By Donald E. L. Johnson

Cautious Speculator

Warren Buffett likes dividend stocks.

Individual income investors trade dividend stocks and sell cash secured puts and covered calls stock options.

JEPI is a low expense, 9.9% dividend ETF. It is more of a buy and hold trade, and traders can try to buy it at a discount by selling cash secured puts on it. Or, income investors can just buy the ETF, or not.

DOW is a 5.5% dividend stock. It is good for selling puts and calls.

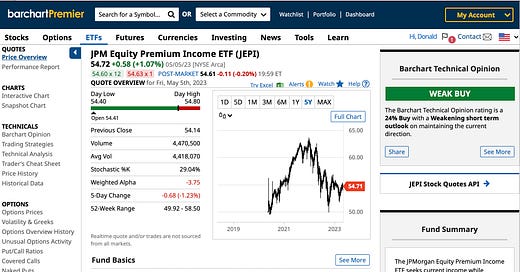

Dividend stock investors are buying JPM Equity Premium ETF (JEPI) because it yields more than 9% annually, pays a variable monthly dividend and over the last year has out performed the SDER S&P 500 ETF (SPY). JEPI is up 5.4% from a year ago and SPY is up 1.4%.

JEPI’s dividend depends on how much income it generates by selling covered calls on about 139 dividend stocks. That income varies with the market’s volatility.

Last week’s headlines included several about how Warren Buffett and Berkshire Hathaway (BRK.B) like dividend stocks. They also trade derivatives like puts and calls.

Income traders are selling JEPI June and July $53 strike and $54 strike cash secured puts hoping that when those stock options expire, JEPI will be a bit below their chosen strikes. BuyChart.com gives JEPI a weak 24% buy rating. SPY has a strong 100% buy rating. That is, all 13 of the technical indicators it tracks on SPY are giving buy ratings. I’ve written about selling covered calls and cash secured puts to beat inflation.

I own JEPI and want to buy more shares. My $54 and $55 strike puts will expire on May 19.

If my JEPI $54 strike puts are assigned, I’ll get a 1.4% discount on the stock compared with its $55.16 price when I did the trade on April 25. Assignments on the $55 strike pubs will give me less than 1% discounts. My annualized return on risk (AROR) on the $54 strike puts will be about 18% if they aren’t assigned. On the $55 strike puts, ARoR ranges from about 13.8% to 18%. The AROR assumes the same ROR can be achieved in 12 trades a year.

Let’s compare JEPI with a well known dividend stock, Dow Inc. (DOW). Its dividend yields 5.5% annually and is paid quarterly.

My DOW was recently called and I’m trading the wheel on it. That is I’ve sold DOW 5.12.23 $53 strike puts for a 12.1% ARoR. And I have sold DOW 5.19.23 expiration $48 strike puts for a 9% ARoR. BuyCharts.com gives DOW a weak 8% buy rating.

While I don’t sell covered calls on JEPI because I don’t want to have it called and miss the monthly dividends and because its options aren’t very liquid, I trade the wheel on DOW to enhance the 5.5% dividend with ARoR puts and calls options premiums income.

For example, an income trader who buys Dow at $54.41 and sells DOW 5.19.23 $57 strike covered calls for about $0.18 cents per share on one 100-share options contract could generate about a 9.6% ARoR in premium income if the same kind of options premium RoR was achieved on 33 11-day trades a year.

Or a less active trader might sell one DOW 6.19.23 (39 days) $57.50 strike covered calls option for about $1.47 a share. That would provide a 9.7% AROR, not including commissions.

What makes both JEPI and DOW attractive to investors with limited resources and those who are just beginning to trade covered calls and cash secured puts is that a one-contract trade in JEPI involves only about $5,472 and a one-contract trade in DOW involves about $5,441. A one-contract trade in SPY requires about a $41,263 investment (100 shares per options contract times $412.63 per share).

Risks

Trading covered calls and cash secured puts is moderately risky.

The risk involved with selling cash secured puts is that the stock or ETF may close far below the puts strike price. That sticks the trader with an instant loss on the stock if the trader takes assignment. Or the investor can buy the puts back at a loss. I do most of these high dividend equity trades in IRAs, and I do low dividend stock options trades in our taxable accounts.

On covered calls, one risk is that the stock will close far below the strike price. If the close is far below the strike, the investor usually can roll the covered calls trade by selling calls on another weekly or monthly calls option. Or the investor can take the loss on the stock and move on.

Another covered calls risk is that a stock will close far above the strike price. Covered calls limit potential gains. Thus, if a stock is sold at a $60 strike and closes at $60.01 and higher, the options writer (seller) will have to sell the stock at the strike or buy the calls options back at small losses or profits to prevent having the stock assigned, or called.

I minimize my risks by doing several mostly small trades each month. Ten $5,000 trades are safer than one $50,000 trade. That way, if one or two trades lose money and the rest make money, I make close to my target income almost every month. I’ve been doing these months and weekly stock options trades for about 17 years.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Good write up Don.

Thank you.