Kimberly-Clark looks like a hold for covered calls traders

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

KMB pays a good 3.45% dividend that will reduce its net debit by $4.72 a share in 12 months and more if I hold it for years.

That plus covered calls options premiums could reduce the net debit by about $10 a share and raise its dividend yield on the net debit.

I discuss how I’m thinking about using dividends and covered calls options premiums to help turn a disappointing KMB trade into a winner.

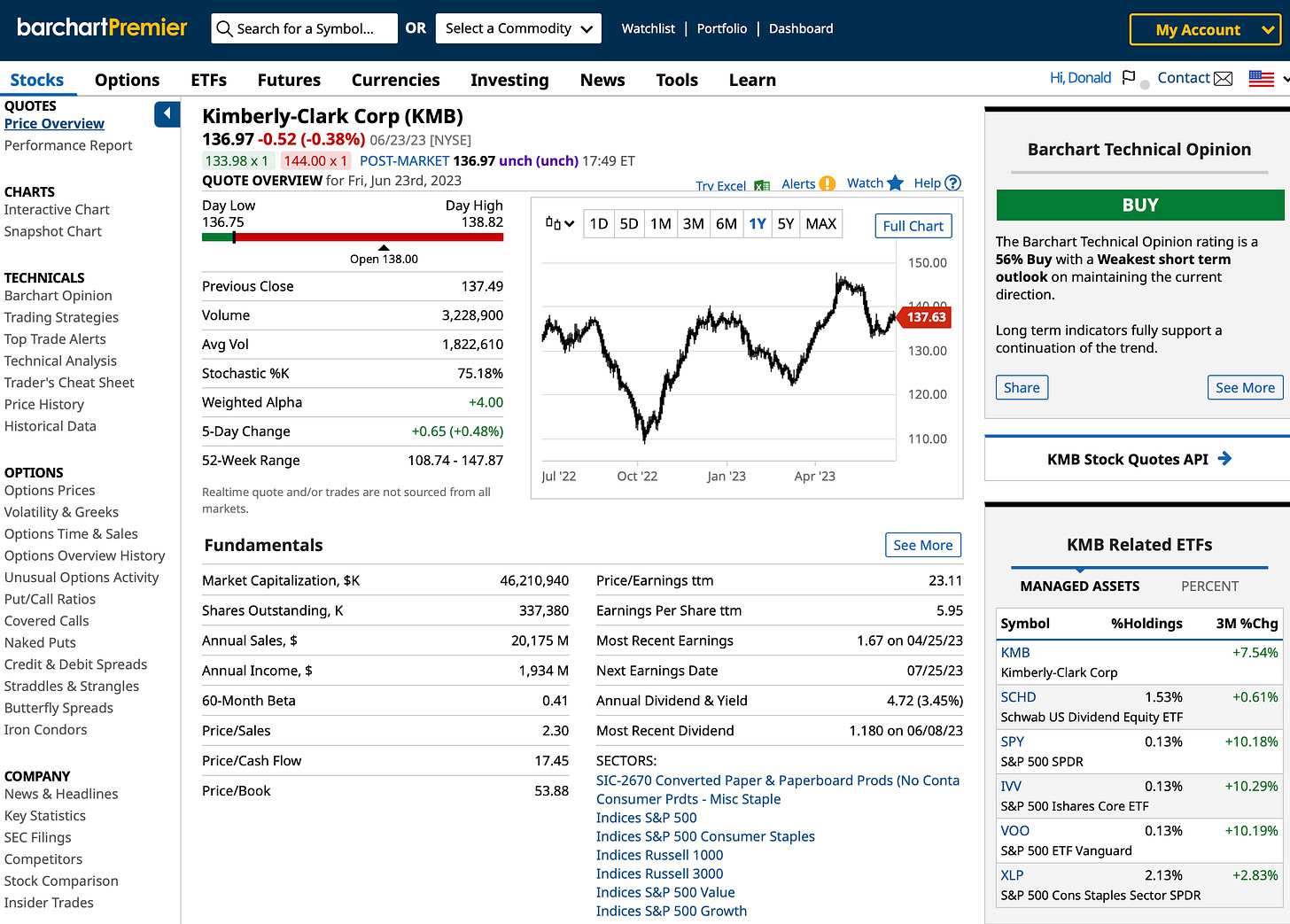

Kimberly-Clark Corp. (KMB), one of the stocks in my July watchlist and portfolio, is a good dividend stock and income stock for traders of covered calls and cash secured puts. It is rated a buy by some Wall Street and independent stock analysts. Others think it is hold or sell. Market technicals indicate the the market likes the stock.

So, for me, it’s a hold.

I own KMB because it pays a $4.72 per share, or 3.39% annual dividend on my $139.29 net debit price. And its 7.21.23 expiration, $145 strike covered call option will give me a 0.32% return on the net debit in my 30-day trade. Net debit equals a stock’s purchase price minus collected dividends and puts and calls premiums. I sold puts on KMB once before I bought it.

If I repeat that kind of trade 12 months a year for the next year, the annualized ROR will be about 3.78%. That could give me an annualized return of dividends plus covered call premiums of about 7.17%. The potential gain on this trade if the $45 call is exercised would be 1.51%, or 18.1% annualized. That probably won’t happen on this trade. It may be several months before KMB will rally and give me a gain.

Few safe dividend stocks give investors those kinds of returns.

Another year of collecting dividends and covered calls premiums on KMB should reduce my net debit to below $129 per share from the $142.85 I paid for it. That would hike the dividend yield on the net debit to about 3.66%, give or take depending on what I get for the monthly call options.

Barchart.com shows that KMB is rated a hold with a mean target price of $139.58, a high target of $153 and a low target of $125. It closed Friday at $136.97. The 52-week high was $147.87 and the low was $108.74. The stock gets a 56% buy rating from the 13 technical indicators tracked by Barchart.

The Street.com calls KMB a buy. Most other rating services offered by TD Ameritrade, call KMB a hold or a sell.

CFRA, whose reports are available on TDAmeritrade.com, rates KMB a hold. It gives KMB three of a possible five stars, a $135 fair estimate and a $132 12-month price target. Demand for KMB’s household products like Huggies, Kleenex and Scott is static, according to CFRA, which is a morningstar.com competitor.

Consumers already are trying to save money by buying private label products instead of KMB’s famous brands. But Kimberly-Clark has the power to increase prices a bit. It doesn’t have a whole lot of control over material costs or the cost of its fairly large debt burden.

TDAmeritrade’s Smart Score on KMB is a 5 out of a possible 10. “The Smart Score combines eight factors to provide a single TipRanks rating,” according to the broker.

At Fidelity, KMB gets a “neutral” rating, which is neither bearish nor bullish.

Vladimir Dimitrov, CFA, wrote on SeekingAlpha.com, “Kimberly-Clark’s disappointing performance in recent years is hardly a surprise and does not make the company a bargain.”

At $136.97, KMB is trading at 20 times its free cash flow and at 95% of its estimated fair value at StockRover.com. That’s pretty high for a “hold” stock, and it’s 23.1 price to earnings ratio also looks rich. That may show that investors are expecting better things from the company’s stock than some analysts expect.

OptionsPlay.com rates KMB’s stock strength (momentum) at a 5 out of a possible 10.

For owners of KMB, OptionsPlay suggests selling KMB 8.4.23 expiration $147 strike for $0.15, or $15 per 100-share options contract. That would yield 0.98% annualized. That looks like a trade for bullish investors and KMB owners who don’t want to sell the stock for less than $147.

Say an investor bought KMB for $140. He could sell KMB 7.21.23 (25 days) $140 strike covered calls (delta .11, out of the money probability 89.88%) for an annualized RoR of about 4.38%. The 0.11 delta indicates that there is about a 11% probability that the call option will be exercised and the stock will be sold at the $140 strike price.

If the trader is willing to sell the stock at a loss in an IRA, for example, the trade could be to sell KMB 7.21.23 $138 calls (delta .17, OTM 84% probability) for about a 7.9% ARoR.

Obviously, a lot of people bought KMB for less than $140.

If they sold the KMB 7.21.23 $145 call for $0.45 and the stock looks like it won’t be called because the price will stay below $145, they could wait until the option price drops below, say, $0.10. Then they could buy the call option back for a $0.35 profit and do one of two things.

They could roll the trade forward into an August expiration at a higher call option price and maybe a better RoR, if it becomes available.

Or they could sell KMB at a loss and put the money into a better trade. This works better if the trade is tax sheltered in an IRA or 401k than if it is in a taxable account– unless an investor is collecting tax losses for some reason.

Having worked myself out of losing positions like this several times in the last 17 years by collecting covered calls and cash secured puts on a stock or ETF until I could get out at a profit, that is what I’ll do with my losers in these trades. I’ll hold KMB and sell covered calls. If I can hold KMB until I sell it for a profit on what I paid for it, I’ll keep all of the dividends and options premiums I collect.

I can live with losses on the stock as long as I can collect good dividends and options premiums on a stock or ETF like KMB while I wait for the equity to rally above my net debit, which is always shrinking as I collect dividend and premiums.

It’s taken me about a day to decide what to do with KMB and to write this post.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.