How To Pay Student Loans With CSCO Dividends And Covered Calls Stock Options Premiums

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

The Supreme Court ruled that people who have student loans must pay them off.

CSCO pays dividends and may give investors capital gains.

CSCO covered calls options premiums can cover most student loan monthly payments.

What is a good way to meet monthly student loan bills that run between $210 and $314 a month now that the Supreme Court has shut down the government’s plan to forgive student loans.

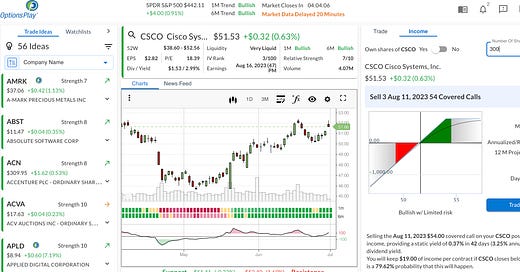

One way to do this is to invest $10,000 to $16,000 in a stock like Cisco Systems Inc. (CSCO), a stock I just bought. See my comments on that article.

A hundred shares of CSCO cost a little under $52 a share, or $5,200, and 200 shares cost $10,400.

The stock pays a $1.53 per share annual dividend, or $153 per 100 shares and $306 for 200 shares. That works out to $12.75 to $25.50 a month. And 300 shares would generate $38.25 a month.

That won’t cover the monthly loan payments.

Maybe this covered call trade will pay the bills.

Invest a little under $16,000 in 300 shares of CSCO, collect dividends plus covered calls options premiums about nine times a year. That will generate $38.25 a month in dividends plus about $551 a month in options premiums, which would cover most student loan payments. Each puts and calls options contract is for 100 shares.

For most college graduates, learning to trade stocks and covered calls should be pretty easy.

Open an account with a stock broker like TDAmeritrade.com, Fidelity.com, Bank of America or Schwab. Read my articles on stock picking and trading covered calls. Ask questions in comments. Talk to the brokers’ support staff and watch on YouTube.com videos that explain how to trade covered calls.

The assumption here is that most people who are college grads or made it part way through college are learners. They can learn new skills that allow them to create side hustles like trading stocks and covered calls for additional income. And they have enough money in the markets or in savings to fund their trading.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Of course, but you are taking on more risk and have to consider what that is worth too. Still not sure I’d encourage someone to take out a 7% loan in order to do option trading, but I may be a more cautious investor than you.

Morningstar.com likes CSCO. https://www.morningstar.com/markets/is-cisco-stock-buy-sell-or-fairly-valued-after-earnings