If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10% Annually

The strategy is simple. Pick good under valued dividend stocks. These 10 have active and liquid options that can be used to generate additional income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

Dividend investors who monthly sell covered calls and/or cash secured puts on stocks they own can generate cash flows exceeding 10% returns on risk (RoR) annually. If they sell both covered calls and cash secured puts on stocks that average more than 3% in dividend yields, their annual RoR, not including capital gains or losses, can approach 20% or better.

A trader who bought a stock that paid a 3% dividend and sold covered calls with an annual premium yield of only 7% would earn a total of 10% in dividends and options premiums in a taxable account and more in an IRA. That would be enough to beat 7.5% inflation, not including capital gains or losses or income taxes.

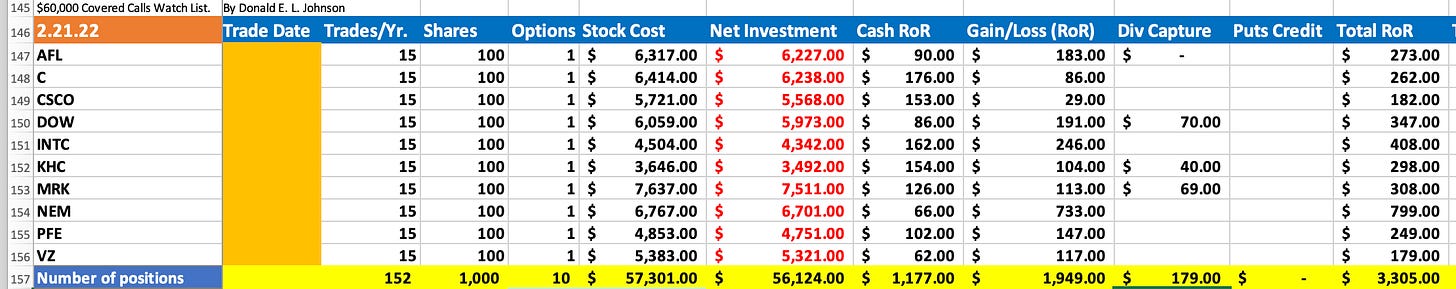

Please click on the image and zoom in for a better view.

What my spreadsheet shows is that an investor who buys 100 shares of each stock and sells one call option for 100 shares in 24-day trades will average a 2.2% RoR on the trade. If that kind of trade is done 15 times a year, the annualized will be about 33%. Actually, the return usually is biggest the first time you do it. As the stock price and its volatility fluctuates, the RoR does, too. When the RoR gets too low, you pick another stock and write covered calls on it.

These trades are set up with the strikes are at the money (ATM) or close to it. This is because the markets look bearish. The stocks are more likely to drop over next three weeks than to close above the strike price and produce a gain.

While some of these stocks may be held long term, most will be called sooner than later. Unless covered calls strikes are routinely done on deep out of the money calls options, most covered calls get exercised with small gains. Then traders sell puts on them, as explained below.

Yes, you pay short term gain capital gains taxes. Taxes are the cost of doing business. Trading stocks and options for income is a business. If you were in another business, you would pay taxes on your income.

The secret is to have the discipline and courage to do the trades monthly and to trade the “wheel” on the stocks. That involves buying a stock, selling covered calls monthly until the stock is assigned, or called. Then selling puts on the stock until it is assigned, or sold back to the trader.

I wrote about selling puts on these stocks yesterday. See that piece for a discussion about the metrics used to pick these stocks for income boosting strategies. And recently I wrote about trading the wheel. And see this article about rolling calls trades forward after call options expire.

Another recent article is about trading puts on CSCO, which in this watch list.

When traders use this strategy, income is more important than capital gains and losses, but trading at the money (ATM) covered calls often produces short-term capital gains and losses. Whether a stock is up or down, money can be made by selling calls and puts on it.

My PFE and VZ are trading for less than I paid for them, and I am collecting their dividends and covered calls premiums on them while I wait for them to rally.

The risk today is that Russia is invading Ukraine in a way that might tank the markets for awhile. No one can predict whether the markets will quickly rebound after the dust settles or will stay down at lower levels for a long time.

A lot of unknowns and variables always face investors when they make trades.

Things are more uncertain than usual due to the Russian threats and invasions, the Cvid pandemic and uncertainty about when the Fed will hike interest rates and how much and how often.

Every trader has to trade so she can sleep at night. A lot of people have taken money out of stocks while they wait for more clarity about today’s unknowns.

The 7.5% inflation tax on cash may be a cheaper hedge than watching the markets drop another 10%, 20% or more. If stocks rally from here on, the 7.5% inflation tax will look expensive.

Traders might put part of a portfolio into this strategy and allocate funds to other strategies depending on their financial situations, trading experience and their tolerance for risks. All trades are risky. So is life.

Please subscribe. It’s free.

Question: What questions do you have about this watch list? We can discuss it in comments.

LINKs:

Home Page. See previous articles on other stocks and watch lists.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own and/or have options positions in DOW, NEM, PFE and VZ.

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks.