How I Am Trading AMZN Cash Secured Puts In June

AMZN is making a bull run. I want to buy it at a discount.

By Donald E. L. Johnson

Cautious Speculator

I am trading AMZN cash secured puts six times in June. None were or will be assigned.

The total puts options premium income for the month on these trades was 2.15%, or an annualized return on risk of 25.8%.

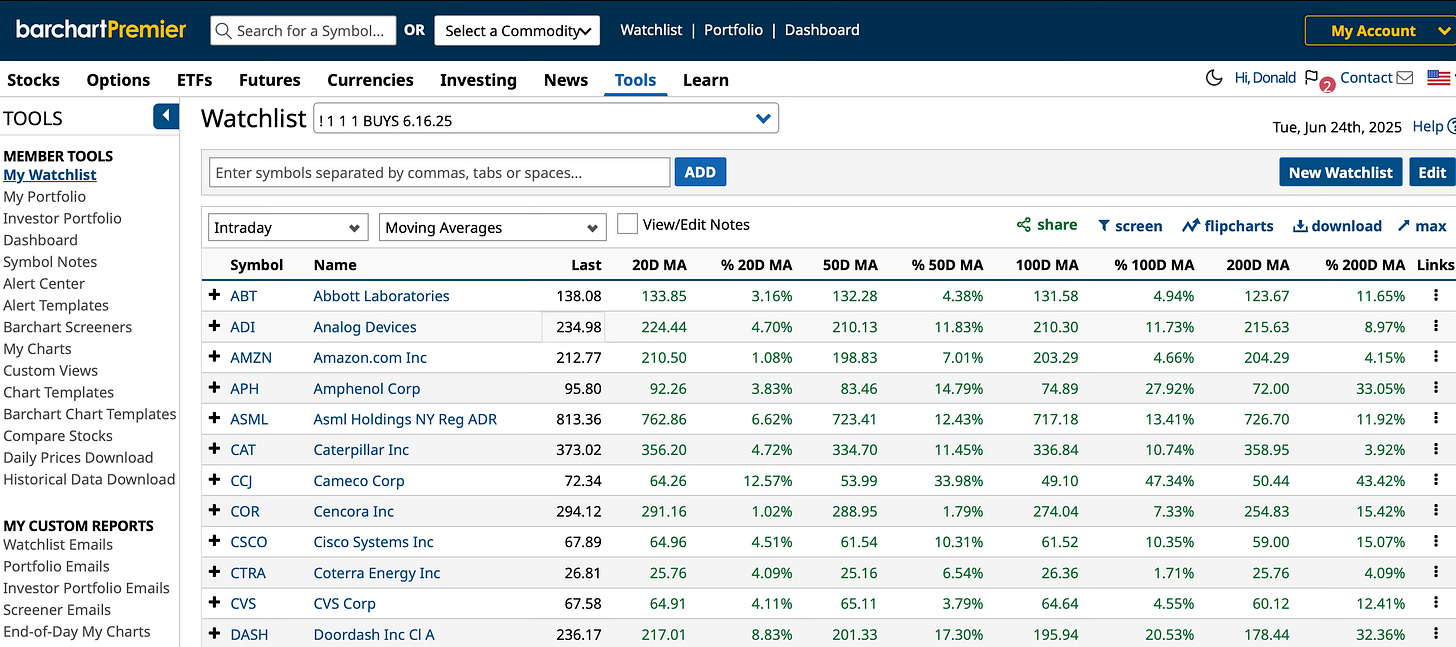

AMZN is trading above its 20-, 50-, 100- and 200-day moving averages. That shows that is on a long-term bullish run after being down 37.5% from its 52 week low.

This strategy can be used by owners of stocks that are sharply below the prices they paid for their stocks while they wait for the stock prices to rally.

Numerous investors are holding high-quality stocks that are trading 10% to 30% or more below their purchase prices.

Disciplined risk managers sell stocks when they are 10% to 20% below their purchase prices.

But traders of covered calls can sell covered calls and cash secured puts and collect dividends to reduce their net debits over a few months or years while they wait for the stocks’ prices get back to or close to their purchase prices. I last wrote about selling puts here.

I don’t own AMZN. But I want to buy it at lower price when the market corrects from its current highs.

A simple way to find stocks in bullish trends is to create a watch of stocks that are in bullish trend. My watch list has stocks with current prices above their 20-day moving averages. Their 20-day DMA is above the 50-DMA. That is above the 100-DMA and that is above the 200-DMA.

AMZN fits that bill. Because I want to buy this stock, I trade it at only moderately low deltas. The deltas on my AMZN trades ranged from -.11 to -.23. The delta suggests that the probability that a puts or call option will be assigned, say from 11% to 23%.

Short durations provide higher returns on risk. Some of my trades are two- or three-day trades. And some are for eight or nine days. Three times in June I traded AMZN puts twice in a week to make sure I hit my monthly premium income and RoR goals. While several trades were for less than a week, I label them as 7-day trades because I usually only do such trades once a week.

My RORs on each trade ranged from .18% to .50%, or 8.13% to 20.5% annualized if I did the trades 45 times a year. In June when stocks still were pretty volatile, my six AMZN trades gave me a total 2.15% ROR, for June or an ARoR of about 25.8%.

I tend to avoid trading puts and calls that will be open when companies report earnings and when the Fed is expected to make important interest rate changes. And I do a lot of puts and calls trades every month to diversify my risks.

Note that with AMZN at $212.77, one 100-share puts option contract costs only $21,277 to back with cash and less if a trader owns the stock and has other collateral to back up the cash secured put.

If my AMZN 6.27.25 expiration $210 strike and $202 strike puts are exercised, I’ll decide whether to take assignment and sell AMZN covered calls or buy the puts back at a loss and roll them out another week into July. I don’t expect that to happen this week.

The cumulative net debit on the $210 strike puts would be $205.46 a share, or $20,546 per puts contract. The net debit on the $202 strike puts would be $199.72, or $19,972.

My point is that a seller of AMZN and other weekly cash secured puts can produce nice monthly incomes based on the premiums collected.

Alternatively, an investor could buy AMZN stock for $212.77 per share and hope to see it appreciate. AMZN does not pay dividends.

Morningstar.com rates AMZN a four star stock with an estimated fair value of about $240. Barchart.com and SeekingAlpha.com sport a lot bullish articles about AMZN. That is another reason I’m bullish on the stock and want to own it at a lower price.

I am short AMZN cash secured puts as described above.

Good to hear from you Donald! Nice write up on Amazon puts. I have been buying shares of AMZN with a cost basis of $192. Not doing any options on it yet. Been also trading GOOGL MRK and CVX. Have also been diversifying with PHYS PSLV and IBIT….about 10% of portfolio. Lots of action in the world right now. As always a pleasure to read your ideas! Take care.

Thank you for the idea, maybe too late for June, watching July...