CNBC's Final Trades Often Flop

The strategy is simple. Pick good under valued dividend stocks. We pick stocks with active and liquid options that can be used to generate weekly and monthly income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

CNBC’s stock picking shows are interesting, useful and fun to watch.

Final Trades at the end of shows are tempting, but beware.

Panelists have to have final trades regardless of market conditions,.

This article is folks who are curious about how the Final Trades work out sometimes.

Two of my favorite CNBC stock picking shows are Half Time Report and Fast Money. They always wrap up with the panelists offering Final Trades. These trades are mostly meant for day traders and swing traders, I think.

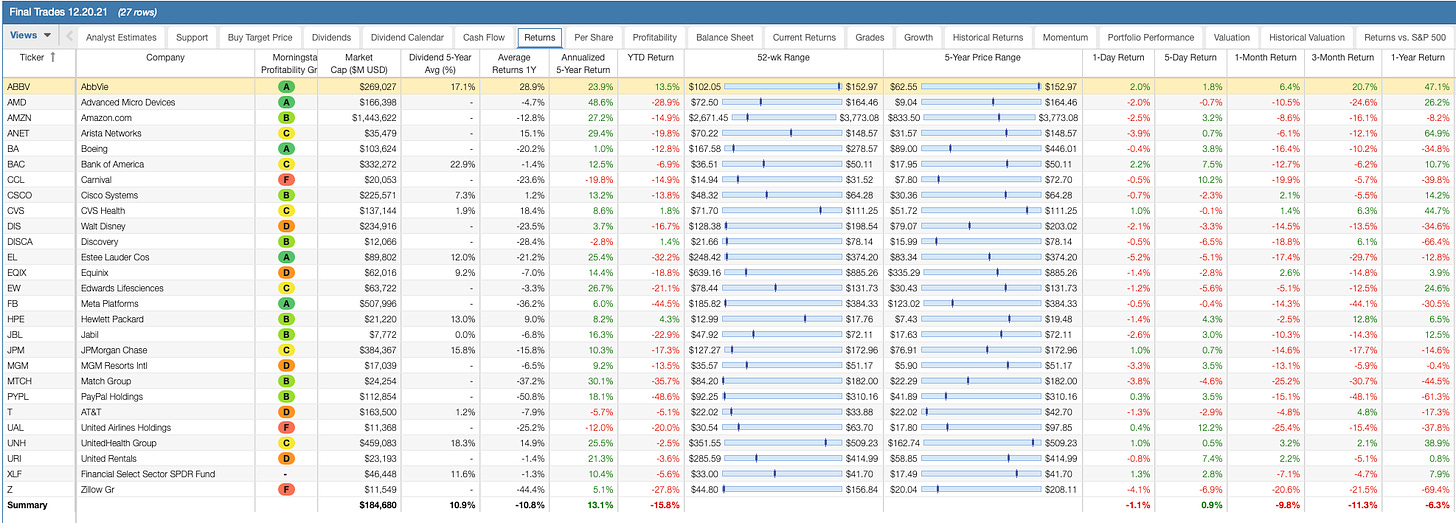

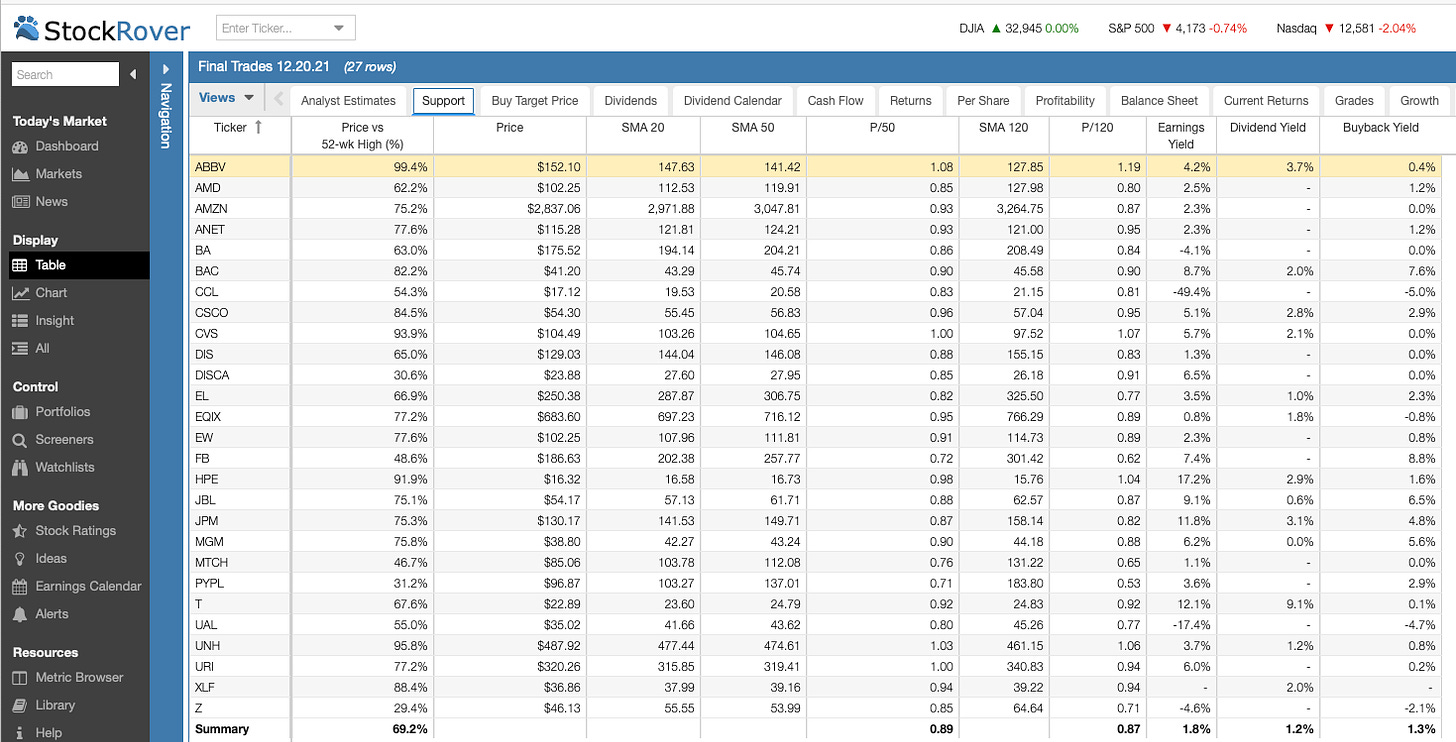

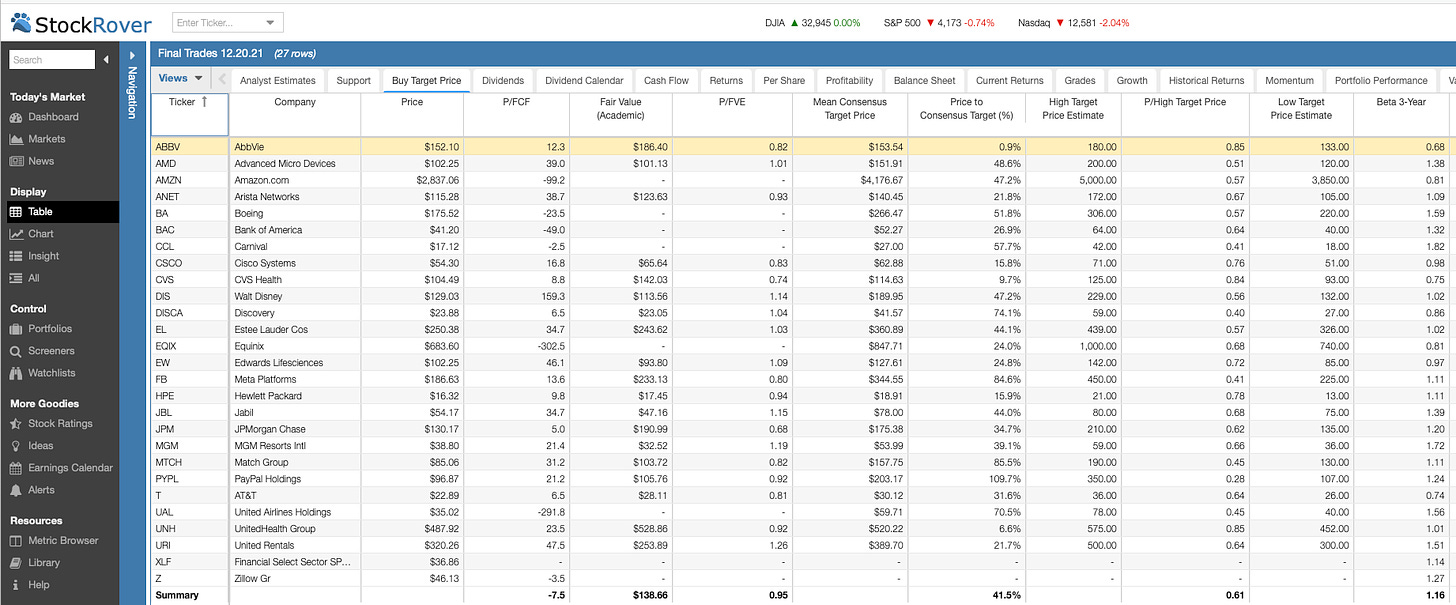

Last Dec. 20 I created a Final Trades watch list for recent recommendations. The StockRover.com watch list, which doesn’t include every final trade those days because often it’s hard to hear them all, is below.

The results aren’t pretty. The 27 stocks that had been recommended over a few days in December are down an average of 15.8% year to date and down 6.3% from a year ago. Again, this probably isn’t a complete list. It’s just a sample of what was recommended, not a table you’d use in a Ph.D. dissertation or a memo to portfolio managers.

For the most part, CNBC’s “Final Trades” panelists seem to favor larger and more widely traded stocks. While sometimes their recommendations do move prices temporarily, they don’t disrupt the market for the recommended stocks’ prices the way they would if they recommended relatively low-volume stocks.

Most of the panelists are very experienced and bright. I sometimes wonder whether those who work for mutual funds and exchange traded funds companies talk their books a little too much.

Because the panelists have to recommend stocks every time they appear on CNBC, they have to go with a lot of over bought stocks most of the time, but now and then they pick depressed stocks like FB, BA, etc.

My favorite panelists are Stephanie Link, Karen Finerman, Josh Brown, Steve Weiss and Jim Lebenthal in that order. Pete and John Najarian are good when they talk about stocks, but when they talk about options, their options trades are wildly speculative, I think.

None of the panelists ever disclose the sizes of their trades. So viewers don’t know whether they’re trading $1,000 or $1 million worth of stock or options. I don’t disclose all of my trades or how big they are, either.

Question: Do you do CNBC’s Final Trades? Please use the comments section below to discuss.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

8 Stocks on $25,000 Covered Calls Watch List

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

Final Trades is more of an 'ideas' section rather than to be taken as pure investing advice. I don't think any of the panelists seriously think people will purchase stocks based on such a quick pick.

Thanks Don! Your list is interesting!