Dow Jones Industrials Are Good Dividend Stocks for Income Investors Trading Covered Calls Stock Options And Puts Options

Pick good under valued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculator

DJIA 30 stocks and their stock options are widely and actively traded.

That makes them volatile and good for trading covered calls and cash secured puts stock options

Use your stock watch lists to find stocks with active options, reasonable values, bullish target prices and discounts to fair value estimates.

Most of the 30 blue chip stocks in the Dow Jones Industrials Average are good dividend stocks that offer active, deep and liquid options for trading covered calls stock options and cash secured puts options. My watch lists and articles about stock picking and selling covered calls and cash secured puts are here.

DIA, the exchange traded fund (ETF) that tracks the DJIA 30 index also is a good covered calls and CSP equity and dividend ETF.

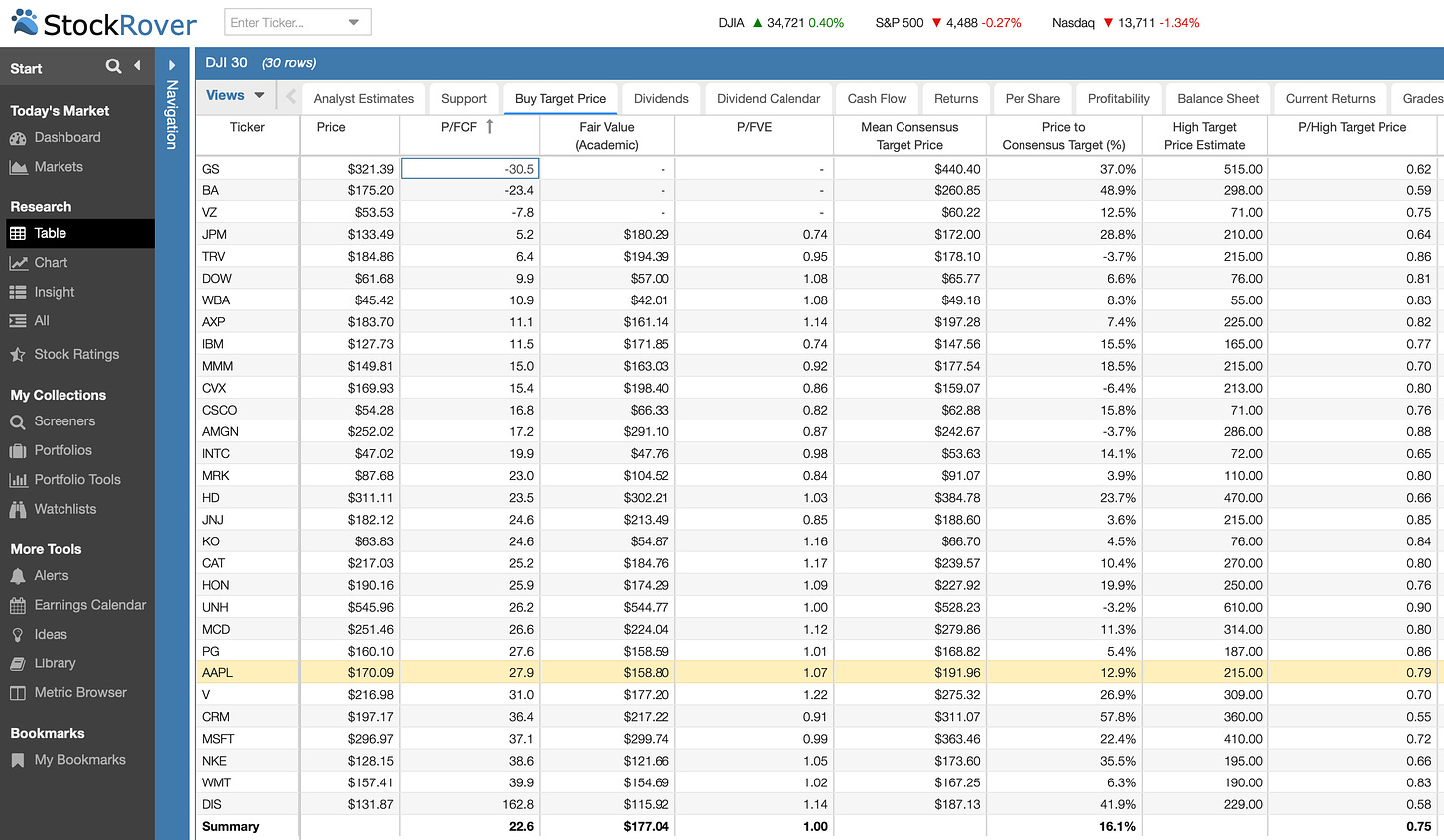

I created this DJIA watch list on StockRover.com to show the price to free cash flow, a key valuation metrix, the discounted cash flow fair value estimate (FVE) and mean consensus target prices for each stock.

Bullish investors can buy the stocks they like the best and write covered calls on them. Or they can sell cash secure puts for premium income. Selling puts is a bullish trade.

Bearish investors are most likely to stay out of the market until they turn bullish on the markets and individual stocks and ETFs.

For dividend investors who use covered calls and cash secured puts to boost their weekly and monthly incomes, some of the best stocks have P/FCF ratios under 20. They are trading near their FVE and at good discounts to average high target prices.

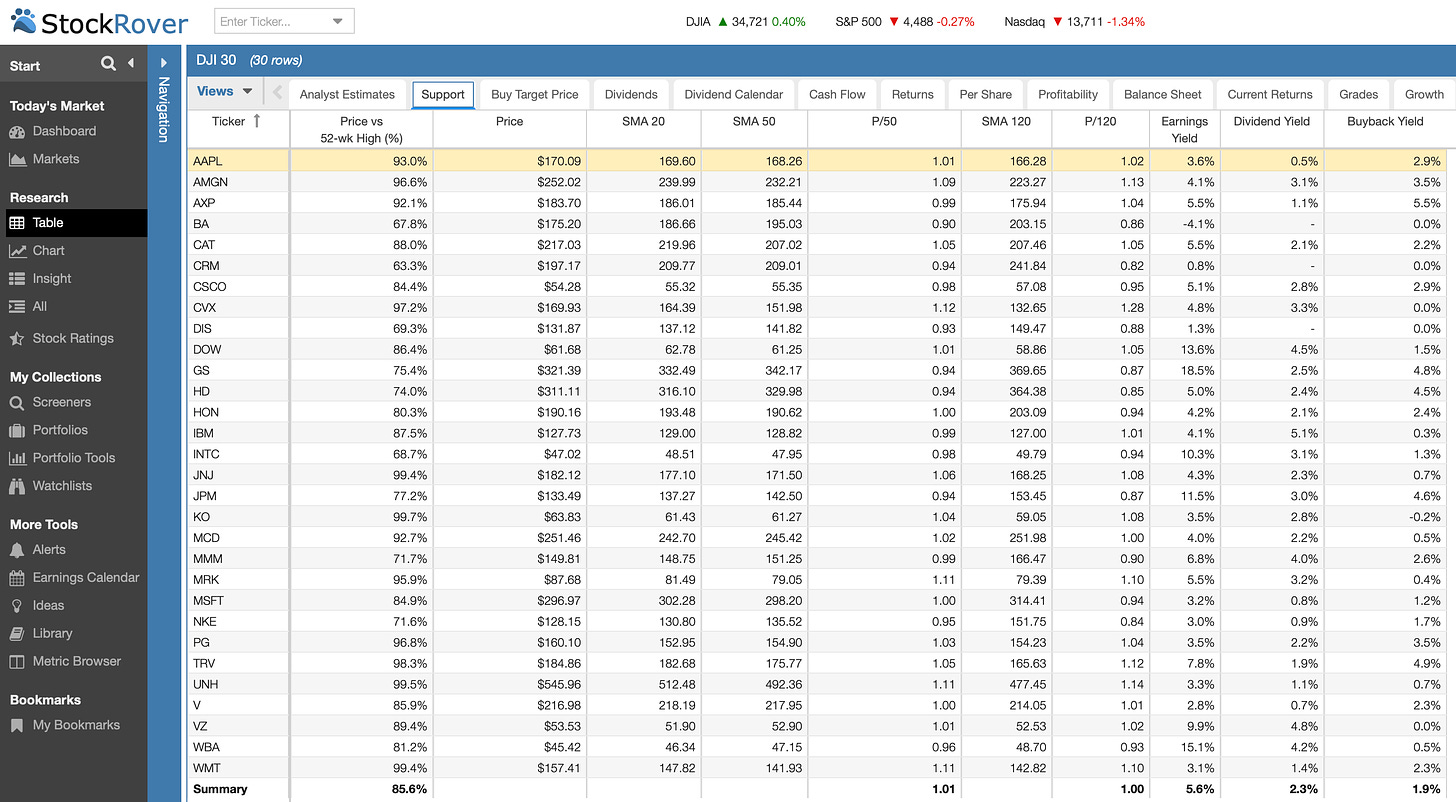

This table shows the DJIA 30 stocks’ momentum. For income traders and dividend stock investors, the best bullish ideas are stocks that are trading above their 50-day moving averages and their 120- to 200-DMAs with the 50-DMA above the 120- and 200-DMA.

Successful dividend stock investing and covered calls and CSP income trades depend on good stock picking. Bullish stocks and ETFs work best for both covered calls trading and CSP trades.

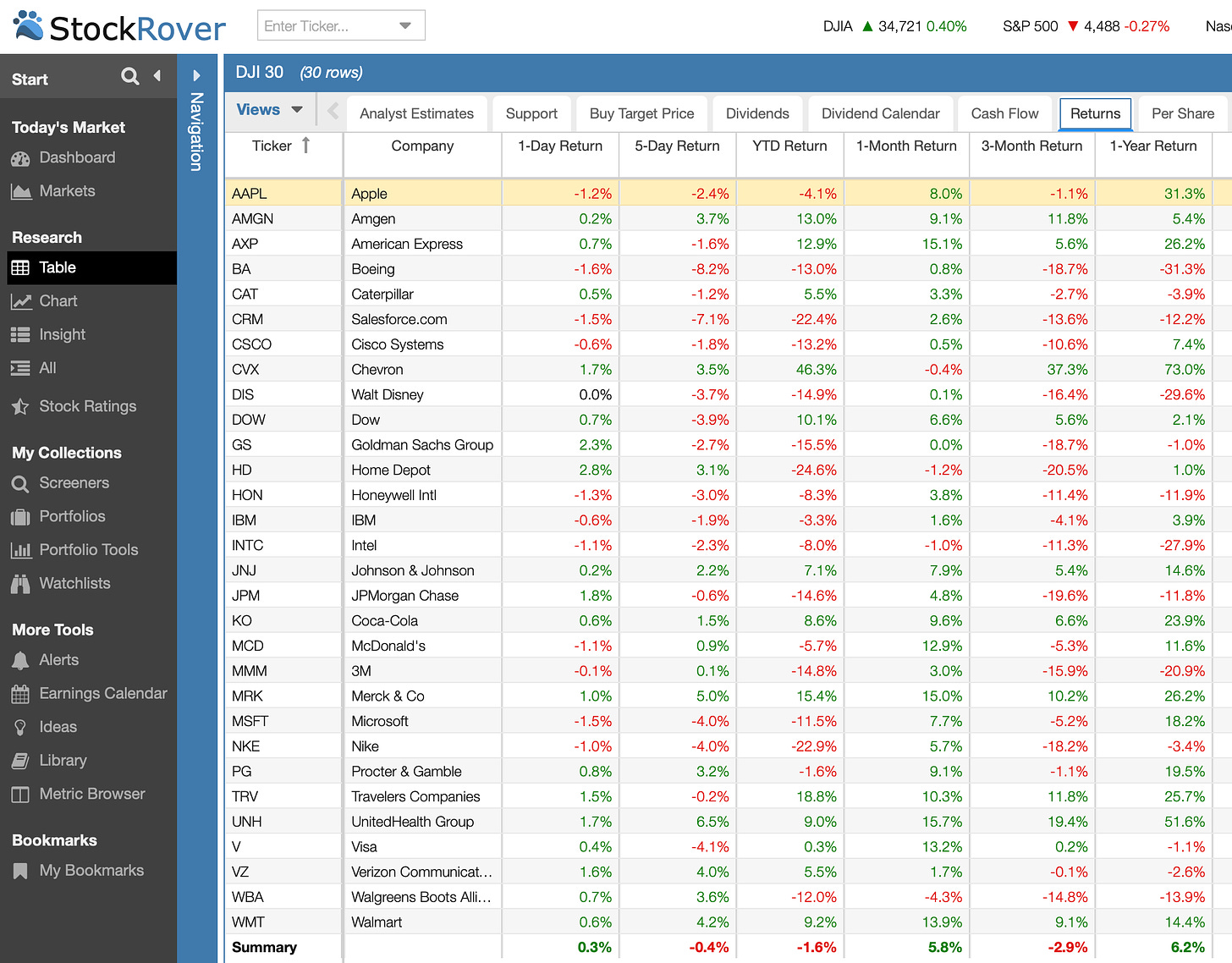

Last week, the DJIA stocks and DIA dipped about 0.4%. I wrote about DIA’s weakening technicals here.

This is how StockRover.com tracks the daily markets.

Please subscribe. It is free.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

12 DJI 30 Stocks Are Winners Year to Date; Good Covered Calls, Options Trades Ideas.

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and have options positions on DIA and some of the securities mentioned. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content or for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

Thanks Donald.

Hi Don. Thanks for the interesting blog. Are you trading options in this uncertain market? I am thinking about taking a few weeks off. The StockRover charts are really good. Is StockRover a free service? Thanks, Michael