FedEx Breaks Out With Nice Bullish Price Objective; Buy And Sell Calls, Sell Cash Secured Puts?

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculator

FedEx (FDX) staged an impressive bullish breakout Tuesday.

I sold cash secured FDX puts for premium income and a discount on the stock if it is assigned to me. I may buy FDX and sell covered calls.

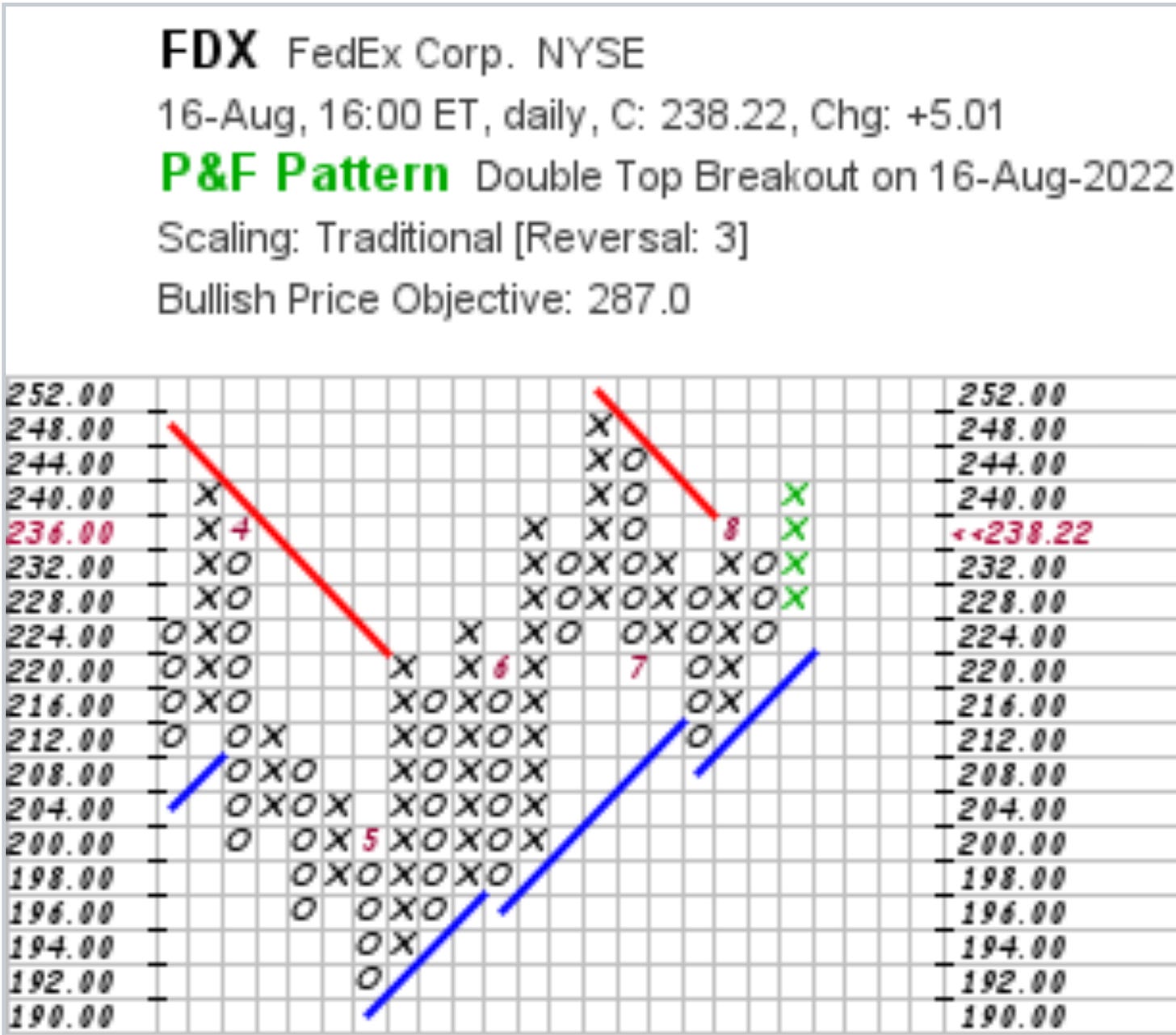

FDX closed at $238.22 Tuesday and it has a $287 price objective.

FedEx (FDX) is breaking out. On Tuesday it jumped $5.01, or 2.15%, to $238.22.

The green Xs show Tuesday’s strong bullish move. If the stock continues to rise, that is bullish. If the breakout fails, as it has following recent breakout attempts when the Xs were quickly replaced by Os, that is bearish.

Tuesday’s bullish move was signaled several days ago in this bullish FDX chart. Click on the images and zoom in for better views.

After picking a good stock, timing a trade is very important. The breakout in the above charts is a buy signal for trend followers who watch these charts.

When there is a buy signal, an investor has to decide whether to buy the stock, let it run higher, or sell covered calls for a quick capital gain.

Another alternative is to sell cash secured puts for options premium income. That gives the trader some time to wait for a correction or a chance to buy the stock at a discount.

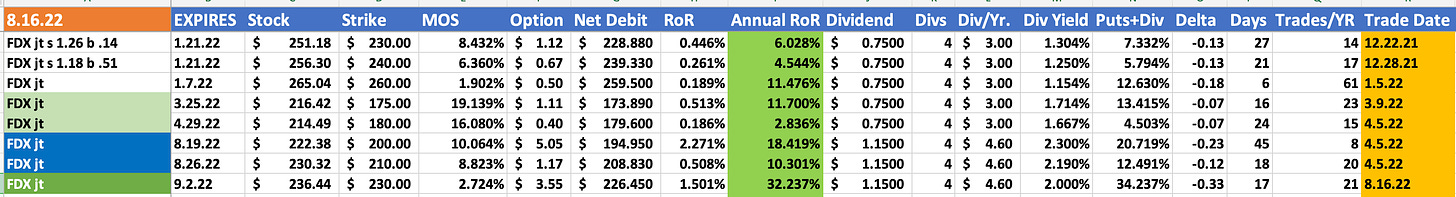

Tuesday, while FDX was up about $3 and the stock was at $236.44, I sold FDX 9.2.22 expiration $230 strike puts for $3.55. The immediate return on risk will be about 1.5%, or about 32.2% annualized. The margin of safety (MOS=stock price minus strike price) is only 2.96%. This is because I’d like to buy the stock at $230. It has a $287 bullish price objective as shown in the StockCharts.com point and figure chart above.

Since late December, I’ve sold FDX puts eight times.

If FDX dips a bit and then starts to rally again, a trader can buy it and write covered calls. Each options contract is for 100 shares, or $23,382.20 in this case. The net debit (stock price minus options price) is $232.89 before commissions. Support is at about $225.56. Resistance is at about $252.

If a trader bought FDX at Tuesday’s $238.22 close, she might sell FDX 9.16.22 (30 days) $240 strike (delta .48) covered calls for about $6.45 a share or the $250 (delta .27) calls for about $2.80. The annualized returns on risk would be about 31% on the $240 calls and $13.4% on the $250 calls. A .28 delta suggests that there is a 28% chance that the calls will be exercised unless the investor buys the call options back before they expire.

I’ll post updates on this post, including any further FDX trades, in the comments section.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Read about some of the trades that I did last week on the home page.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.