How To Use Stock Rover To Evaluate 8 Dividend Stocks for Options Trading, Options Premiums

StockRover.com is the best web site a dividend stock investor and options trader can use to do due diligence on stocks and exchange traded funds.

By Donald E. L. Johnson

Cautious Speculator

How and why I use StockRover.com to find and check ideas for covered calls and cash secured puts options trading.

For a fraction of the cost of services used by professional portfolio managers, I can focus on the data and metrics that help me make better decisions.

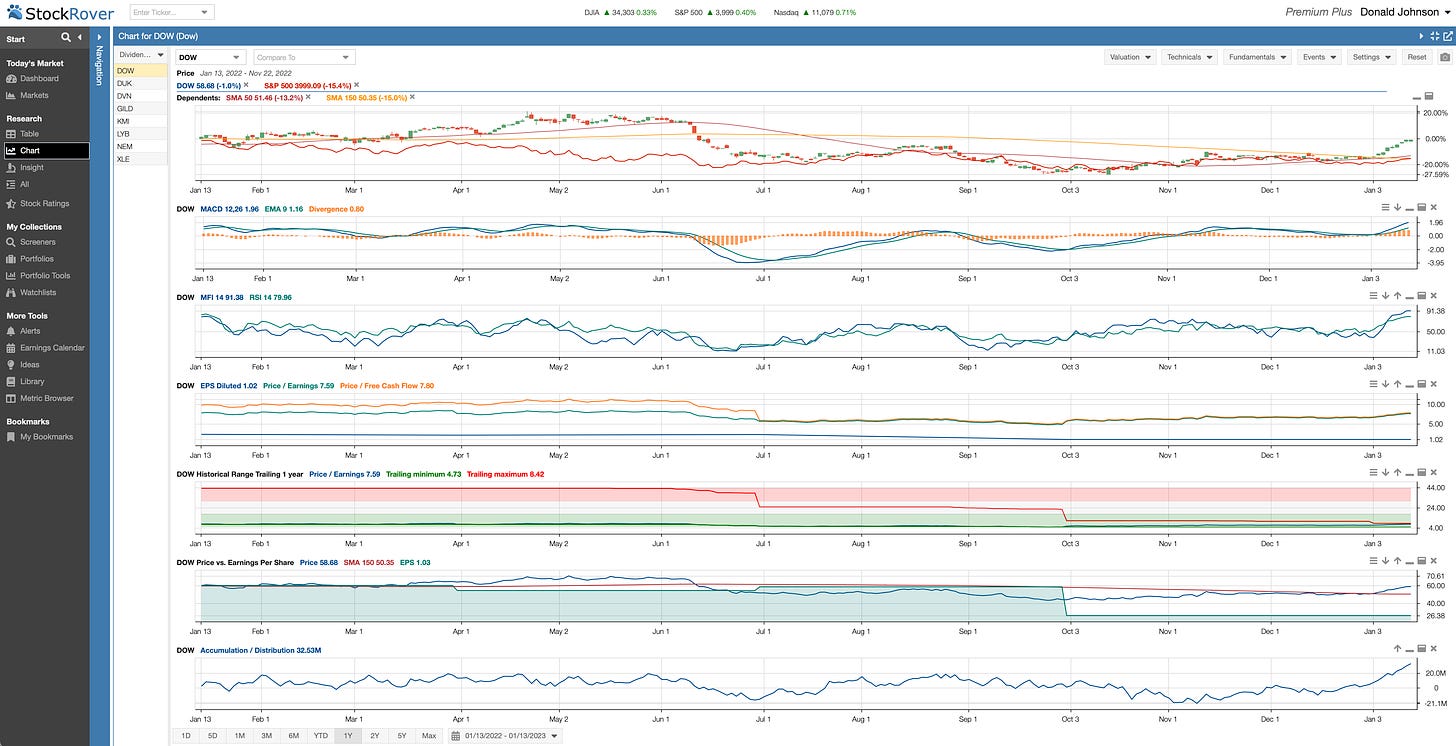

Stock Rover helps me look at momentum, technicals, historical data and news about the markets and stocks I follow and own.

I show Stock Rover tables in most of my newsletters.

StockRover.com is the best web site I’ve found that can be used by individual investors to research stocks and exchange traded funds for options trading.

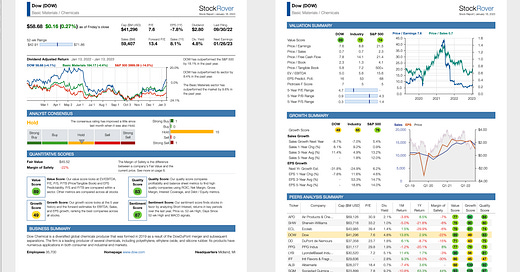

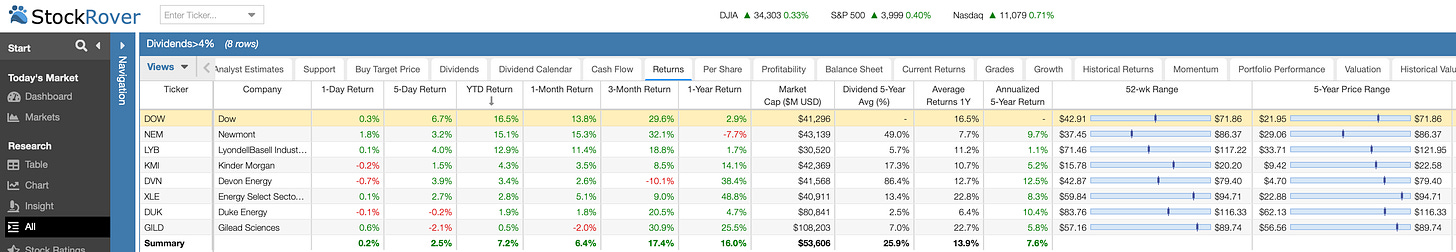

In my previous newsletter, I looked at eight dividend stocks that currently yield about 4.9% in dividends and have bullish momentum. The table above gives a good overview of momentum for the eight stocks we’re discussing.

Every investor should review a stock’s momentum, trends and fundamentals before trading a stock or its options.

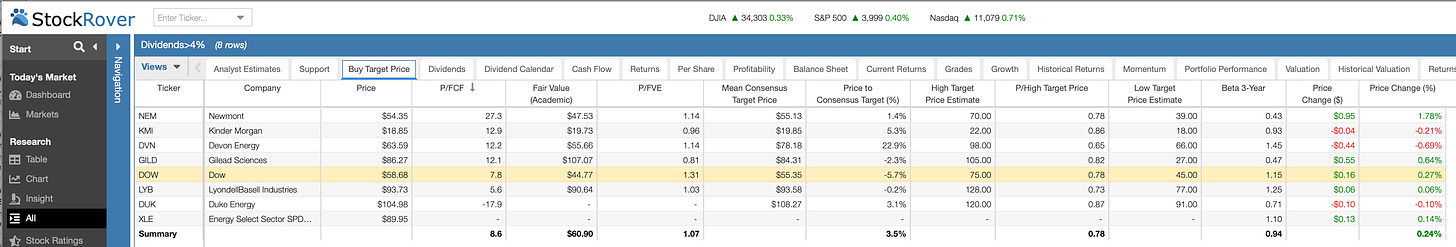

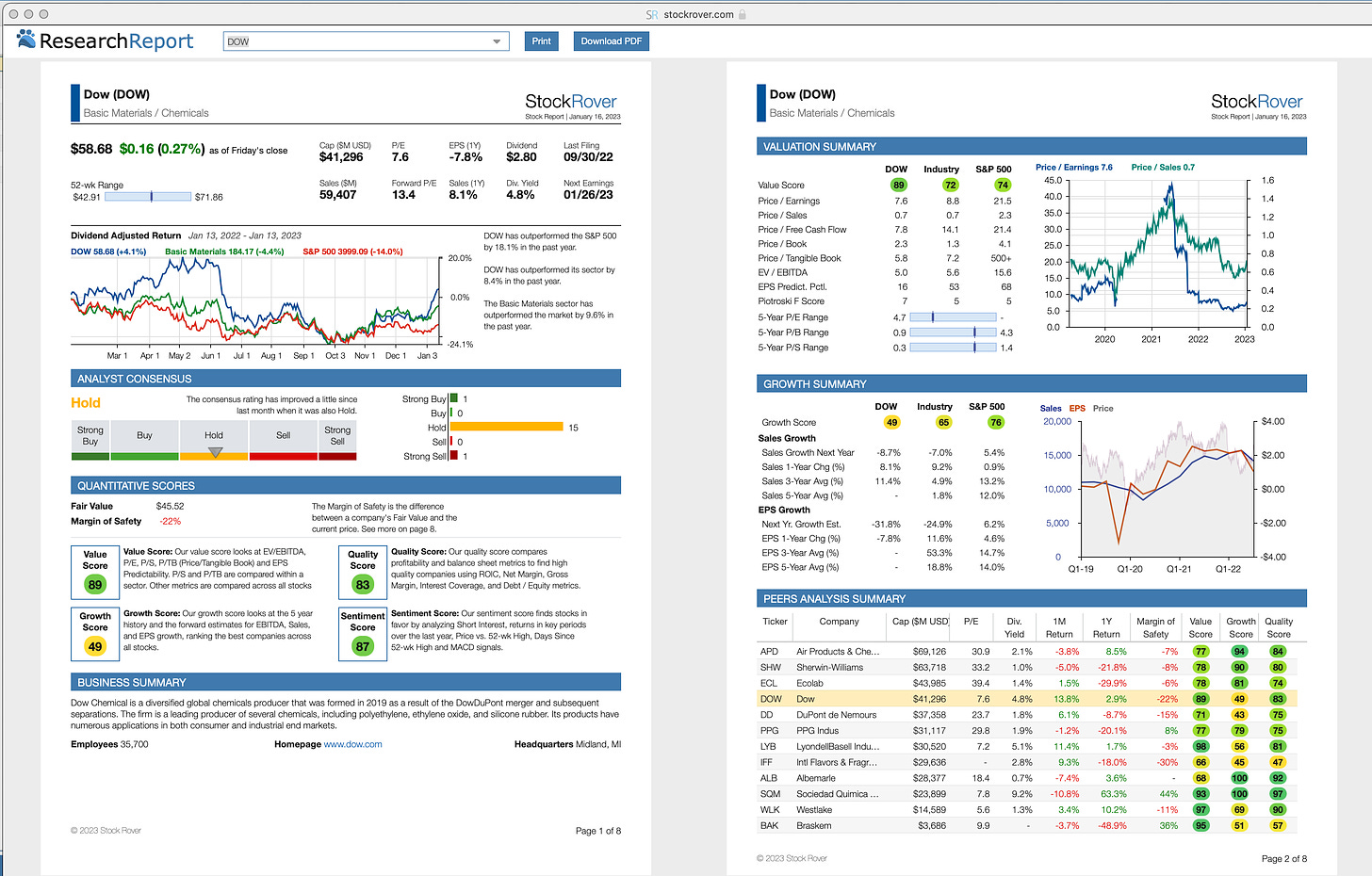

The first thing I check is the most important valuation metric and ratio, price to free cash flow (P/FCF).

Then I check the discounted cash flow-based fair value estimates (FVE) and Wall Street analysts’ mean, high and low target prices.

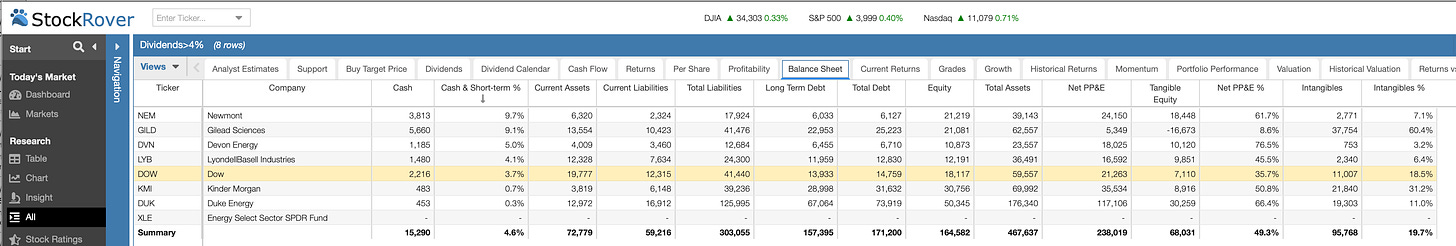

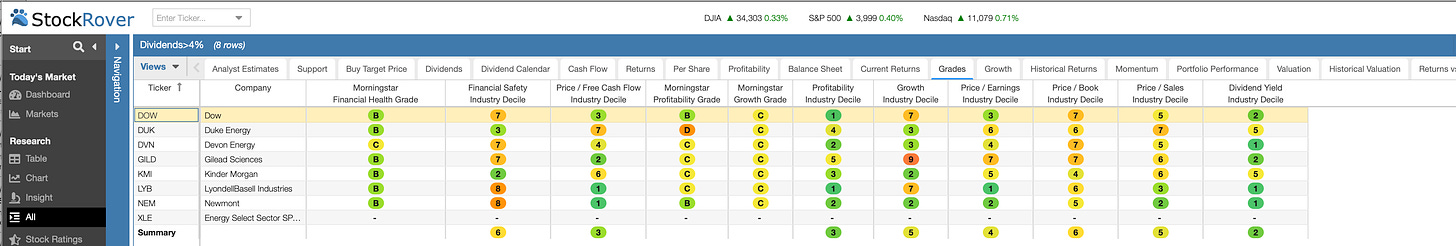

Stock Rover offers some 1,000 metrics that users can use on any portfolio or watchlist table a user wans to format.

That’s why P/FCF is so prominent in this table that I created, not the PE ratio, which too many companies try to manipulate with financial engineering.

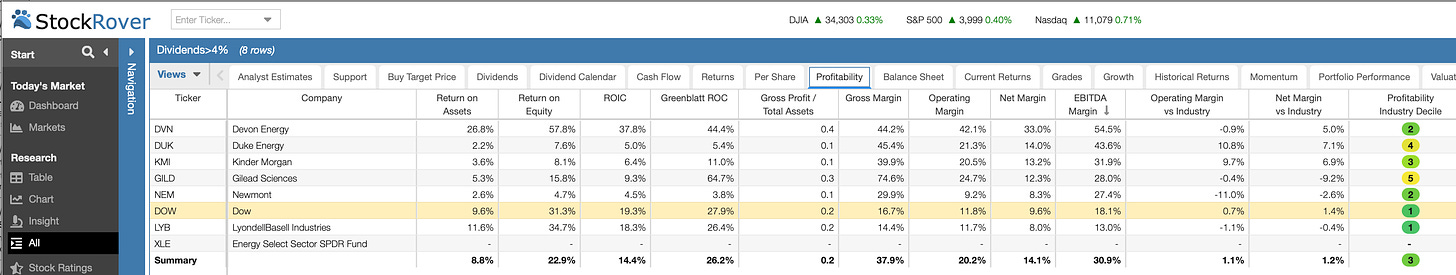

A company’s profitability also is important, especially its return on assets (RoA). I like a ROA greater than 10, but in mining, utilities and other industries that are capital intensive, very competitive and generate low profit margins, lower ROAs are acceptable.

Balance sheets help analysts determine a stock’s dividend safety.

Morningstar.com’s financial grades and other grades on these high dividend payers offer additional information about each company. The headings on each table show the dozens of other ways analyst can look at stocks on Stock Rover.

With a simple click on an arrow next to a stock simple, an analyst can bring up very useful eight-page Research Reports.

Note in the first column that there also are powerful, programmable screeners, guru’s portfolios, portfolio tools and an earnings calendar, a portfolio’s dividend income estimator and the ability to generate trading alerts and see Stock Rover’s latest trading ideas. Traders also can connect their brokers’ trading platforms to StockRover.com.

Stock Rover is like a computer operating system. The more you use it and play with it the more powerful it becomes. Most programing is done by clicking on boxes and dragging metrics and column headings, which makes it easy to use for non programmers.

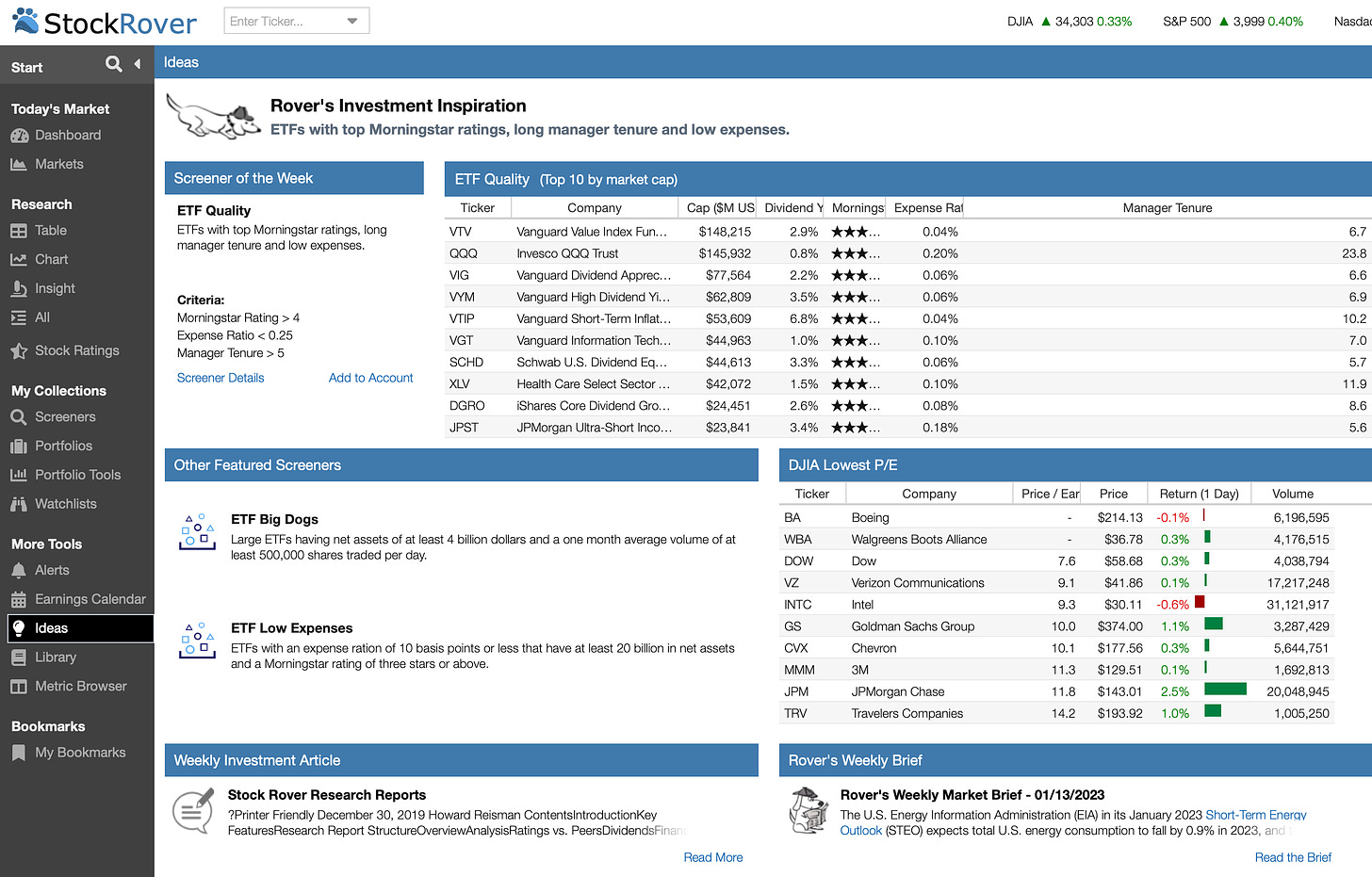

This is Stock Rover’s Idea of the Week.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

We knew a Wight Martingale in NYC back in the late 60s early 70s. I think he went on to be a very successful investment banker.

In addition to SR, I recommend Barchart.com, which makes it easier to evaluate stock momentum while SR is the place to evaluate values. Some SA writers offer very good pieces on individual and groups of stocks while others seem to tout their market places with boiler plate every day.

Hi Patrick, I'm using wsj.com, Bloomberg.com, seekingalfa.com, stockrover.com, Barchart.com, stockcharts.com, OptionsPlay.com and cws.com. At the moment, Barchart is my main go-to for trend info and seeking alpha has the best articles by authors, but Barchart's authors are very good, too, I think. You also can search company names on Bing, Google or Yahoo. DuckDuck Go is worthless when it comes to options. I wonder what sites my readers are subscribing too.

On Substack.com, the going rate for paid finance sites is about $330 per year. OptionsPlay is about $700 per year.. I paid $500 a year for a site like mine until the writer died. He didn't write or post anywhere as much as I do. Another SeekingAlpha site charged $700 a year, seldom published and seldom responded to commenters and didn't stay in business very long.

I'm guessing that if I charged $40 a month, or $480 a year, the site would easily pay for itself as long as subscribers did one or two moderately risky trades on $50 to $150 stocks.

In addition to the paid services mentioned above, I also watch some free sites like Stocktwits.com.