Gold Miner Newmont Is A Hot Dividend Stock; How I'm Trading NEM Covered Calls, Cash Secured Puts

The strategy is simple. Pick good under valued dividend stocks. NEM has active and liquid options that can be used to generate additional income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

When wars break out and inflation sends interest rates higher, investors move their money into grains, energy and metals futures like gold. That can send commodities prices soaring, as they have in recent weeks.

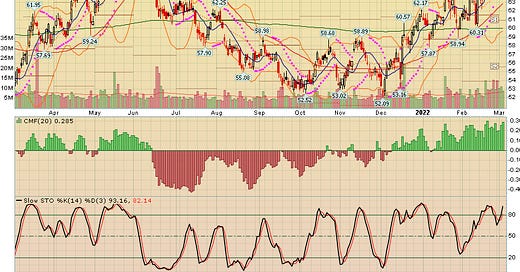

Gold miners, like Newmont Corp. (NEM), profit from rising prices for their commodities, and that turns their “dead money” stocks into momentum leaders. In the very bullish chart above, the Stock Charts Trend Rating (SCTR) of 93 is a strong momentum indicator. At 69.3, the relative strength indicator (RSI) is almost in overbought territory.

Investors who own and buy NEM because it is a rock solid gem that yields about a 3.23% dividend on my cost can boost that yield by selling covered calls and cash secured puts options.

Such trades usually are routine when repeated (rolled) 12 to 52 times a year, depending on whether monthly or weekly expiration options are traded.

But when a nice dividend and options stock turns into a hot, over valued winner that a trader is not ready to take profits on, things can get a bit complicated.

On Feb. 17, when NEM was trading for $64.77, I sold NEM 3.18.22 $75 strike covered calls for $0.66 a share.

The problem was that NEM was scheduled to report earnings on Feb. 24. An earnings surprise could depress the stock or send it above the strike price where it could be called.

I closed the trade after six days at a small profit. And I also had sold NEM 2.25.22 $53 strike puts for $0.19 a share. I closed that one, too, because I didn’t want more NEM shares, which meant that I didn’t want to have the puts assigned (sold) to me.

After I did those trades, I decided that NEM was too good to write covered calls or sell puts on it. The plan was to let it run.

NEM reported strong earnings and by today was up to $70.68. It goes ex-dividend on March 9.

Today, I sold NEM 3.4.22 (one day) $72 (delta .21)covered calls for $0.17. There is about a 21% probability that NEM will close above $72 on Friday and it will be called, unless I buy the calls back before the close. I’ll be watching the computer monitor closely all day.

If the trade works, the immediate RoR will be about 0.25%. Should the exact same kind of trade be done every week for the next 52 weeks, the annualized return would be about 13%. Of course, the trade can’t be replicated exactly because prices change. These returns on risk are calculated as seven-day trades because they are done only once a week.

This is a one-day trade because I really don’t know where the stock is going. I’m pretty comfortable that the stock won’t be called. If it is, I might let it go and take my potential 5.63%. gain. If that happens, I might buy the stock back as it dips on Monday, when it goes ex-dividend. Or I might sell puts on it.

After the covered calls trade was filled, I sold NEM 3.25.22 (22 day) $63 strike (delta -0.23) puts for $0.46 a share. The immediate ROR is 0.651%, or about 10.8% annualized. The margin of safety (stock price minus strike price) is 12.52%. That is, the stock has to drop about 12.6% from Thursday’s close to be exercised after the close of trading on March 25.

Assuming the NEM calls and puts expire worthless and I collect the options premiums and dividend, the current trades’ combined annualized returns on risk would be about 3.23%+13%+10.8%, or 27%.

Reality check: It is unlikely that I will have these trades on all of the time over the next 12 months.

NEM is on our $25,000 watch list. Please click on images and zoom in for better views.

When screening for stocks for covered calls and cash secured puts watch lists, the price to free cash flow is a critical metric. The lower the better. NEM’s P/FCF ratio is approaching expensive at 21.5. The average P/FCF ratio for comparable stocks in the DOW JONES 30 Index is 22.

NEM’s fair value estimate at StockRover.com is $83.38. The mean consensus target price of Wall Street analysts is $69.18. Look for analysts to raise their estimates if NEM stays hot.

Please subscribe. It’s free!

Question: What questions and comments do you have about this strategy? We can discuss it in comments.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees.

Calls vs Puts Options: What’s the Difference?

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own NEM and have NEM calls and puts positions.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

NEM closed at $74.28, up $3.60, or 5%. I let it be called. I'll sell some more $65 to $70 strike puts, depending on what the stock does next week. Meanwhile, I rolled my weekly covered calls on several other stocks today.

I sold the puts when the stock was around $73.93 to $74.20. Now $76.91. So I have about 50% profit on the sold puts.