Market's Technicals Look Mixed and Weak

Barchart.com's buy and sell ratings and its point and figure charts are mixed on major market indexes like SPY, DIA, IWM, MDY and QQQ.

By Donald E. L. Johnson

Cautious Speculator

When technicals on major market indicators are mixed, experienced traders reduce their risks.

SPY and QQQ technicals are buys at Barchart. Their charts aren't so bullish.

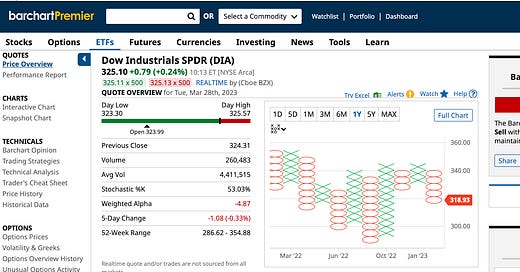

DIA is a Barchart sell, and it is breaking down on its P&F chart.

All but one major exchange traded funds that track market indexes, Nasdaq (QQQ), are looking like a weak buy or bearish.

Barchart.com buy and sell ratings on the S&P 500 (SPY), Dow Jones Industrials (DIA). Russell Small caps (IWM) and Midcaps (MDW) are mixed. And Barchart’s point and figure charts on these ETFs are mostly holds or bearish.

Barchart rates DIA a weak sell. The P&F chart shows DIA falling through its support. The trade could be a bear vertical spread trade or just sell DIA May puts.

SPY is still a buy on Barchart, or possibly a hold. The P&F chart shows SPY on the brink of break down through support. It’s down so far this morning.

MDY diverges from SPY with a weak sell rating from Barchart. Its P&F chart shows a breakdown through support. P&F technicians consider that a sell signal.

IWM also diverges from the SPY rating with a 40% sell rating. The P&F chart shows another breakdown and sell signal. Traders who own equities that are breaking down can sell them or sell covered calls on them on the way down.

QQQ is with SPY. It gets an 88%, or strong buy rating from Barchart. The P&F chart still hasn’t broken out on the buy side. And as a result of QQQ’s recent strength, some analysts and traders are fading, or doing contrarian trades on QQQ.

For example, OptionsPlay.com’s opening trade of the day is a bearish vertical spread trade on QQQ.

For traders bullish on QQQ, OptionsPlay’s calculator suggests that options premium income traders sell QQQ puts. Selling puts is a bullish trade.

Full disclosure: I'm a long-time paid subscriber to OptionsPlay and I wrote for them for a few months before I decided that I didn’t have time to write for them and trade. I don’t do many vertical spreads trades. Mostly, I use OptionPlay’s calculator to get a second opinion about my trading ideas and to see how they rank individual stocks.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.