FB, PYPL Sink After Disappointing Shareholders, Analysts And Pundits

When companies change strategies, make bold moves and surprise stock holders and analysts with disappoint guidance, it can take them a long time to win investors back.

By Donald E. L. Johnson

Cautious Speculator

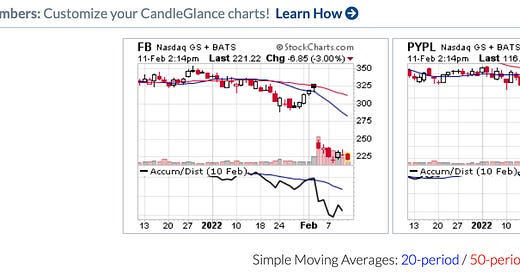

FB and PYPL are down sharply since reporting earnings and lowering their guidance on future earnings. Both are down again today.

Analysts and pundits who advised buying these stocks are reluctant to say sell and take your losses. They say hold or buy more. That isn’t a good plan unless traders plan to work their way out of the hole by selling covered calls and puts while waiting for the stocks to recover.

Both companies appear to have deeply angered shareholders and analysts with their surprise announcements.

It may take a long time for analysts and investors to forgive the companies for their missteps.

The Dispatch (paid subscription) has a good writeup on Meta Platforms, which owns Face Book (symbol FB). I wrote about PYPL on Feb. 2.

I posted this lightly edited and enhanced comment on The Dispatch:

For a long time, Face Book (FB) got Valuentum.com's top rating, a 10, or buy. And it was the only stock rated a real bargain like that over the last few years. Its VBI rating is now a 6, or hold.

The service estimates FB’s fair value is $416. It is at $221.58, down about $6 so far today. Its 52-week high was $384.33, and it’s low was $216.15.

Unexpectedly, the founder and CEO who owns almost all of the voting shares pulled a fast one on his non voting shareholders. (I don't buy non voting shares in GOOG, BRK.B, etc.)

He decided to become a venture capitalist. He forgot or didn't care that FB was owned by millions of people either directly as shareholders or indirectly through mutual funds, exchange traded funds and pension funds.

The "meta verse", a distraction for political targets like social media companies, caught his eye as a financial PR whiz, if not as a venture capitalist and responsible CEO and employer.

To him, $10 billion is a good play money bet on a dream that his cult would buy into. That bet forced him to lower his earnings guidance and created a lot of doubt about Face Book's future as a growth company and stock.

The stock tanked.

This angered not only shareholders who were paying attention, but also CNBC anchors and other touts who had been getting viewers and clients of their financial advisory services into the stock.

When you get so many people angry with you, you are in a very deep hole. Suddenly you are not trusted not only as the world's most powerful liberal and biased editor of political comments and posts, but also as custodian of other people's fame and fortunes.

What pundits, analysts and financial advisors and financial services do when a stock they have gotten their customers into tanks as FB has is defend the stock.

No matter how bad things look, people whose reputations are on the line for a stock too often advise averaging down, buying the dip and giving the company a few quarters, years or decades to prove itself.

They don't like being forced to say they made a huge mistake and it's time to take your losses and move on. Clients don't like to hear that, and so they often don't.

As a long-time very active member, I never liked FB or its strategy, and I don't own it. But PayPal (PYPL) is in the same boat, and I own that.

We all make mistakes and get bombed by black swans. Then we make another mistake and don't cut our losses short when we can. Talk about painful!

What I’m doing with PYPL is holding it while selling out of the money, low delta covered calls and puts on it.

Question: Will you hold or buy FB or PYPL? Do you buy, sell or sell their puts and calls?

LINKs:

Home Page. See previous articles on other stocks and options strategies.

Calls vs Puts Options: What’s the Difference?

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own PYPL and am short its puts.

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks that I like.

Don: Your honesty is appreciated along with the feedback! Have a great weekend !