IBM Downgraded. How Dividend Stock Investors Can Trade Options For Income, Higher Yield

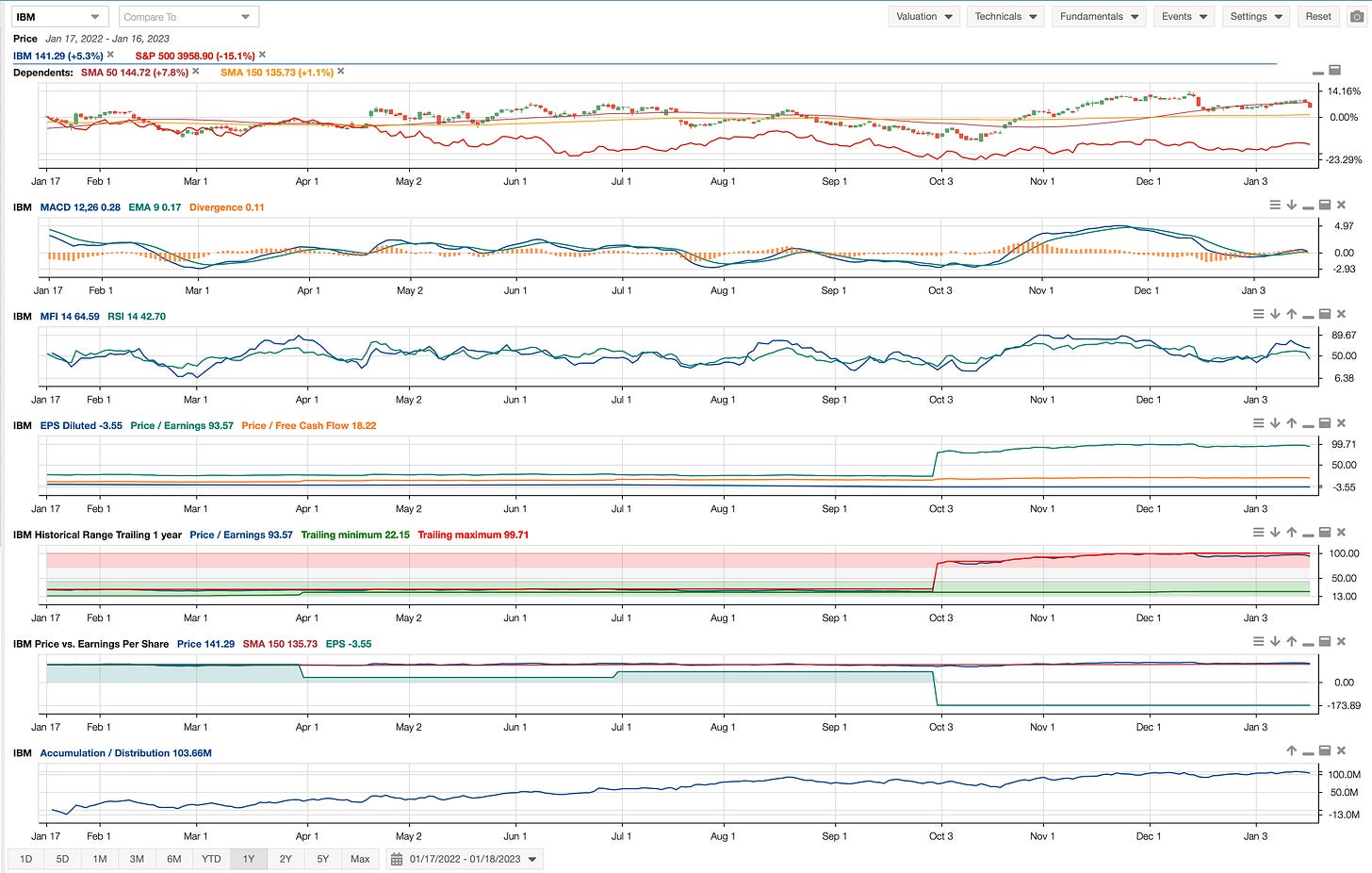

Morgan Stanley downgrades IBM. New target is $148 vs $152. Yield 4.7%. Wait for lower price, sell puts or calls to get better dividend yields, options premiums income.

By Donald E. L. Johnson

Cautious Speculator

After a rally, IBM is downgraded.

If investors can buy IBM, they can get a dividend of 5% or more.

Owners can sell covered calls and take profits on IBM.

Investors looking to buy IBM at a lower price can sell cash secured puts.

Reacting to a strong rally in IBM’s stock price in recent weeks, a Morgan Stanley analyst downgraded the stock and lowered his target price to $148 from $152. At the moment, IBM is trading at $141.74, down 2.36%. Its dividend yield is 4.66%.

There are several ways IBM owners and prospective buyers can trade IBM and its calls and puts to take advantage of the market’s reaction to this downgrade, which could be supported by more downgrades.

In a bull market, IBM wouldn’t look that high priced with a price to free cash flow (P/FCF) of about 18.3. With Morgan Stanley and others looking for the bear market to continue as the Fed hikes interest rates, that valuation may be high.

On StockRover.com, analysts’ average target price is $141.50. The high estimate is $160. The low estimate is $111.

IBM owners looking to take profits could sell IBM 2.17.23 $140 strike (delta .56, OTM probability 46.75%), calls for about $5.25. That would give them an annualized return on risk of about 31% and a cushion against further price declines. Or they could just sell the stock.

IBM reports its fourth quarter and 2022 earnings on Jan. 25. It goes ex-dividend on its $1.65 quarterly dividend on about Feb. 9. Traders may not want to trade options until the earnings and new guidance are announced.

Investors looking to buy or add to their positions might sell IBM 2.17.23 $120 strike (delta -.06, OTM probability 92.70%) cash secured puts for about $0.41 a share. That would give them an annualized return of about 3.42%. More important, if they could buy the stock at $120 a share, their dividend yield would be 5.5%. The tax equivalent yield would be higher in an IRA, Roth or other tax sheltered account.

IBM may never get to $120, but it is likely to go lower and offer higher dividend yields and some good options trading opportunities. While investors wait to see what happens to IBM and the market, they can sell puts to generate income and keep some IBM skin in the game until it is time to buy the stock and sell covered calls and collect dividends.

I don’t have any positions in IBM or its options.

My Trades

Yesterday I sold CAT 1.27.23 $240 puts (delta -.09, OTM probability 89.9%) for $0.57 a share. The AROR is 8.12%. CAT reports earnings on Jan. 31, which is why I chose the Jan. 27 expiration option. I’m hoping to buy the stock for $210 or lower.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.