My 11 Covered Calls Options Trades

What I'm doing in the markets is trading covered calls and cash secured puts for dividends and options trading income. I can't pick a stock for 2023. Nobody can.

By Donald E. L. Johnson

Cautious Speculator

Dividend stock investors who trade covered calls and cash secured puts for income don’t have to pick a stock or exchange traded fund for 2023.

We just have to keep doing options trades for options premiums and dividend income and manage our risks.

My 11 covered calls trades are shown below. My 22 puts trades will be published tomorrow along with my revised puts spreadsheet.

No one knows what markets or individual stock picts or options trades will do in 2023, but anyone can update and create portfolios for the new year. The assumption is that as time goes on, investors will sell some of the stocks that they have in the beginning of the year and buy and sell cash secured puts options on new ideas.

In other words, instead of picking a stock or stocks for a portfolio for 2023, I will continue to disclose my recent trades. I’m hoping what I'm doing is more interesting than what I’m predicting.

My Trades

This newsletter is about the 11 covered calls trades that I opened on 10 stocks since December 12.

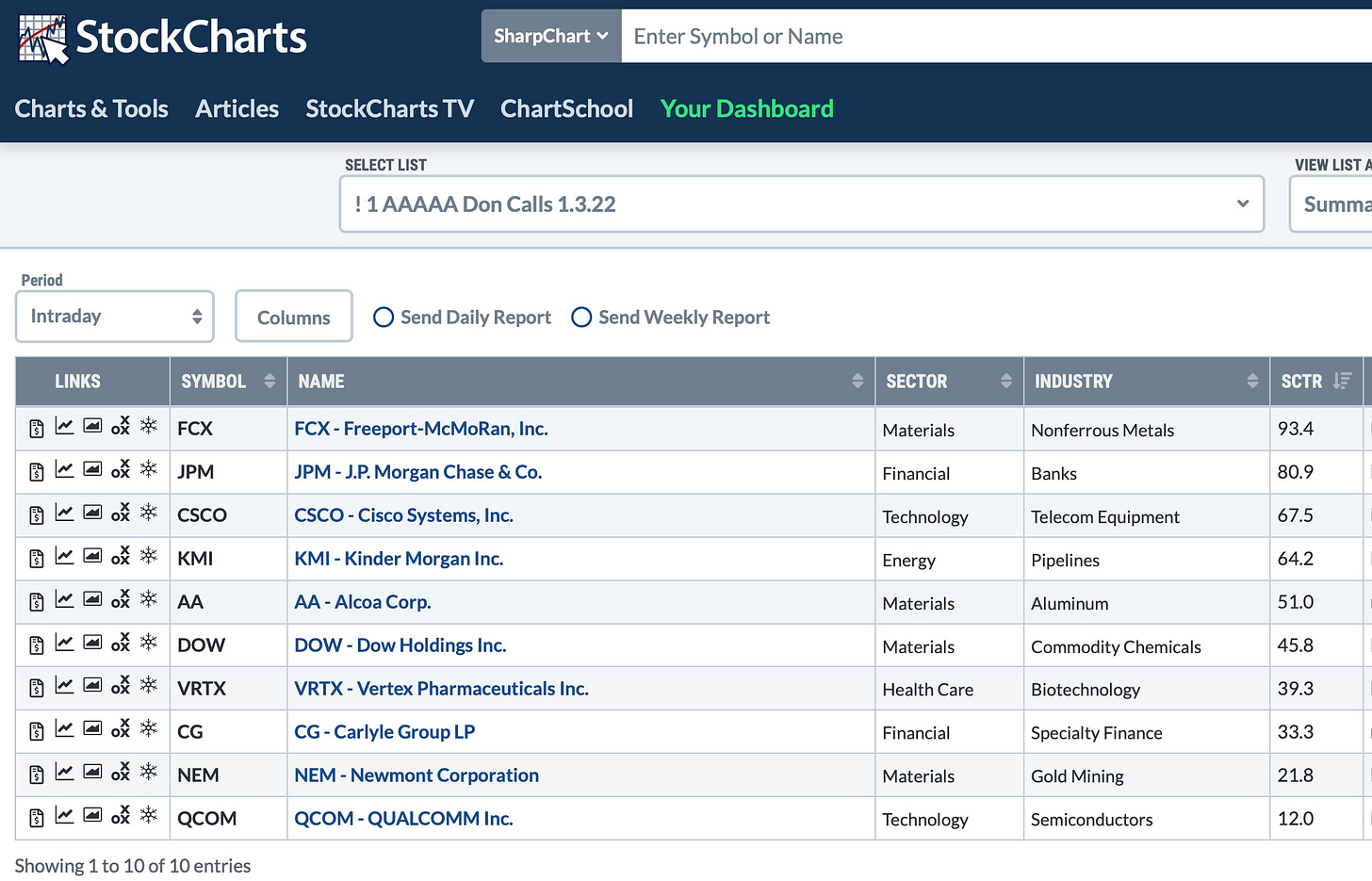

The Stock Charts Technical Ratings (SCTR) above are strong buys on the stocks I bought and sold covered calls on last week: FCX, JPM and CSCO. I also did a buy/write on AA. It’s 51 SCTR is the equivalent of a hold rating, I think. KMI is a long-time holding and one of my biggest positions. Its 64.2 SCTR is a strong buy rating. For more details, see my spreadsheets below. Please click on images and zoom in for better views.

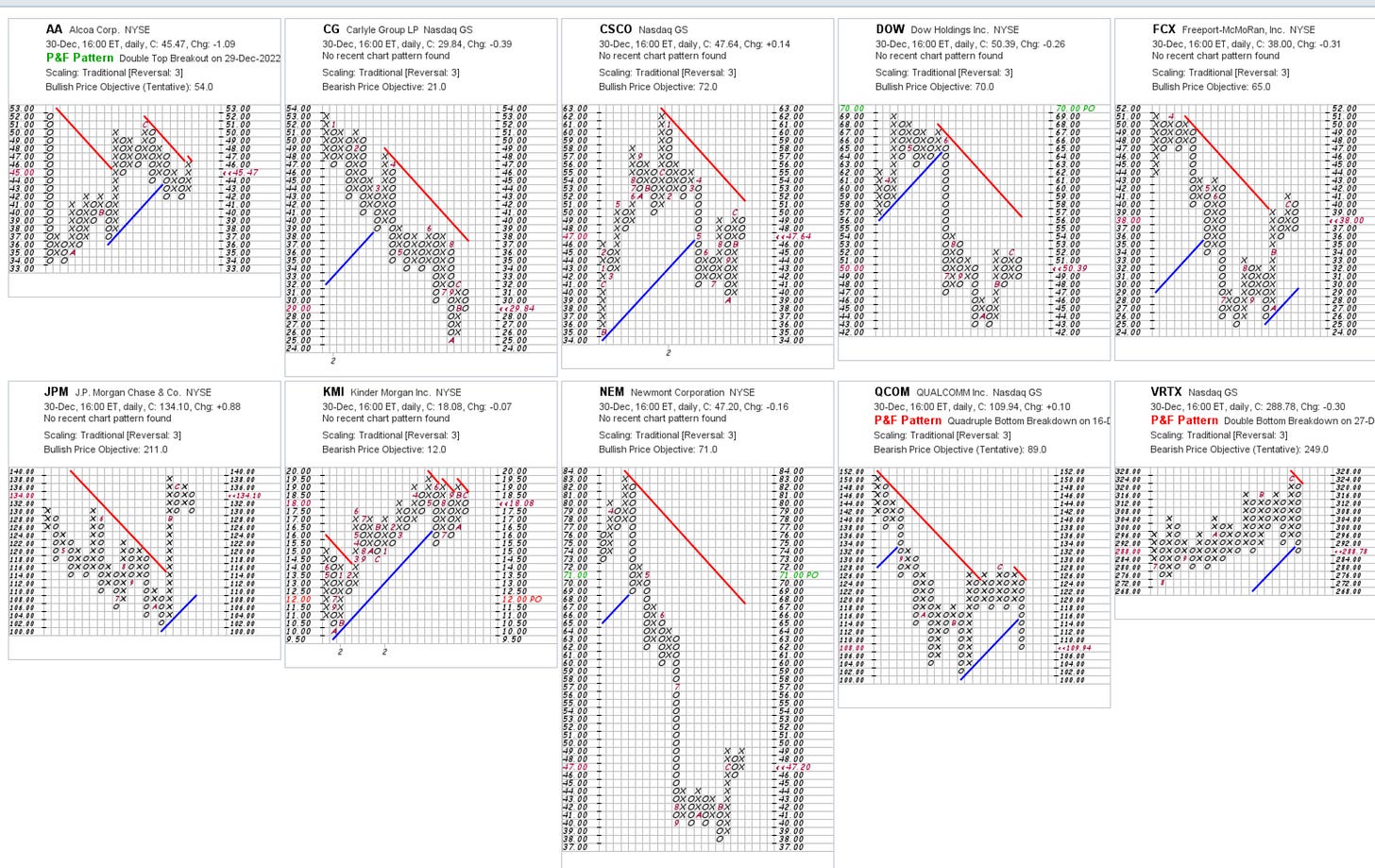

Six of my 10 covered calls stocks have bullish point and figure charts price objectives. They are: AA, CSCO, DOW, FCX, JPM, and NEM. Covered calls on Pfizer (PFE) and Devon Energy (DVN) expired Friday and probably will be rolled forward on Tuesday. The charts are from StockCharts.com.

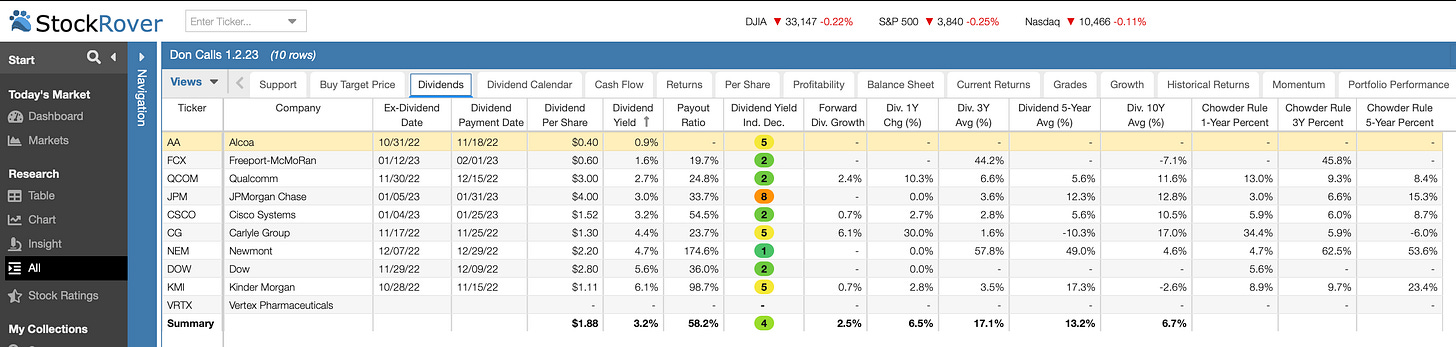

Most of these stocks are big cap and mega cap enterprises. The average price to free cash flow ratio is a low 10.3, which is a bit depressed by CG’s negative 25.3 P/FCF. None of these stocks look over bought. On average, they are trading at fair values.

The stocks are trading about 15% below the mean consensus analysts’ target prices. FCX is trading a bit above its target price and 31% below the highest target published by an analyst. QCOM is trading 39% below its target price and CB is 42.1% below its target price. I expect their target prices will be lowered.

The portfolio’s average 3-year beta is 1.10. NEM has the most defensive beta of .43. FCX’s beta is a highly volatile 1.54, AA’s is 1.49 and CG’s is 1.35. This is not what I would call a defensive portfolio.

CG is a private equity firm, or diversified conglomerate, that is the equivalent of a mutual fund or ETF that pays a dividend instead of charging a management fee. It is going through a CEO change and dealing with tough market conditions, but I can trade covered calls on it if I do two-month covered calls to get my target returns on risk. CG gives me exposure to its portfolio’s companies that are not publicly traded.

VRTX is a long-term holding because it is a hot drug stock that is way above my purchase price and has a positive price objective. While its options are not as actively traded as I would like, I get fills on covered calls and puts trades that give me good options premiums.

I prefer dividend stocks, which is appropriate for an old guy like me. Investing in stocks that may be big winners in 10 to 20 years doesn’t make sense for me.

Most of these stocks are in our IRAs. The average dividend yield is 3.2%, compared with 2.6% for the 30 stocks in the Dow Jones Industrial Average index. Only NEM’s 174.6% dividend payout ratio looks out of line. As a gold company’s stock, it’s a speculative diversification with a good 4.7% dividend, decent returns on options trades and the ups and downs that come with commodity stocks.

Dow is a chemical and materials stock that is depressed due to high oil and other raw materials prices. It’s also down in the face of the world wide recession and inflation. But it’s in the DJIA30 index, which is a form of vetting. For me, it is a long-term dividend and options premiums trade regardless of what happens to the stock’s price. I’m selling puts on it because I’d like to avenge down my purchase price over time. I’ll cover my puts portfolio on Tuesday.

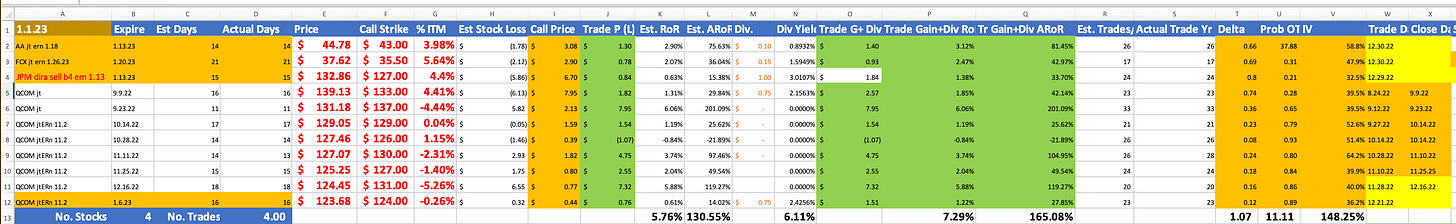

This is my spreadsheet (revised for 2023) that shows my seven more traditional covered calls trades on six stocks. The strike prices are out of the money (OTM) and if exercised will produce short-term capital gains. Having just bought CSCO, I sold covered calls with a relatively high delta of .33 and only a 68.8% probability of expiring out of the money. If it’s not called, the annualized ROR is a nice 20%. If it is called, the ARoR will be higher. The stock goes ex-dividend on Jan. 4, which is one reason I bought it when I did.

This year, I intend to be more disciplined about rolling over my covered calls and puts trades to produce more options premiums income and to reduce net debits (purchase price less collected dividends and options premiums).

This spreadsheet shows the four stocks on which I’m trading in the money (ITM) covers calls. The strike prices are less than the purchase prices. These trades are recommended by CoveredCallsAdvisor.blogspot.com. Since last July, I’ve done 41 of these trades on 22 stocks. On 14 of the stocks, the covered calls expired OTM and expired worthless on the first trade. On six of the stocks, the options expired worthless on a few covered calls trade before being called at prices that gave me profits.

I’ve been trading covered calls on QCOM since Aug. 24 when I bought the stock for $139.13 a share and sold covers calls on it. On Friday, my eight QCOM covered calls option will expire OTM again, and I’ll roll it forward next week. I’ve collected enough dividends and call options premiums to reduce the net debit to about $122.18 with the stock at $109.94. The P&F price objective is a bearish $89. So I may collect dividends and options premiums on QCOM for a long time before the stock rallies and I get the net debit down to break even or a better price.

Wall Street analysts’ mean target price is a little over $152. I expect that target to fall. With China reopening and the factories that make Apple’s products ramping up, QCOM should bottom out sometime this year. But who knows? Meanwhile, I’m getting a pretty good annualized RoR. I’ve also sold January $103 strike puts on QCOM to average down the purchase price while I wait for the stock to rally.

I plan to report on my current puts trades sometime on Jan. 3.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Good to see another option seller writing on substack. Always love reading your articles even though I only sell puts on ES futures and not individual names. I would love for you to read my articles and give your honest opinion.