Should You Trade Puts Options on 7 Stocks in the News? JNJ, KR, LUV, MAT, MCD, PTON, WHR

Cautiously trade stocks, covered calls options and cash secured puts options with me for a year. Then you should have a nice income and total returns trading business. You won’t need me anymore.

By Donald E. L. Johnson

Cautious Investor

Every Saturday, The Wall Street Journal publishes “The Score, the business week in 7 stocks” on page B-2. I can’t find it on wsj.com. This just one of many ways to find and evaluate trade ideas.

Johnson & Johnson

The seven stocks are: Peloton, Johnson & Johnson, Whirlpool, Kroger, Mattel, McDonald’s and Southwest Airlines.

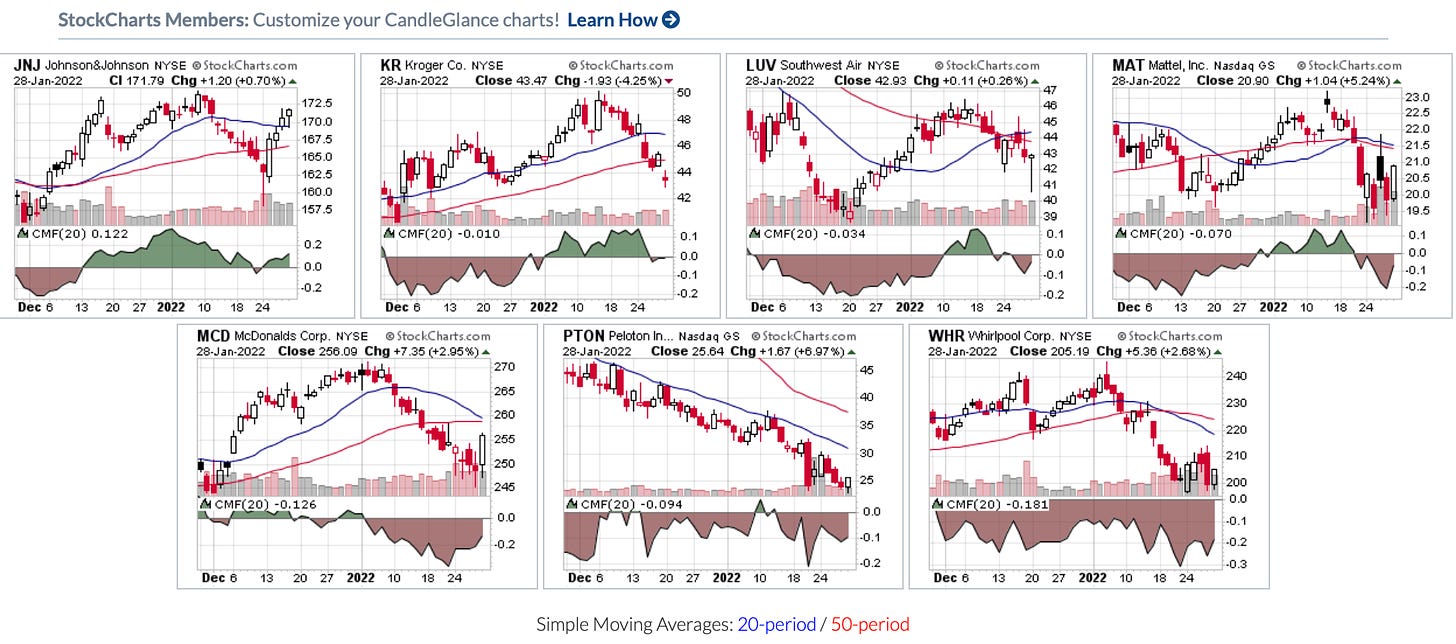

JNJ is the only one in the group with a bullish Chaikin Money Flow. That indicates institutional portfolio managers are buying. JNJ also is the only one trading above its 10- and 50-day moving average, which is bullish. Traders who sell cash secured puts (CSP) and covered calls stock options prefer to sell them on bullish stocks with good options volume and liquidity.

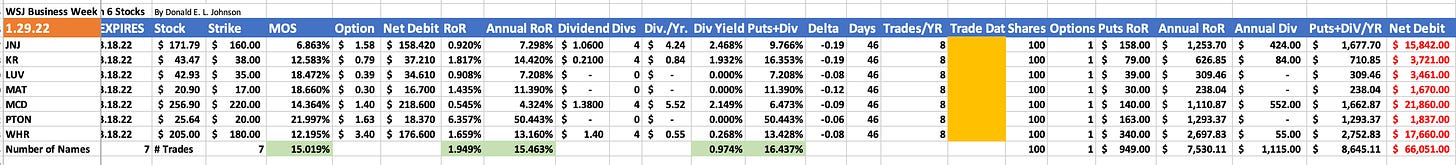

Here is my spreadsheet and calculator, which I also use to track my trades. Feel free to replicate it. One service sells similar calculators for over $500 a year.

Our mission

This article is more about how to trade to generate reasonable monthly and annual incomes from dividends, options premiums and capital gains than about what to trade.

What is traded is up to every investor based on their financial situations, time horizons and risk management skills and inclinations.

Whether you are at the beginning, middle, near the end of a career or in retirement, most people need hobbies or side gigs (second jobs, businesses) to generate enough income to maintain their life styles and keep their minds young. That is what this newsletter is all about.

Trading is like playing chess, bridge or poker. After every trade, game or hand, you deal the cards and to another trade. But you get to rig the odds of winning in trading stocks and options by making good trades with good odds. You don’t need to find playing partners. This is a work from home business.

I want to help people learn to use their wealth, smarts, courage, discipline and work ethic to enhance their dividend income, enhance capital gains and hedge against stock and market corrections.

Selling puts for income

One way to earn puts premium income is to sell cash secured puts. The puts are secured by cash equal to the cost of buying the stock or ETF as collateral. If a put is assigned, the cash pays for buying the puts. Of course, there are risks. Life is risky. A bit of luck helps.

For cautious income and total returns traders who own the stocks and want to buy some more of them on the dip or during a correction, it might make sense to sell cash secured puts (CSP) on JNJ, KR, LUV, MCD and WHR. They are all great companies, their options are liquid and a lot of people are long-term owners. As the comments below show, I have concerns about most of them.

Selling stock puts options is a bullish trade because it is a contract to buy 100 shares per option contract at the strike price if the price of the stock is under the stock’s price after the options expire, in these examples, options expire after markets close on March 18, 2022.

If stocks are put to the sellers, the new owners of the stock can sell the stock, sell covered calls or wait for the stock to rally before selling covered calls or selling the stock.

To avoid having stocks assign, a lot of traders buy back the options at smaller than planned profits or at losses, which can be big and small, depending.

Speculators can take more risks

Speculators may want to sell MAT and PTON at very out of the money (OTM) strikes and high margins of safety (stock price-strike price discount).

Deltas show two things. The most important for options traders, is the probability that a CSP will be assigned or a covered call will be called. On JNJ the delta is -.19, or a 19% probability of assignment. The margin of safety on this drug and medical devices stock that is going through major structural changes is only 6.83% in this example.

Also, if a stock changes $1 per share, its options price will change in the same direction by about its delta. If KR falls $1, its delta is -.19 and the price of the option will drop $0.19.

This is about the 15th version of this Excel spreadsheet, which I’ve just modified. It is all about simple math and algebra. I’m a numbers phobe who started using the long-forgotten Super Calc about 40 years ago after I got my first PC.

When you enter the variables in a spreadsheet, include your notes about the stock. That will crystalize your thinking. It took a little over an hour to copy this spreadsheet and put it together as a possible trading plan.

About the stocks

JNJ. Ex. div. 2.18.22. Earnings 1.25.22. Big spinoff a concern. Hard to analyze. Analysts like it.

KR. Ex Div 2.14.22, Earnings 3.3.22. Benefitting from the pandemic and eat at home era.

LUV. Strong quarterly earnings recovery. More travel slowing COVID variants coming?

MAT. AVOID. Disney toy deal bullish. But lightly traded, illiquid puts options make getting easy and good order fills more tricky. No dividend. Earnings 2.9.22, which increases risk.

MCD. Owners might sells puts and covered calls for income while waiting to see if inflation problems ebb.

PTON. Cautious investors Avoid. Speculators may buy on activist investor news and possible acquisition talk volatility.

WHR. Great company. Supply chain, inflation, slower economy headwinds. Needs high MOS.

Controlling assignment and price risks

Generally, inexperienced traders try to avoid trading puts and calls on stocks when earnings reports are scheduled while the options are open. More experienced traders take more risks. Stocks often move sharply just before and after a company reports its earnings.

Similarly, the smaller the margin of safety, the lower the RoR. The lower the delta, the lower the risk of assignment and the lower the RoR.

The more diversified a portfolio, the less risk. Several small trades on lower priced stocks are better than one or two options trades on high priced stocks. At Yield Busting Corner, members like to trade about dozen options a month. Another way to diversify trade timing risks is to do a trade a day or a few trades each week.

Question: Which of these stocks would you sell cash secured puts on? Why or why not? Please use the comments section below this article.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks at any time. I do not own and nor have options on the stocks mentioned in this article.

For me, I like JNJ, but don't trust the earnings ,so I would probably do MCD