Bear Markets Cause Dividend Stock Investors to Sell Covered Calls, Not Cash Secured Puts

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculators

With prices down sharply, look at selling weekly expiration calls for income.

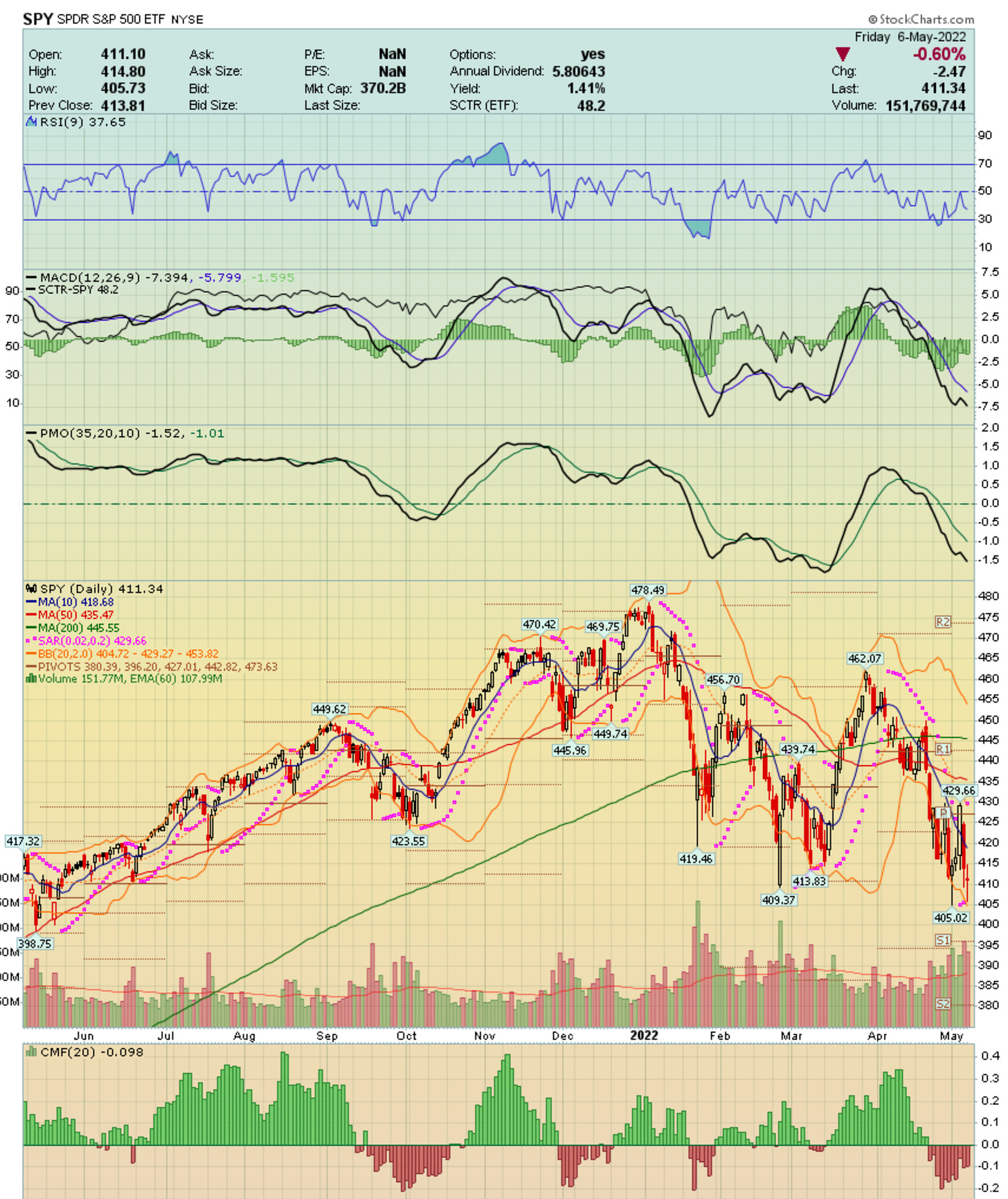

Technicals are weak but don’t appear to be signaling a bottom.

Selling cash secured puts in bear markets is very risky.

Pre-market futures are sharply lower, continuing the 2022 bear market with no end in sight.

Since about Jan. 4, the markets have been working their ways lower, and in the last week, the SPY, DIA and IWM charts have been looking like falling knives. So far the puts to call ratios are not where they usually are when markets bottom.

In short, regardless of the current strengths in the economy, markets are showing that investors and speculators are expecting that inflation, rising interest rates and a reluctant Federal Reserve are likely to cause a recession later this year or early next year.

This doesn’t look like a good time for dividend stock investors to buy stocks or sell cash secured puts. Selling puts is a bullish trade.

And in bear markets, selling puts can be very risky unless traders want to own shares at the strike prices regardless of how low the stock prices fall before they bottom out.

What I’m doing is writing mostly weekly (4-days and 2-days) covered calls on stocks I own. This helps me manage my risks.

With futures headed lower this morning, I’m waiting for a snap back in stock prices before I'll sell any new covered calls.

For example, if a trader owns DOW, he could sell DOW 5.13.22 $68, $69 or $72 strike covered calls. The strike used would depend on the price that looks good to the trader selling the calls. I own DOW and sell calls and puts on it. If prices don’t snap back this week, I might not sell any calls.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Ways to use StockRover.com to analyze stocks.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and have options positions on CAT, DOW and WBA. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.