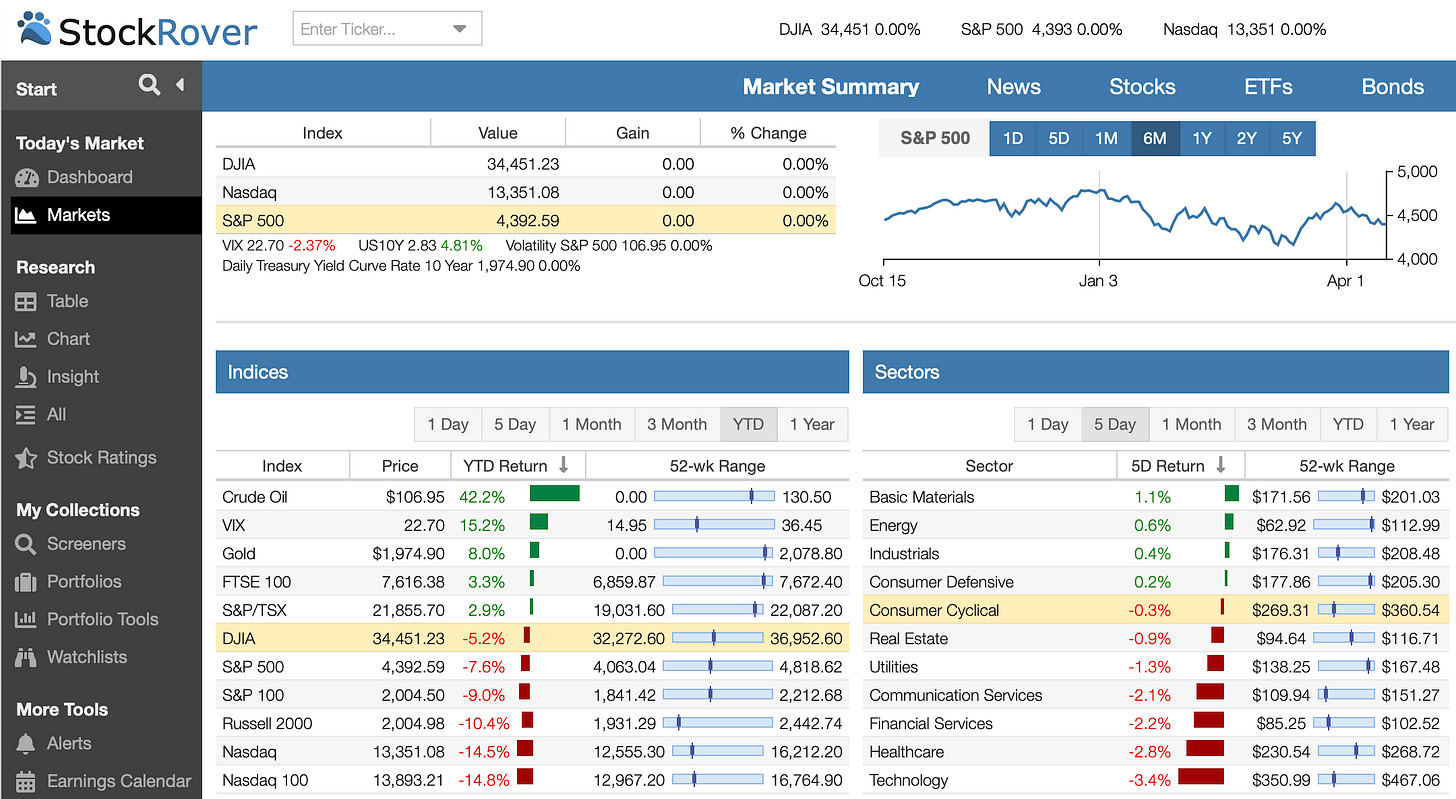

S&P 500 (SPY) Is Down 7.6% YTD; Covered Calls Stock Options Can Be Good Bear Market Hedges, Dividend and Income Trades

Pick good under valued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E.L. Johnson

Cautious Speculator

SPY is down 7.5% year to date.

Dividend stock portfolios hedged with cash and covered calls are near break even YTD.

Bullish traders might buy SPY, sell covered calls, or sell cash secured puts.

Bearish traders are likely to stay in cash.

Covered calls and puts trades ideas are offered.

The S&P 500 index and SPY, the exchange traded fund that tracks the index, are down about 7.6% year to date.

But if owners of SPY have been selling and rolling SPY covered calls since the first of the year, they’re probably at break even or up YTD on the ETF. I last wrote about selling SPY covered calls and puts on March 17.

Dividend stock investors who have been selling SPY covered calls this year have been collecting about a 1.49% annualized and collecting dividend puts calls premiums at an annualized rate of up to 30%. Annualized returns on risk (RoR) that high provide a nice long-term hedge against a bear market.

In addition, by selling 7- and 14- or even 30-day duration SPY covered calls stock options at fairly high deltas of, say, .25, have a 25% chance of having their calls assigned. When that happens they collect both the options premiums and short-term capital gain. If the trade is done in an IRA or other tax sheltered account, the trade and income are tax free.

Sell covered calls on bullish stocks, ETFs

That is this the recent history. What about the future, which might include an extended bear market?

Selling covered calls and cash secured puts are bullish trades. But often they’re done in uncertain and moderately bearish equities when traders think that they can take advantage of a price snap back.

For options traders looking for the markets to bottom soon, there are several possible bullish trades in SPY options.

If a trader is mildly bearish and hoping to take a quick capital gain and wants a bigger hedge against a price drop, buy SPY for about $437.79. Then sell SPY 5.2.22 (15 days) expiration $438 strike (delta .50) calls for about $6.91, or about a 34% annualized RoR. If the call is exercised, the annualized RoR would be about a 35% annualize RoR plus the 1.25% dividend. Ex dividend is June 18. A .50 delta indicates that there is about a 50% probability that a call option will be exercised, or called.

Traders who are more bullish and don’t expect the calls to be exercised or don’t want them to be called, might buy SPY at $437.79. Then sell SPY 5.20.22 (33 days) $450 strike (delta .31) for about $4.52 per share. That would generate about a 10.8% annualized RoR if the stock wasn’t called and about 40% if it was called.

Bullish speculators who own SPY and don’t want to take profits or losses on it, can reduce the probability of having covered calls exercised by selling lower delta and higher strike calls. For example, sell SPY 5.20.22 $457 strike (delta.19) covered calls for about $2.21. That would result in about a 5.3% annualized RoR if the ETF wasn’t called and about 51% annualize RoR if the calls were exercised.

The risk is that the markets will continue to decline. The calls won’t be exercised and the covered calls will collect 1.25% dividends and 3% to 25% or higher annualized premiums until the ETF is called at a profit or loss. How to trade depends on a trader’s view of the market and actual market conditions.

Selling cash secured puts is a bullish trade

Another bullish trade that could be done in addition to or instead of buying SPY and selling covered calls would be to sell cash secured puts. When CSPs are sold, a speculator puts up cash equivalent to the cost of buying the stock or ETF at the strike price.

In this kind of market, a trader can sell SPY 5.20.22 $430 strike (-.39 delta) puts for about $8.14 per share, or an annualized RoR of about 19.4%.

Or a trader might do the trade with a 10% margin of safety (MOS) of about 10. That would involve selling SPY 5.20.22 $400 puts (delta -.13) for about $2.56 a share. The annualized RoR would be about 6%. MOS equals the stock price minus the strike price.

In a bullish market, lower strike prices might appeal to more traders.

The risk in selling cash secured puts is that for some reason the market plunges more than 10% and the puts are exercised at the $430 or $400 strike sticking the trader with an instant loss on the ETF.

During the 1987 market crash, puts sellers were frozen out of the market and crushed, according to Black Monday and the future of Financial Markets by Robert J. Barry, Eugene Fama, et al (Irwin 1989).

The stock selling during the crash so overwhelmed buyers that options traders stopped buying or selling puts. Options prices plunged with stocks. As a result of the market freeze and lack of market liquidity, puts were assigned at strikes far above the prices of the stocks at the time that the puts options expired. Traders who were short puts couldn’t but them back to cut their losses.

Options markets were restructured after the 1987 crash. But that still doesn’t protect CSP sellers who sell a stock and watch plunge before they get a chance to buy the options back to cut their losses. Sometimes stocks plunge more than 10% in a few days. If traders don’t pay close attention to their trades, they can get hurt.

This is why it is important to do several small puts trades way out of the money instead of selling puts on only one or two equities. Diversified options portfolios are as critical to long-term profitable trading as diversified stock and ETF portfolios.

Please subscribe. It is free for now.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

12 DJI 30 Stocks Are Winners Year to Date; Good Covered Calls, Options Trades Ideas.

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I do not own and have options positions on the securities mentioned. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.