How To Trade Humana With Covered Calls, Cash Secured Puts And LEAPs

Small and large dividend stock and ETF investors can use covered calls and puts trades to generate monthly options premiums income.

By Donald E. L. Johnson

Cautious Speculator

This educational blog is about how investors can think about how to trade a stock like HUM after it posts disappointing earnings reports and gives guidance that makes some traders and analysts skeptical.

HUM jumped Friday and it could bounce higher, but its momentum is bearish.

Owners of HUM probably can sell close to the money February expiration covered calls and not have the stock called.

Bullish risk takers might buy HUM and sell at the money covered calls for good returns on the options premiums. The risk on this trade is that HUM will continue to drop after it bounces a bit.

Because HUM is closing in on being over sold, income traders and traders looking to buy HUM at a discount might sell deep out of the money February or March expiration cash secured puts.

Buying HUM January 2025 LEAPs call options and writing (selling) covered calls on the call options could yield good returns. This would be a much smaller investment than it takes to buy a stock and sell covered calls or to sell cash secured puts.

On Jan. 25, Humana Inc. (HUM) plunged after it reported disappointing earnings and gave even more disappointing guidance in its news release and conference call with Wall Street’s buy side stock analysts. After the call, Deutsche Bank downgraded HUM’s stock. SeekingAlpha.com writers also turned cautious. More price target revisions could be published soon.

But HUM rallied a bit on Friday. Click on the images and zoom in for better views.

This column suggests ways total returns investors can use calls, covered calls and cash secured puts to profit from the “dip” in HUM’s stock. This is an educational piece and is not meant to be trading advice. Please see the disclaimer below.

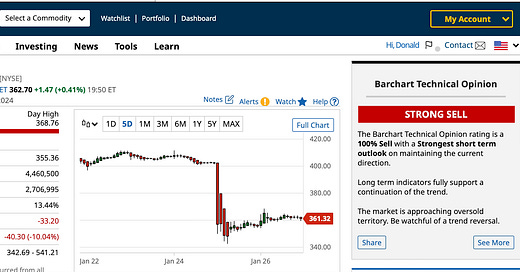

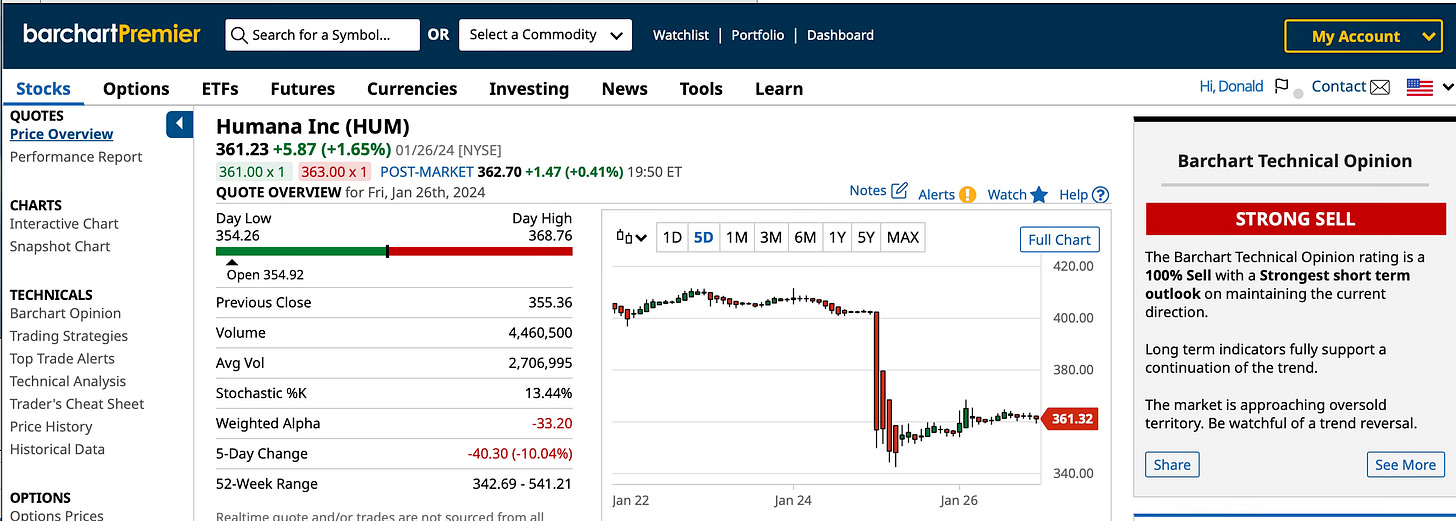

While some analysts downgraded HUM after its conference call, they also kept their target prices above its latest price. Bears posted bearish comments on SeekingAlpha.com. One commenter boldly predicted that the stock will fall to about $200. A SA writer suggested a $300 price target. HUM closed Friday at $361.23, up $5.87, after trading between $354.26 and $368.76. HUM’s 52-week high was $541.21 and its low was $342.69.

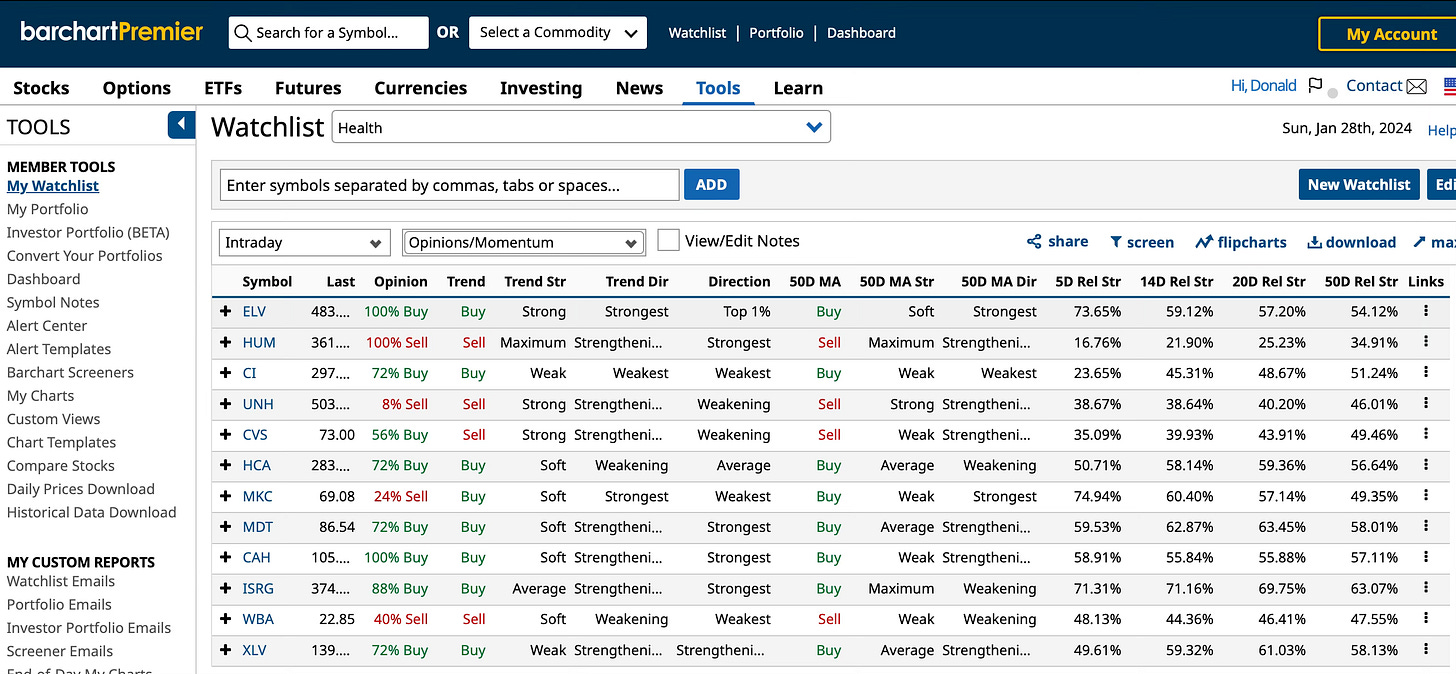

UnitedHealth Group (UNH), the health insurance industry leader, closed Friday at $503.20, up $9.80, after trading between $489.90 and $503.69. It’s 52-week high was $554.70. Its low was $445.78.

I don’t have positions in either stock or their derivatives.

In its conference call Thursday, HUM’s executives said a higher medical loss ratio (MLR) during November and December hurt their profit margins. They promised to raise prices and cut benefits to fix the problem over the next two years. And they talked about possibly losing thousands of enrollees when they raise their premiums and cut some benefits. They also talked about pulling out of unprofitable Medicare Advantage markets.

They predicted that “the big competitor”, UNH, will also raise prices and cut benefits after spending 2023 using lower prices than HUM was charging to increase their market share. I don’t know if this was price signaling or not. Maybe they were just facing reality with the analysts and investors.

Another problem for HUM and its competitors is that Medicare’s latest payment and pricing is hurting their profit margins.

Medicare Advantage PR problems

HUM executives didn’t discuss the impact of growing consumer and political unhappiness with the way Medicare Advantage (Medicare Part C) insurers ration health care for very sick beneficiaries and advertise “free” MA wellness benefits to win new enrollees. Apparently, it’s not material, because the analysts didn’t ask about the bad publicity Humana and Medicare Advantage are getting.

Jeff Goldsmith has been a prominent consultant and strategist in the hospital and health care markets since about 1980 when he published his first article in the Harvard Business Review.

In his Substack.com blog Jeff’s Substack, Jeff wrote about his bout with cancer nine years ago. Now cancer free for nine years, he declares,

“I’d been warned by several of my policy colleagues about selecting Medicare Advantage when I turned sixty-five. “Wait ‘till you get sick”, they sagely warned me.”

Humana was his Medicare Advantage insurer. He got the care he needed even though he went out of network to a hospital 500 miles from home, he asserted:

But otherwise, my Medicare Advantage plan added no value to my cancer care, and grossly underpaid the University of Chicago for my surgery The hospital was paid $15 thousand under their Humana MA contact for my total care, not counting Alex’s surgical fee, for a complex surgery, an eight day hospital stay and an emergency readmission.

Bad publicity like this has to be slowing. the growth in enrollments in Medicare Advantage Plans.

My wife, Susan Alt, and I both wrote numerous articles and editorials about health insurance and employer-sponsored health care, and we created and produced the Managed Care Digest for about 15 years. She was editor of Business Insurance and I was editor of Modern Healthcare at Crain Communications. We owned the Health Care Strategic Management newsletter for about 20 years and for a few years offered HMO and PPO plans to our employees.

Thanks to modern medicine and health insurance, we’re in our late 70s and mid 80s and enjoying retirement.

We are not in Medicare Advantage.

On Morningstar.com, HUM gets four stars out of a possible five and a $500 fair value estimate. That’s up 38% from the current price. The current price is 27% below the FVE. A one star (over bought) price would be $742.50 a share, according to MorningStar. A five star (over sold) price would be $385. That is, HUM is trading below its possible five star and over sold price, according to Morningstar.

Selling covered calls

A bullish trader could buy HUM for about $361.23 and sell HUM 2.16.24 expiration $365 strike covered calls for about $8.30 a share, or about a 44.37% annualized return on risk. This would be an 18-day trade. To get the ARoR, a trader would get the same results on similar trades of HUM or other equities by doing about 20 times a year. (365 days/18 days=20 trades a year.)

The delta would be .47. That suggests that there is about a 47% probability that HUM would close at least a penny above the strike price on the last day of trading the call option. There is a 56.15% probability that the stock will close out of the money and option will expire worthless.

The risk is that after two or three days or more, the stock will sink $5 to $30 a share before the option expires. That may send the option price close to zero pretty quickly, but selling covered calls usually is a pretty weak hedge on a stock. A moderately high implied volatility of 29.45% and a high option price indicate that buying HUM at the current price is a pretty risky trade.

A trader who still has a profit on a HUM trade could do the same trade. Or a buy and hold trader could sell deep out of the money monthly covered calls while waiting for HUM to rally over the next 12 to 18 months.

HUM’s options are very active and liquid. That would allow an owner of the stock to, say, sell HUM 2.16.24 $400 covered calls for about $1.25, or about a 6.71% ARoR. HUM’s $0.885 dividend yields about 0.98% at Friday’s close. This covered calls trade would make HUM a pretty good income stock.

On Barchart.com where I’m a paid subscriber, HUM is rated a 100% sell. That is, of 13 momentum metrics tracked by Barchart, 100% are saying sell. Contrarians may buy.

HUM’s relative strength (RSI) numbers have been sliding over the last 50 days. A RSI below 40 is a sell signal for most speculators while a RSI over 60 is a buy signal for a lot of speculators. RSI under 30 indicates that an equity is over sold.

But RSI numbers are fickle and some consider them poor trading signals.

Barchart lets subscribers create data views that work for them. My daily moving average table shows some important and easy to review short-term trends in daily moving averages.

I like to see stock prices that are higher than 5-day moving averages, 5D above 10D, 10D above 20D, 20D above 50D, 50D above 100D and 100D above 150 day moving averages.

HUM’s 20 DMA is below its 50D and its 50D is below its 100D and 150 Day moving average. That looks bearish to me.

But on StockCharts.com, HUM’s point and figure chart shows that it is trading below its $429.65 price objective. So it may be ready to bounce.

Selling cash secured puts

Selling cash secured puts is a bullish trade done by investors seeking options premium income and hoping to buy a stock like HUM at a discount from the current price.

I often sell 80% OTM probability puts on correcting stocks for several weeks and months before having the stock assigned to me or I buy it. After a stock is assigned, a trader can sell it, hold it for the long term or sell covered calls for options premium income as described above.

I’ve written a lot of newsletters about selling puts in bear markets.

A bullish speculator could go for about a 43% AROR in an 18 day trade by selling HUM 2.16.24 $360 puts for about $8.20 a share on a 100-share contract. The stock could fall way below the strike price and stick the puts seller with an immediate loss on the trade. Or it could bounce back, give the $820 premium per contract to the speculator and soar higher before the speculator could buy in. The delta on this trade is .45 and the OTM probability that HUM won’t be assigned (sold) to the trader is about 52.3%.

To get a bigger potential stock price discount, a speculator could sell HUM 2.16.24 $330 strike puts for about $1.10, or a 5.8% ARoR. The delta on this idea is -.09 and the OTM probability is about 90%. These are probabilities, not predictions, targets or promises.

Buying LEAPs call options

Then there are LEAP call options trades that expire in about a year or in two or three years.

A speculator could buy HUM 1.17.2025 $360 strike calls for about $48.55 a share.

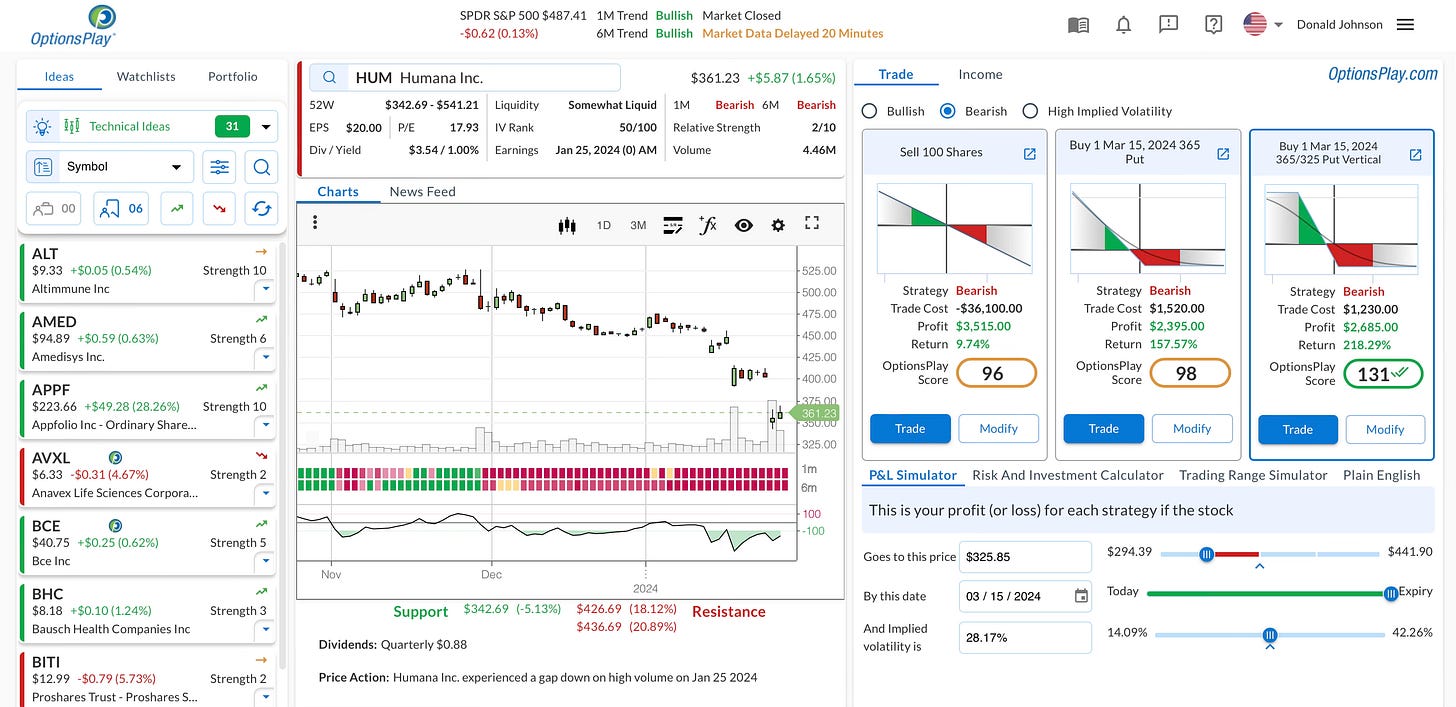

Tony Zang at OptionsPlay.com recommends selling LEAPs with about a .60 delta. For every dollar change in the price of the stock, the call option changes about 60% of that move.

The implied volatility of HUM on this trade is a moderately high 29.9%. So the risk that the price of the option will fall a lot as the IV sinks is tolerable.

The stop loss on the LEAP is up to the speculator. It could be 10% to 50% below the price paid for the January 2025 call options.

A trader could turn the LEAP in to a more affordable covered calls trade by selling covered calls on the January calls seven or eight times a year.

That is, after buying the $48.55 per share or $4,855 per contract, 1.17.25 HUM $360 call stock option, a trader could sell February or March deep out of the money covered calls with the January calls serving as the underlying security.

For example, buy the HUM 1.17.25 call for $48.55. Sell HUM 2.16.24 $400 strike covered calls for about $1.25 a share. There is a 10% probability that the 2.16.24 calls will be exercised and a 91.3% probably the they won’t. The ARoR would equal $1.25/$48.55 times 20 trades a year or about 51%.

Selling covered calls on the HUM 1.17.25 expiration LEAP for about $1 a share five or six times before the LEAP expires could cut the net debit and break even price almost in half. The net debit is the price of the call minus collected call premiums.

Thus, selling covered calls on the HUM LEAP could make it a lot easier to make a nice profit on the LEAP trade.

Assume HUM will close on 2.16.24 at $400.01 per share. With a .62 delta it is likely that if the stock jumps $40, the price of the call option will jump about $24.806, or about 51%. Again, the 10% delta suggests this is unlikely to happen in February, but will it happen by early next year or sooner?

No one knows. All we can do is trade.

P.S. I’m a paid OptionsPlay.com subscribers. It suggests that traders who are bearish on HUM’s stock consider shorting the stock, sell puts or buying a vertical puts spread. If you trade options on Merrill Lynch’s MerrillEdge active traders platform, the OptionsPlay.com calculator is built into the platform.

LINKs:

Home Page. See my more than 190 articles on options trading, stock picking and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @RealDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my Donald E. L. Johnson byline is my handle.

I lost over 11k on Humana last week. Not sure how long it will take to recover.