By Donald E. L. Johnson

Cautious Speculator

JEPI pays a monthly dividend and goes ex-dividend at the beginning of July.

I sold JEPI covered calls to increase the annualized return on risk to about 12%.

Because I want to collect the dividend and JEPI may hike its dividend and move higher with the S&P 500 index, I bought the calls back at a small profit.

After JEPI goes ex-dividend, I’ll sell covered calls on it if and when I can get the options price that makes sense at the time.

JEPI’s puts and calls stock options are not very actively traded. That makes getting the options prices you want difficult.

The monthly dividends on JPM Equity Premium Income ETF (JEPI) are down to 8% from trailing dividends of about 11%. This is primarily because with the VIX down around 13.80, the premiums that JEPI’s trade on covered calls are down, too. JEPI is one of my July covered calls trades.

As part of my dividend stock and ETF portfolio, I own JEPI, which trades covered calls on stocks in the S&P 500 index, which allows it to pay high dividends.

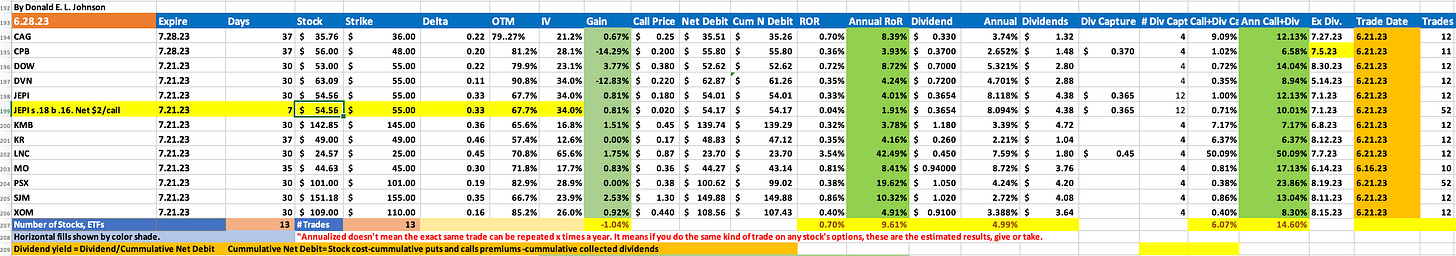

In addition to my other 11 July covered calls trades, I sold JEPI 7.21.23 expiration $55 covered calls for an annualized return on risk of about 4%. That brought my JEPI annualized monthly dividends plus call premiums to about 12%.

I paid $54.56 for my JEPI in an IRA. After collecting dividends and covered calls premiums, the net debit is about $54.17. JEPI is at $54.77 and it goes ex-dividend next week. I don’t want it to be called, and I don’t want to miss the dividend.

On 6.21.23 I sold the JEPI calls at $0.18 on a 30 day trade that gave me a 0.33% RoR.

I bought the calls back on 6.28.23 for $0.16, giving me a $0.02 profit before commissions and fees. JEPI has a 56% buy rating on Barchart.com.

Next week, after the ex-dividend date, which is yet to be announced, I can sell JEPI 7.21.23 $56 strike calls if the stock gets up to about $55. Or after the ex-dividend date I could sell JEPI 7.28.23 covered calls if the ETF dips again, which is what dividend paying equities usually do after their ex-dividend dates. That dip seems to have begun today after JEPI almost topped my $55 stock price yesterday.

My July covered calls spreadsheet shows that after I closed the 30-day trade at 16 cents, the AROR sank to 1.91% on a 7-day trade from 4.01% on the original 30-day trade. The revised trade is highlighted in yellow. I’ll take the old one out after I publish this post.

I could have allowed the JEPI calls to be exercised. That would have given me a $0.44 profit instead of the $0.3624 dividend paid last month. But JEPI’s strength indicates the this month’s dividend may be raised. Or JEPI could just be moving with the S&P 500 and SPY.

With a 60-month beta of about 0.62, JEPI’s price moves about $0.62 for every $1 move in SPY, the ETF that tracks the S&P 500. At the moment, SPY is dipping but it still has a 100% buy rating on Barchart.com.

Dividend Sensel, one of the leading writers about dividend investing at SeekingAlpha.com, advises in the conclusion of his latest post on JEPI that covered call ETFs like JEPI belong in tax sheltered accounts, not taxable accounts. Scroll to the end of his article to get the details. Premium members can search Seeking Alpha for other analysts’ posts about JEPI and its competitors.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Interesting idea that I never considered. The possibility of doing a Covered Call on a Covered Calls ETF -- kind of a DOUBLE Covered Call. That is, a Covered Call on top of a Covered Call ETF.

Jeff Partlow