ll take the stock. It still will have a good dividend of close to 5%, options are suddenly more active and liquid and T should hit its estimated fair value of more than $30 sooner than later. At the moment, it is at $24.25.

Traders also could buy T at the new discounted price and then sell (write) T 2.18.22 expiration $23 or $24 strike covered calls. Look for the prices of the stock and its options to fluctuate quite a bit for a few days, if not longer.

While T today announced that it will cut its quarterly dividend to $1.11 per share (about a 4.4% yield) from $2.08 (8.16), its spin off of Warner Media, which includes CNN and HBO, will amount to the equivalent of more than a $5 per share special dividend (Special dividend= T price x 0.24). This will not be taxable for shares held in IRA, 401K or other tax sheltered accounts.

On SeekingAlpha.com, a lot of commenters were unhappy with the spinoff. But they have been unhappy with AT&T for years. My comment was:

The trade is a bet that the values of T and WDB will gain as a result of their restructuring. They both are in very competitive industries and markets.

T's options might become more volatile making its covered calls and cash secured puts options premiums more attractive. Options traders will continue to generate incomes of 10% and higher annually by collecting the 4% to 5% dividend and options premiums on relatively low risk weekly, monthly and longer puts and calls trades.

Traders who have the companies in IRAs and other tax sheltered accounts won't have to worry about income tax consequences of the deal.

Markets change, businesses change and stock outlooks and prices change. That is why buying and holding a stock makes little sense. Traders who are paying attention and taking advantage of opportunities created by change are doing fine.

If you are looking for a relatively safe dividend stock, consider XYLD. It pays a monthly dividend that changes fairly frequently depending on the premium income it generates trading covered calls and cash secured puts, among other things. Its options can be traded by experienced speculators, but the volume of options trades is nil and the liquidity is poor. That makes getting trade orders filled takes a little time and work.

Question: Will you hold T, buy, sell or sell T puts and calls?

LINKs:

WSJ.Com AT&T to Slice Dividend After Spinoff of Warner Media

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks at any time. I own T and have options on the stock.

@realDonJohnson

$T closed at $24.56, +.02 on low volume; DISCA $28.93, +1.24 on low volume. Incredible in a down market.

T $24.82. CEO on CNBC's Squawk Box Friday a.m. Doing pretty well despite CNN upheaval.