FedEx Gets Bullish Pick From Barron's; It Is A Possible Covered Calls, Income Trade

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculator

Barron’s says FDX could be a long term buy if it improves its margins.

FDX profit margins are not as good as United Parcel’s.

FDX is over sold; charts are bearish and it may be ready to snap back.

FDX and its peers face labor shortages, high fuel prices and a possible recession.

Federal Express (FDX) received a moderately long-term bullish recommendation in this week’s Barron’s, and retiring founder and CEO, Fred Smith, was the subject of a great essay and interview in Saturday’s edition of The Wall Street Journal.

To achieve the biggest cushion or hedge on FDX, a speculator who buys the stock for about $205.74 (Friday’s close), could sell FDX 5.20.22 expiration $210 strike (delta .43) for about $5.80 a share. If the shares aren’t called at $205, the annualized return on risk (RoR) would be about 30%. If they are called (about 43% probability) with the stock above the strike, the annualized RoR (premiums plus a 2.1% potential capital gain) would be about 53%.

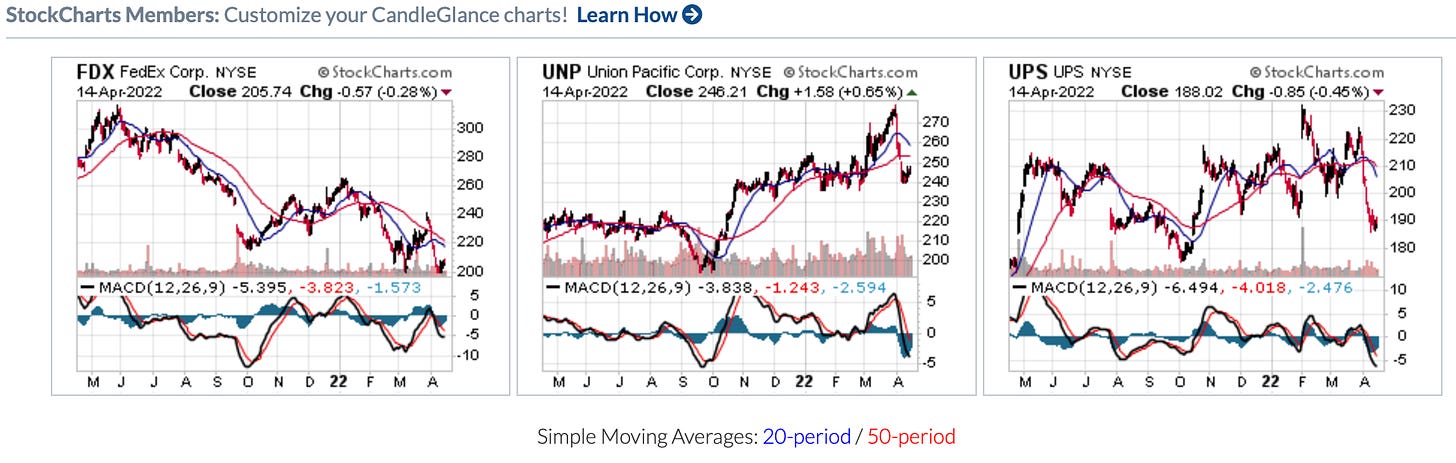

FDX’s technicals are very bearish and its recent tiny snap back is being tested.

Barron’s impact paragraphs:

FedEx’s stock (FDX) amounts to an inexpensive bet on higher margins, better earnings, and greater free cash flow. Its shares, at $205.74, have changed little since mid-2017, badly trailing the S&P Index. The stock looks appealing, valued at 10 times projected earnings of $20.45 a share in its fiscal year ending in May and nine times estimated earnings of $22.61 a share in the next fiscal year ending in May 2023.

UPS, at $188, fetches 15 times estimated earnings in calendar 2022 and trades at an unusually wide premium to FedEx. The recent weakness in both FedEx and UPS shares reflect concerns about the economy and consumer spending later this year.

FDX is trading at 18.3 times its free cash flow, compared with United Parcel (UPS), which is trading at 15.3 times, according to StockRover.com data. Union Pacific (UNP) is trading at 26 times its free cash flow.

FDX is trading at about 96% of its estimated fair value (FVE), compared with 1.01% for UPS and 98% for UNP.

FDX is trading 47.7% below the mean analysts’ target price of $303.92, according to StockRover.com. UPS is 23.5% below its $232 target price, and UNP is 8.8% below its $268 target price.

All three companies are facing labor shortages, high fuel prices and the high probability of a recession, which could start any time over the next year.

Whether a dividend stock investor wants to buy any of these stocks and write covered calls on them for enhanced income depends on how they feel about the market and whether they want to wait before making any trades.

I wrote on April 16 about using covered calls as an inflation hedge and as a hedge against a bear market.

Please subscribe. It’s free.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

12 DJI 30 Stocks Are Winners Year to Date; Good Covered Calls, Options Trades Ideas.

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and have options positions on FDX. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.