July Dividend Stocks Covered Calls Trades Update #1

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

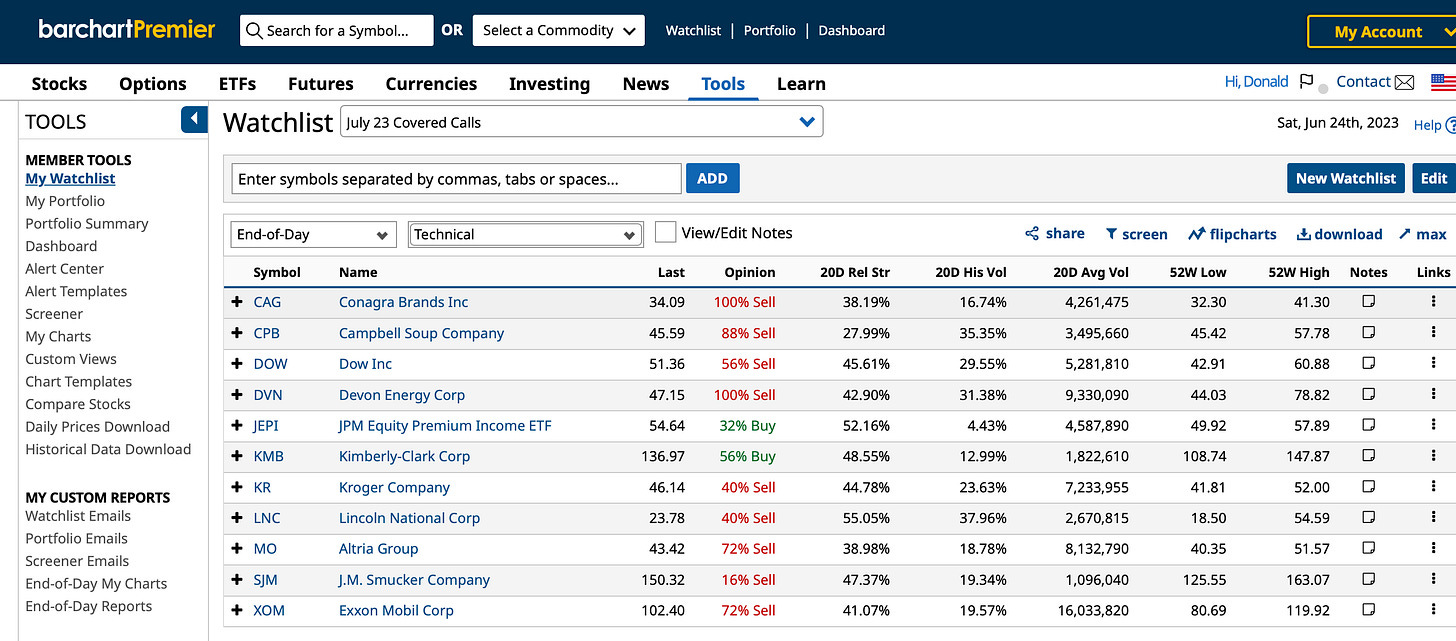

July covered calls trades equities fell last week.

Kimberly-Clark and the JPM Equity Premium Income ETF have buy ratings.

The other 10 stocks have sell ratings.

Top market indexes SPY, DIA, IWM and QQQ have buy ratings on Barchart.com.

The 12 dividend equities in the July covered calls model portfolio fell an average of 2.3% last week.

None of these options trades look like they will be called next month. I’ll continue to post updates in comments.

The July list equities are down 6.2% year to date and up an average of 3.9% from a year ago. I sold covered calls on most of these stocks on June 21. Their call options expire between July 7 and July 28.

Fair value prices for the 11 stocks in the watch list are an average of 10% above current prices, according to StockRover.com.

Wall Street analysts’ average consensus target prices are 16% above current prices.

On Barchart.com, Kimberly-Clark Corp (KMB) has a 56% buy rating. That is, 56% of 13 charts and other technical indicators tracked by Barchart are giving buy signals on KMB.

JPM Equity Premium Income ETF has a 32% buy rating.

Conagra Brands Inc. (CAG) has a 100% sell rating.

The rest of the stocks on the list have sell ratings. They include Campbell Soup Co. (CPB), Dow Inc. (DOW), Devon Energy Corp. (DVN), Kroger Co. (KR), Lincoln National Corp. (LNC), Atria (MO), J.M. Smucker Co. (SJM) and Exxon Mobil Corp. (XOM).

Although the S&P 500 (SPY), Dow Jones Industrials SPDR (DIA), Russell 2000 Shares ETF (IWM) and Nasdaq and Nasdaq QQQ Invesco ETF are dipping, 17 critical ETFs have buy ratings at Barchart.com.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.