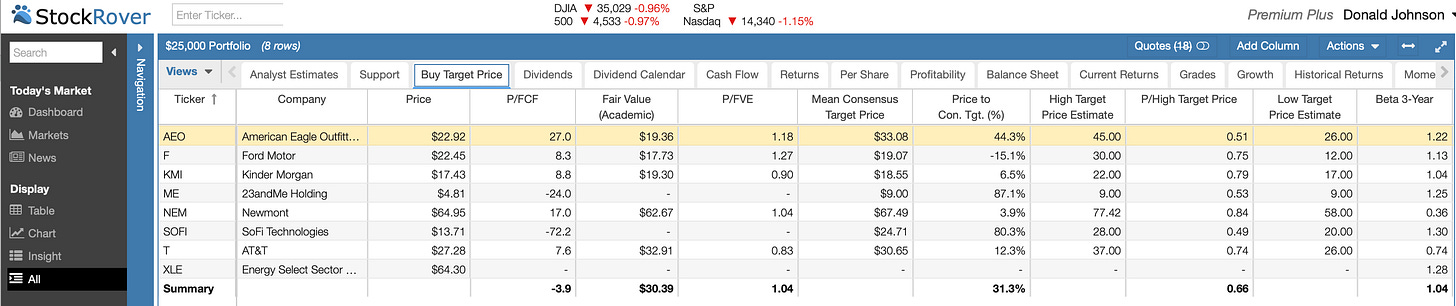

Eight Stocks for a $25,000 Diversified Puts Portfolio

I cover what I’m trading and how I’m looking at stocks and options. I can’t predict markets, stock prices, interest rates or black swans. Nobody can. All we can do is trade and manage risks.

By Donald E. L. Johnson

Independent Speculator

Stock futures are bouncing back a bit this morning, which may encourage some speculators to sell cash secured puts (naked puts).

Stock picking is key to successful options trading.

Selling CSPs is a moderately bullish, moderately risky trade.

Traders limit risk by selling puts with larger margins of safety (MOS).

Traders with at least $25,000 in cash that they can afford to lose can create a pretty well diversified portfolio of cash secured puts options on some relatively low-priced but not cheap stocks as shown in my spreadsheet. I created the spreadsheet years ago and just revised it. I use it as my options trading calculator and trade tracker.

Please click on the image and zoom in for a better view.

What I try to do to reduce risk is have at least a dozen options positions on as many stocks and ETFs to diversify my risks. Usually, I get very few, if any assignments on my CSP trades. But in this month’s down market, I will take several assignments because my stocks have dropped below their strike prices.

After I own those assigned stocks, I’ll write covered calls on them for income and collect dividends until they’re called. Then I’ll sell covered calls on them. Tomorrow I’ll show how to write covered calls on these stocks.

The options on these stocks are relatively liquid in terms of the number of puts and calls strikes that are being traded. This makes it easier to get orders filled at the mid points of the bid and ask prices.

Generally, it is best to sell CSPs on stocks that are rising in a bullish market. But traders seeking income also sell naked puts and puts on stocks they own to generate income regardless of whether the stocks are rising or the market is bullish.

They do that to generate premium income and to get into stocks with options that they want to buy at discounts from current prices.

Experienced income traders in today’s correcting markets are most likely to sell naked, CSPs at a 10% to 15% MOS. That limits risks and offers big discounts if stocks or ETFs are assigned. A 10% to 15% MOS also makes it easier to trade in and out of the puts before they expire in 30 to 45 or more days.

For example, if a puts trade turns a big profit a few days after I do a trade, I’ll buy the puts back at a nice profit and do another puts trade. Puts prices fall when the underlying stocks and ETFs rise. And time devalues the price of a puts option, especially during the last month or so before the option expires.

New puts and covered calls traders might treat the stocks shown above as a watch list and wait for lower prices before jumping in. Or they may wait a few trading sessions to be sure that the markets and stocks are recovering before they do bullish cash secured puts trades.

New traders might want to paper trade the stocks we’re discussing before trading with real money.

MOS is the current stock price minus the stock price. Annualized means that if the exact same kind of trade is done repeatedly over 12 months, you might achieve or beat the “annualized” estimate.

Before trading, do your due diligence. All of these stocks are trading below their 52-week highs and most are below their 50-day and 120-day moving averages, which is bearish in the eyes of technicians.

Fundamentally, the stocks shown above are a mixed bag. But most are trading below the highest target prices posted by analysts. Most speculators probably will pick two or three to trade and watch the rest before adding them to their portfolios.

To me, the key valuation metric is price/free cash flow (P/FCF). It can’t be manipulated by companies the way price/earnings (PE and PEG) ratios can. I like to sell puts and covered calls with a P/FCF under 20, but I break that rule more often than I like to admit to myself or others. I break it when a stock like Apple, which I don’t own, obviously is something I should own and can trade relatively safely.

Sell side brokers’ analysts’ target prices always are suspect, especially at this time of year, because they’re paid to be mostly bullish. If they can’t be bullish on a stock, they usually don’t follow or rate it unless it’s widely owned like T, F, NEM and KMI.

Another important metric is return on assets (ROA). AEO’s 9.9% ROA is relatively good and the best of the stocks on this list. The others are pretty dismal.

SOFI and ME are still startups even though they’ve been in business for years. They appear to have good prospects, which is why I own them. The other companies, which I also own, are well established and good companies that look promising to me, but I can’t predict stock prices. That’s why I don’t give trading advice. All I can do is trade and hope for the best.

LINKS:

CNBC.com

Coveredwriter.blogspot.com

OptionsPlay.com

SeekingAlpha.com

StockCharts.com

StockRover.com

Beware. I'm an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. I reserve the right to trade any of the listed stocks at any time. I own and/or have options on the stocks mentioned in this article.