Merck Is Strongest DJIA Stock; 6 Dow Jones Stocks Are Weak Technical Buys

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly options premiums income.

By Donald E. L. Johnson

Cautious Speculator

Most Dow stocks are weak and weakening. MRK is rising and analysts are optimistic about it.

In bearish markets, covered calls traders sell covered calls for higher premiums and closer to the current price of the stock or the price that they want to get for it when they sell it.

This post explains how beginners can pick stocks and plan covered calls trades that will give them annualized returns on risk.

The AROR on the MRK trades shown below range from about 6% to about 30%.

Traders of stocks’ covered calls and cash secured puts look for stocks and exchange traded funds with bullish momentum.

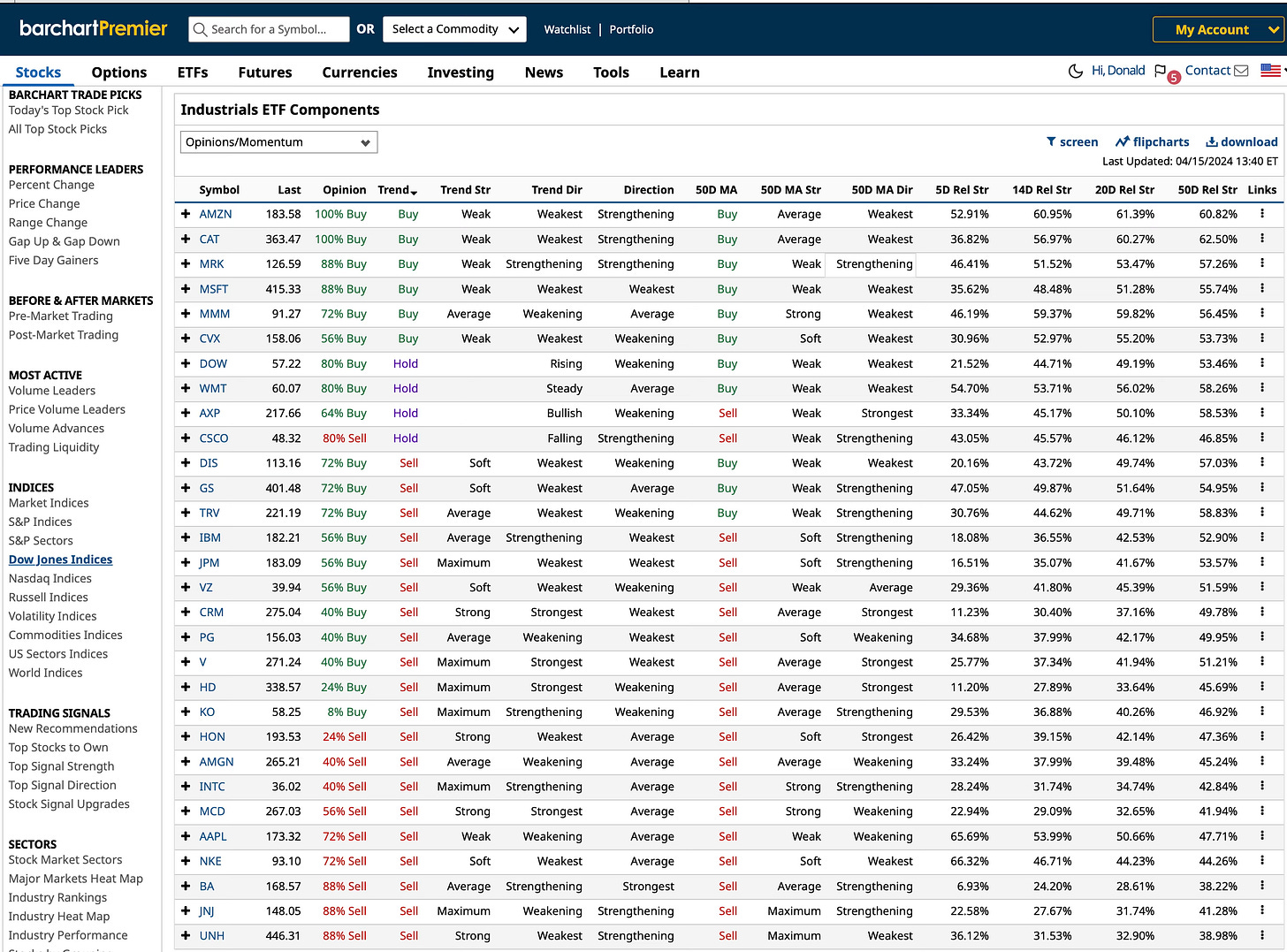

Merck & Co. (MRK) is in the Dow Jones Industrial index. It looks like it has the most bullish momentum of all the DJIA 30 stocks. Its trend strength is weak and strengthening, according to Barchart.com.

Of the 30 Dow Jones index industrials, MRK and five other stocks sport bullish buy signals, buy trend signals and 50-day moving average buy signals. The other five bullish stocks are Amazon (AMZN), Caterpillar (CAT), Microsoft (MSFT), Chevron (CVX) and 3M Company (MMM).

When the markets are trending lower as they are now, covered calls traders are likely to sell covered calls at strikes closer to at the money, or the current price of the stock

For example, MRK is trading at $126.38 per share, or $12,638 per 100-share options contract. Owners and buyers of MRK might sell MRK 4.19.24 expiration $129 per share strike covered calls for about $0.49 per share or $49 per contract. The risk or probability of having the stock called after the April 19 close of trading in four days is about 24% as indicated by its .24 delta at that strike.

The probability that the call will close out of the money Friday is about 77.23%. The option’s implied volatility is about 26%, which means that the seller of the MRK call option at the $129 strike will get a pretty good price for the option.

Assuming that this weekly trade or trades like it were done with the same results over the next 52 weeks, the annualized return on risk on this trade would be about 30% plus any dividends collected.

That most stocks are weak indicates that MRK could move lower with the market or stall at its current price over the next few days.

Beginning traders will trade one MRK covered call contract for $49 and about a 21.6 annualized return on risk. I think trading weeklies is safer in volatile markets because traders can get out of losing positions with smaller losses more often than not. But a lot of beginners trade monthly call options like the MRK 5.17.24 calls.

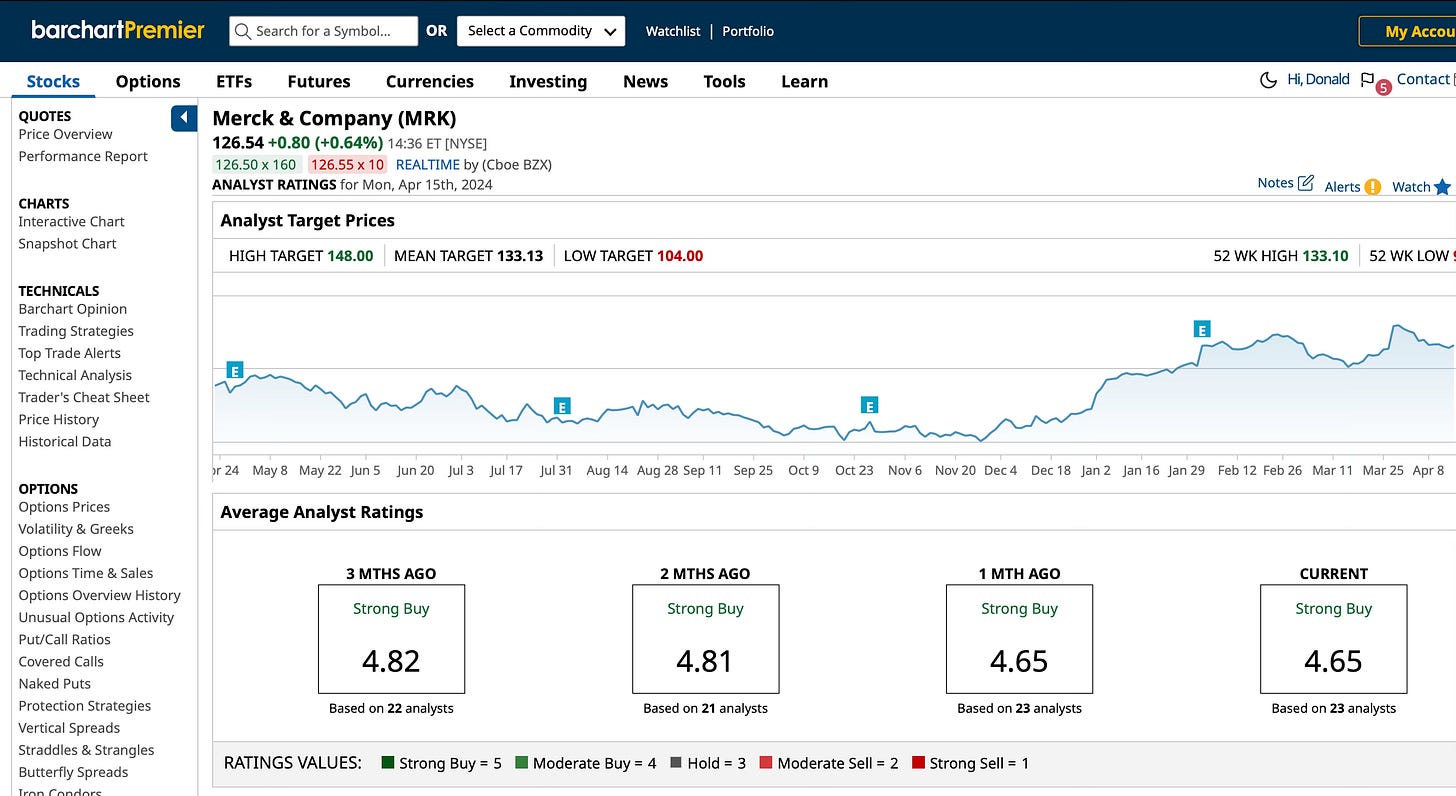

Analysts are bullish on MRK.

Traders who think MRK might rise this week will sell the $129 or higher strike because of the lower probability that it will be called. MRK owners who are looking to get out of MRK at a nice short term or long term profit will sell the MRK covered calls at the money, or at about a $127 strike.

I always try to sell calls at strikes that give me even small capital gains when they are exercised, or called.

But when a stock is deep under water, I’ll sell covered calls at strikes that I think and hope won’t be reached by stock before the call option expires. I don’t like to have stocks called at losses, but it happens. And it hurts a bit.

For example, if I had bought MRK at $150 a share, I might sell MRK 4.26.24 (11 days to expiration) $136 covered calls for about $0.24 a share. The delta would be a low risk 0.08 while the OTM probability would be a pretty safe 92.7%. The AROR would be about 6.4% and the implied volatility would be a nice 29%. MRK’s quarterly dividend is $0.77 per share, or 2.44%.

This would be a lower risk trade for investors who want the covered calls income but don’t want to risk having the stock called before they are ready to sell.

This is how I setup my trading platform on Think or Swim by Schwab.com.

I don’t own MRK or have an options position in the stock.

LINKs:

Home Page. See my more than 190 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my Donald E. L. Johnson byline is my handle.

Thanks Don. I was just looking at the Fast Graphs chart and info on Merck.

Merck looks strong long term.

Thanks Donald! Hope things are going well with you! Haven’t heard much lately. Nice article…I own CVX and MMM and write calls on them over the last year. A little underwater but both pay nice dividends.