Solid Dividend Growth Stocks for 2023 Income Stocks and Options Income Investors.

When the markets are taking stocks to more reasonable price levels, it is a good time to create stock watch lists that can be used when buying stocks makes sense.

By Donald E. L. Johnson

Cautious Speculator

Solid dividend growth stocks make sense for investors with long trading horizons.

Seniors with shorter life expectancies trade for the highest dividend and options premium income they can find without taking excessive risks.

While the stocks mentioned below look solid, I don’t buy REITs.

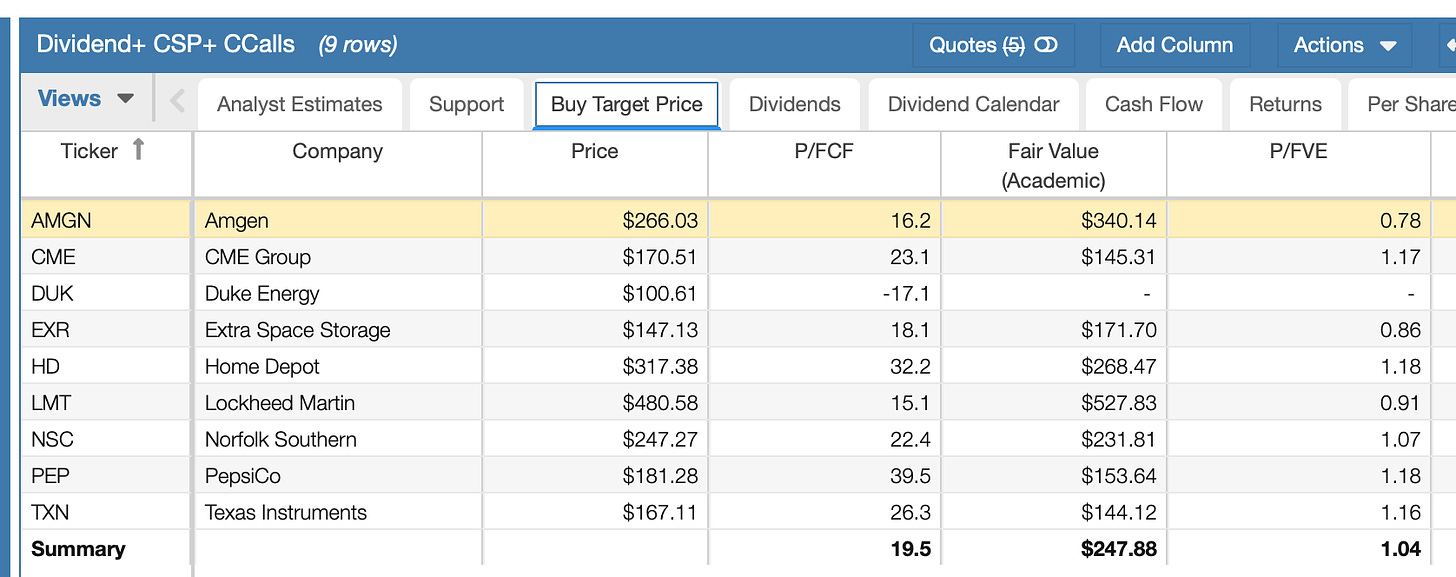

In terms of price to free cash flow ratios, these stocks range from reasonably priced to over bought.

Instead of buying them, a trader might sell short-term cash secured puts until the stocks are lower priced.

Leo Nelissen proposes nine stocks for a $100,000 (or $1 million) dividend portfolio. His piece is written for people who are young and have 20- to 30-year time horizons.

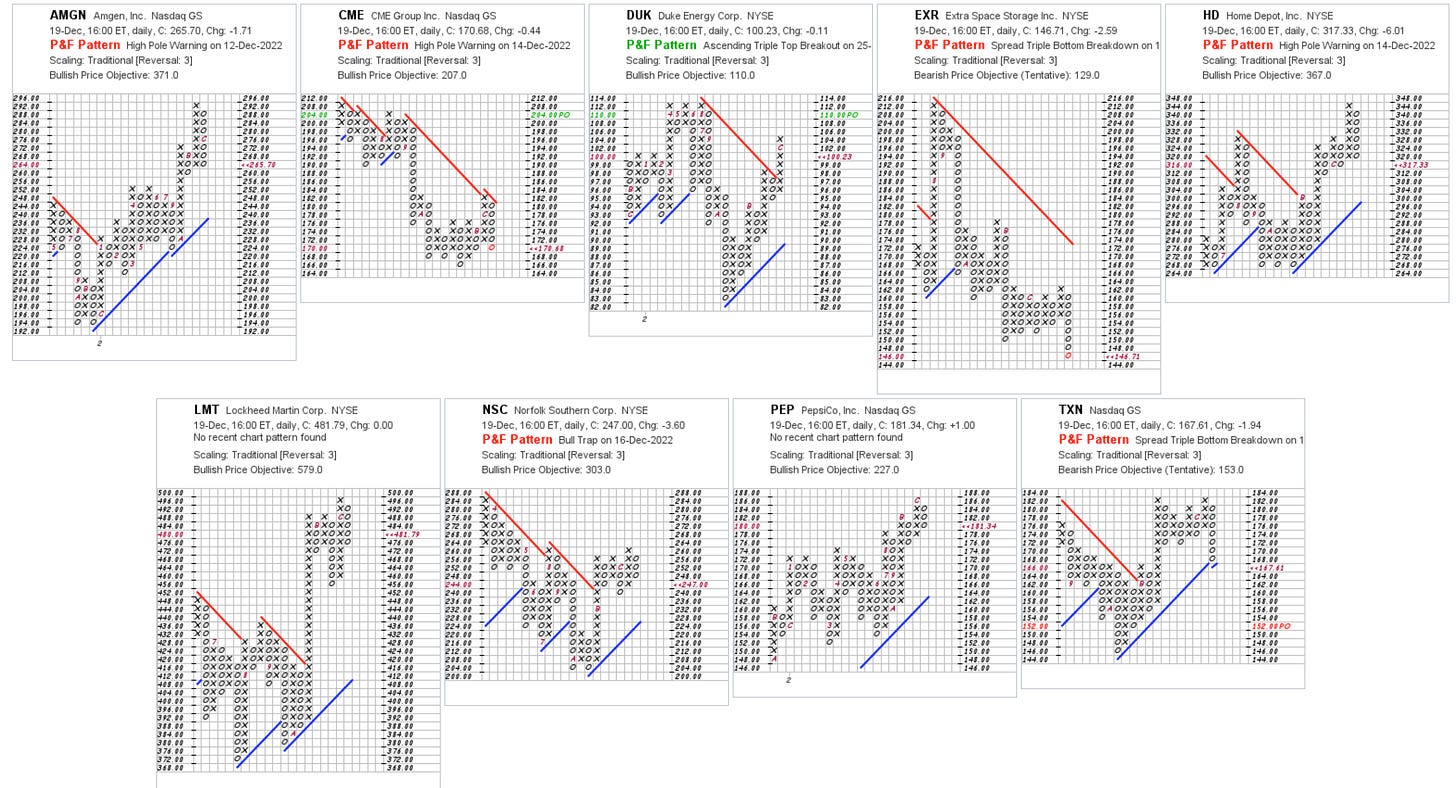

Source: StockCharts.com. Please click on image and zoom in for a better view.

As a senior, I'm looking for strong stocks that have the potential to yield better dividends, a steady stream of options premiums from selling covered calls and cash secured puts and capital preservation, if not capital gains.

Dividend growth rates are a low priority for my short time horizon. Instant gratification with good income is my old man's top priority.

These stocks (except EXR, a REIT) will go on my prospect lists.

My strategy in this bear market is to not buy the stocks but to sell cash secured puts at strike prices that I would like to pay for them. I'll sell the puts that expire in about 14 to 21 days. This will allow me to sell out of the money puts at low deltas several times until the markets and stocks bottom out. If the stocks prices rise, the puts will expire worthless and I’ll keep the options premium income.

Then I'll sell at the money (ATM) puts to lower the net debits on the stocks and start selling ATM calls on them until they're called. Then I'll sell puts on them again. See the links below to the home page where you’ll find my previous articles on trading covered calls and cash secured puts. Net debit equals stock price less earned dividends and options premiums.

Ultimately, I'll try to make my target income for each month and each year. That is more important to me than beating the market or achieving average yields of 10% to 20%, which is very possible in bull markets. That is not so likely in bear markets.

The average price to free cash flow ratio on these stocks is 19.6%, ranging from -17. for DUK to 39.5 for PEP, according to StockRover.com. I like them to be under 20 but I sometimes trade over 30 P/FCF stocks.

The stock shown above are trading at about 1.04 times Stock Rover's "academic" fair value estimates. These are fairly over bought stocks.

They're trading an average of 7.5% below analysts' estimates and at about 78% of their high estimates, which are expected to fall over the next 12 to 18 months as we go into a soft or hard recession.

The average three-year beta is .83, which is very defensive.

The stocks are trading at 83% of their 52-week highs, 101% of their 50-day moving averages and 100% of their 50-DMAs.

Their average yield is 3.2%; earnings yield is 4.8%, buyback yield is 2.3%. If a trader gets a 7% yield on options trades, the annualized taxable yield is an easy 10% or better, especially in IRAs.

Their average Chowder Rule 1-year percent is 6% and the 3-year Chowder Rule percent is 6.5%. StockRover.com says, "Calculated as the sum of dividend yield and the 5 year compound annual dividend growth rate this metric was popularized on Seeking Alpha by user Chowder to find good investments. In its simplest form values over 12% are desired."

My Trades

I didn’t do any trades today. I’m heavy in cash and trying to let the markets find lower prices for me before I do many trades. Meanwhile, I’m creating watch lists.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.