How To Calculate Covered Calls Options Trades on 12 Strongest Stocks in Dow Jones Industrials Average

This blog follows up on today's earlier article about 12 DJI 30 strongest stocks. These 11-day duration trades are set up for higher risks, higher returns on risks and quick and small capital gains.

By Donald E. L. Johnson

Cautious Trader

Short duration trades yield higher annualized covered calls stock options yields.

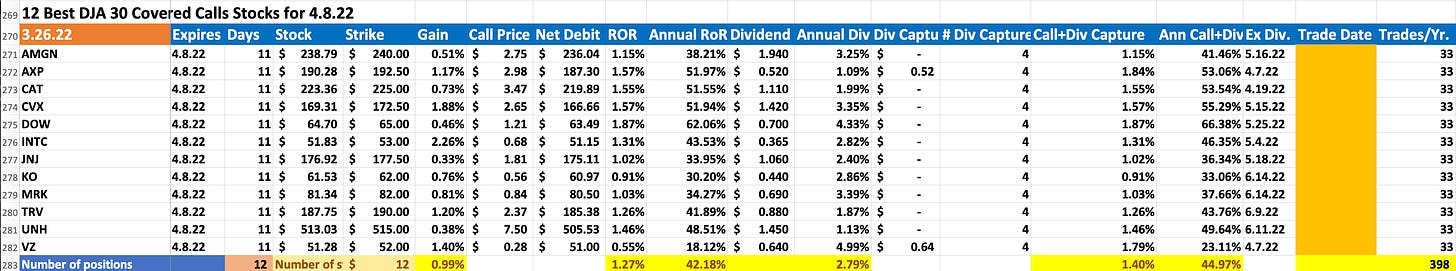

Spreadsheet shows how covered calls options trades are expected to work.

Selling options on stocks during earnings season is riskier than at other times.

This morning my blog, 12 DJI 30 Stocks Are Winners Year To Date; Good Covered Calls, Options Trades Ideas, proposed writing covered calls on the strongest dividend stocks year to date in the Dow Jones Average 30 Industrials index.

One of many ways to do the trades is to sell short duration, 11-day covered calls at the money (ATM) or one or two strikes out of the money (OTM) as shown in my spreadsheet below. Please click on the image and zoom in for a closer view.

Weeklies and bi-weeklies generally offer better premiums than monthly or longer duration covered calls trades. These trades are designed to capture premium income with some dividends and potential capital gains if the stocks continue their recent rally.

If a trader invested an average of just under $20,000 in each stock and they all closed on April 8 just above their purchase prices and just below their call strike prices, the average return on risk (RoR) would be about 1.99%. If the same exact kinds of trades could be done on these or other stocks 33 times a year, the “annualized” RoR would be about 42%, give or take. Changing market conditions make predicting or estimating true annualized RoR impossible.

If all the stocks were called after the April 11 expirations of the calls, the average gains on the 11-day trades would be about 0.99%, give or take.

A lot depends on what the prices of the stocks and call options are when the trades are made and the options expire.

Few plans work out exactly, but over the long run, this strategy can work pretty well. These are relatively low-beta, defensive stocks.

The risks are that the stocks for some reason–good or bad–could drop sharply. That would lead the covered calls trader with the covered calls premiums and losses on the stocks. It happens.

The idea is that if a stock hits a mental or actual stop loss price, the covered calls premiums will cover a small amount of the loss. That is what makes selling covered calls a hedge against a down turn.

As always, try to cut losses short and let profits run. In this market, taking small and relatively quick potential gains. It' isn’t day trading, but it is swing trading.

An alternative to doing these trades would be to sell covered calls on DIA, the exchange traded fund (ETF) that is pegged to the DJI 30. Or traders could sell 5% to 10 OTM cash secured puts on some or all of these stocks or on DIA.

During earnings season, selling covered calls and puts on DIA, SPY, IWM and other stock market indexes is less risky than selling them on individual stocks.

CoveredWriter, Covered Calls, Cash Secured Puts, and More just posted some puts trades on SPY, DIA, QQQ, IWM and other ETFs. The blog is a free service.

I respond to comments and questions. Please subscribe. It’s free. I make my money trading.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

12 DJI 30 Stocks Are Winners Year to Date; Good Covered Calls, Options Trades Ideas.

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and/or have options positions on several of the securities mentioned above. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content or for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

Hi Donald. Just wanted to let you know that I enjoy your blogs. I am mostly a put seller. I work the wheel when I get assigned.

I am practicing option selling (both puts and calls) similar to you. How do I see the latest transactions? For example would have liked to see the 3/25 trades on 3/25.