How To Buy Back Covered Calls Options On Depressed Stocks And Roll Them Forward

The strategy is simple. Pick good under valued dividend stocks. I pick stocks with active and liquid options that can be used to generate weekly and monthly income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

Many dividend investors’ puts and calls stock options expired Friday.

And not a few of the stocks involved are down sharply from what they cost.

When deeply depressed stocks appear at risk of being called at unacceptable losses, traders take smaller losses by buying back the options instead of letting the stocks be called.

Then they roll the options trades forward.

The examples discussed are CAT, DGX, DHR, DPZ, FDS, FDX, PYPL and SPY.

Owners of dividend stocks who sell covered calls options and cash secured puts stock options most likely rolled their March expiration options to options that will expire in the next week, month or several months.

The mission of this newsletter is to help beginning traders learn to pick stocks and how to decide when and how to sell options and then roll them over.

In this issue, I’m showing how I traded some stocks that are under water, including some that almost were called on Friday. The stocks are CAT, DGX, DHR, DPZ, FDS, FDX and PYPL. Some of the options were bought back. Others expired and were rolled forward.

I let SPY be called Friday and was going to sell puts on it Monday. But the ETF closed weak, so I’m hoping I can get a better strike and premium in the next few days.

After stock picking, managing risks and generating an options premium income stream are the most important tasks. To keep the income coming in, after an option expires, it has to be rolled forward. Some trading platforms let traders automate option rolls, but I prefer to do it manually. That lets me evaluate each stock as a new investment every time I roll a trade. If I don’t like a stock after an option expires, I sell it and trade something else.

There almost always some good trades out there.

Some investors trade options on only five or six stocks. Others do many more trades to further diversify and minimize their risks. That is my strategy.

On Friday, I rolled six options trades. Today I rolled 15 calls and puts options trades. Six more options trades expired unfilled today because I tried to get higher premiums than the market wanted to give me. Tomorrow I’ll try to do those trades and a couple of others.

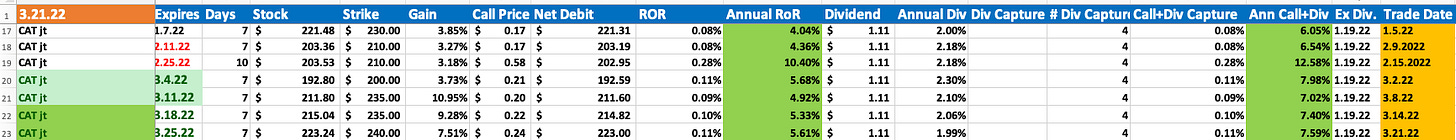

These are the covered calls trades I’ve done on Caterpillar (CAT) year to date. For me, CAT is a buy and hold stock that. according to StockRover.vcom, is trading under analysts’ mean target price of $239.60. The highest analyst’s target price is $270.

Because I don’t want to have it called, I trade its call options weekly at low deltas. The delta .06 on today’s trade indicates that there is about a 6% probability that the stock will be called after the option expires on March 25. While this really is a four-day trade, I recorded it as a one week trade because I only do it weekly, not every four days.

The next stock is Quest Diagnostics (DGX). Although I’ve owned it for awhile, I’ve only done two covered calls trades on it YTD. The stock is trading at $143.85, down from my $150 cost. Because I don’t like to operate under income tax wash sales rules, I sold the calls at the $150 strike. That way if the stock closes above $150 and is called, I can buy it back again right away or I can buy back the options before they expire.

Danaher (DHR) also is down from my $290 cost. Here I chose a strike that will give me a $10 per share profit if it closes above $300. Today the stock closed at $289.27. Analysts’ target price is $340.25. The high target price is $400.

Domino’s Pizza (DPZ) closed at $400.05. Analysts’ mean target price is $480.45. The high target is $590.

Again, I sold DPZ 4.14.22 $450 strike calls because I don’t want the stock to be called below my $450 cost. This lowered my annualized return on risk (RoRO) to 7.6%. Lower risks give lower RoRs.

FactSet Research Systems (FDS) closed Mondays at $437.52, down from my $450 cost. I sold FDS 4.14.22 $450 calls assuming it will not be called. If it is, it will be called at my breakeven price. Analysts’ target price on FDS is $27.38, and the high target is $550.

Federal Express (FDX) disappointed investors with its latest earnings report. It closed Monday at $222.16, down from my $259.40 cost. I sold FDX 3.25.22 $240 calls. That looks like a strike with a safe margin of safety on another four-day trade.

Thus, FDX is unlikely to be called while generating a 5.42% annualized return. As the stock appreciates, I’ll sell calls closer to the money, or the stock price. Analysts’ target price on FDX is $317.53 and the high target is $380.

The iShares Russell 200 ETF (IWM) closed Monday at $205.44, down from my $223 cost when it was put to me. I will sell covered calls on IWM until it is called. Then I will sell cash secured puts on it.

Meanwhile, I don’t want to sell IWM for less than I paid for it. So I sold IWM 3.25.22 $215 calls because IWM is unlikely to top that strike in four days. The annualized premium plus dividend income is a nice ROR while I wait for the markets to rally.

I bought PayPal (PYPL) for an average cost of $150. Monday it closed at $114.66.

This is a good example of what happens when a deep under water stock is about to expire at a strike way below the cost of the stock. If called, the investor would be left with a huge tax loss on a stock that promises to rally sooner than later.

Analysts’ target price on PYPL is $203 and the high target is $350.

So as shown in the spreadsheet below, I had sold PYPL 3.18.22 $110 strike calls for $0.28 a share. When PYPL was about $112 and change, it appeared that it was certain to be called. I bought the options back for $2.99, or a $2.71 per share loss. On Friday the stock closed at about $118.77. That was more than $5 above where the stock was when I bought back the calls.

A few minutes after I bought back the March calls, I sold PYPL 4.14.22 $150 calls for only $0.16 because I wanted to give the stock time to snap back some more. Instead of rallying some more Monday, profit taking took PYPL down $4.12. Disappointing, but no surprise. Things happen.

Question: Do you have any trades that you’d like to discuss? Please use the comments section below to discuss.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and/or have options positions on the securities mentioned above. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

A reader emailed: "Looking at your PayPal paragraph, it seems that you initially sold 3/18 calls, not puts, correct? Just trying to piece together your strategy and I think you meant to write calls.

I am also curious about your strategy of selling calls below your purchase price. I am hesitant to do that so as not to experience an overall loss. Since the philosophy is to use strong companies for the options trades, holding on to the stock while it recovers (and also possibly get a dividend payment) is more bearable with a strong company that should recover before then seeking to place a covered call, better with a profit."

I replied: Great catch. I’ve corrected that in the article and in comments. Thanks.

On deep under water stocks, I frequently sell calls below my purchase price and at low deltas. I try to do the trades so they won’t be called. It usually works. When it doesn’t, as on PYPL and a couple of others last week, I buy the calls back at a small loss and roll the trade forward. It can take awhile to recover the small loss by selling calls and waiting for the security to recover, if it does. This is when it helps to trade only one contract on a security. Sometimes I forget and get over aggressive and pay. Thanks for being my editor. I hope you keep it up and that I can return the favor.

Don

Correction: I sold PYPL calls, not puts. Late night brain fog.