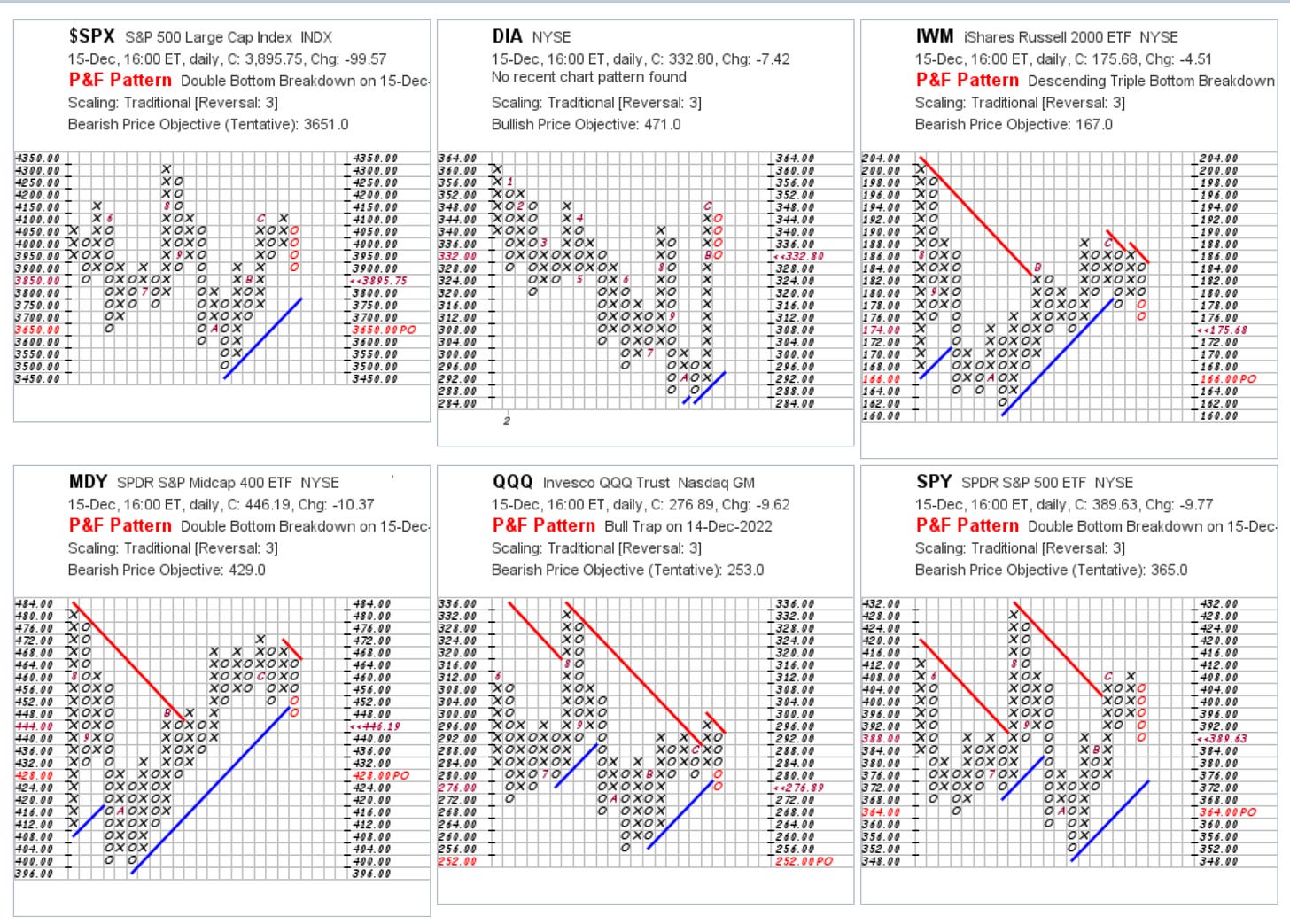

Major Stock Indexes, ETFs Turn Bearish; Time to Buy DIA, SPY, QQQ, IWM, MDY Puts Options?

An easy but risky way to short the markets is to buy puts on ETFs that track the major indexes, but the dip may be close to bottoming out.

By Donald E. L. Johnson

Cautious Speculator

The Dow Jones Industrials index fell 2.25% Wednesday; S&P 500 index fell 2.49% and NADAQ 100 fell 3.37%.

Point & Figure charts’ bearish price objectives hint markets could drop another 6% or more.

Buying puts is a bearish trade, and its easier and cheaper than borrowing an equity and shorting it.

Is this a good time to short the markets by buying puts on SPY, DIA, IWM, MDY or QQQ?

Exchange traded funds that track major stock indexes turned bearish Thursday as the S&P 500, Dow Jones, Russell 2000 ETF and S&P Midcap 400 ETF sank in response to the Federal Reserve Board’s declaration that will continue to raise the Federal Funds rates in its fight against inflation.

The bearish price objective on $SPX is $3,561 per share, down 6.3% from Wednesday’s close of $3895.75. After a stock or ETF breaks support, it could easily drop below the price objective. But just as these charts were bullish a few days ago, they could reverse over night and create losses for puts buyers, unless they take quick and small profits.

Options on $SPX, SPY and the other ETFs shown above in the StockCharts.com point and figure charts are liquid and active.

Buying puts is a bearish trade because as stock or ETF prices sink, puts prices rise. Traders can hedge their bets by creating bearish vertical puts or calls spreads. Selling covered calls on owned stocks is another way to hedge against price declines. But covered calls don’t provide the profit potential that buying puts or bearish vertical puts or calls spreads do.

A speculator can:

Sell short a share of SPY for about $389.73 or a share of $SPX for $3,895.75 a share.

Buy SPY puts. Each put and call option is a contract for 100 shares. Buying, say, 1 SPY 2.17.2023 $390 put would cost about $1,412.00, according to a calculator on OptionsPlay.com. The maximum risk would be $1,412 if the puts expired worthless, and the maximum profit would be about $2,057 on the 64 day trade. Depending on what the market does, the trade could be closed at a profit or loss at any time between when the trade was filled and the option expired on Feb. 17.

Buy a SPY 2.17.2023 $390/$355 put bear vertical spread. This is less risky and cost less than buying a put. It would involve buying the at the money SPY $390 put and selling the SPY $355 put. It would cost about $1,013 per 100-share option vertical spread contract. The maximum risk would be the $1,013 cost of the trade. The maximum profit should be about $2,456 per contract, but many vertical trades are closed when they are about 50% in the red or offering a 50% to 100% profit—depending. OptionsPlay.com’s calculator shows this trade has a greater probability of being profitable than shorting SPY or buying a SPY put.

Buying a put is a bearish trade. It is profitable when the price of the equity drops and the buyer of a put has the option to sell the equity if SPY’s price falls below its strike price. Selling a put is a bullish trade. If the price of the equity is below the strike price when a puts option expires, the seller is sold the stock at the strike price unless the trade is closed before the option expires. Usually, traders do a vertical spread trade in one trade rather than sell each leg of the trade separately.

Shorting stocks and ETFs usually is more risky than buying them. Timing these trades can be tricky. It may be too late to do these trades, but the options trades are fairly long duration trades to give them time to become profitable. Some analysts think the Santa Claus rally has a few days to run before the new year brings another leg down in the bear market.

No one can predict prices. All we can do is trade and manage our risks by cutting losses short, especially in relatively volatile markets.

My Trades

I have 15 sold puts trades expiring at the close of trading on Jan. 16 and others expiring during the next three weeks. I’ll sell more puts in the next few days. My covered calls on CG, KMI, DVN, DGX, QCOM and VRTX will expire tomorrow. I’ll roll them forward when the markets recover a bit.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Thanks again Donald! Have a great Holiday season!

OptionsPlay.com this morning posted a bearish SPY vertical puts spread trade. Search #optiontrading on twitter. @realDonJohnson.

Futures are down this morning extending the two-days dip to a third day.

I'm not recommending the trades. I'm providing interesting market observations. See my disclaimers.