Apple, Caterpillar, Cisco, Fedex, American Express Look Like Strong Momentum Buys

Small and large dividend stock investors can use monthly covered calls to generate steady monthly income from options premiums and options trading.

By Donald E. L. Johnson

Cautious Speculator

With options prices low, investors may want to buy bullish momentum stocks or call options that are likely to provide short term and intermediate term capital gains and some dividends instead off buying stocks and selling covered calls options on them.

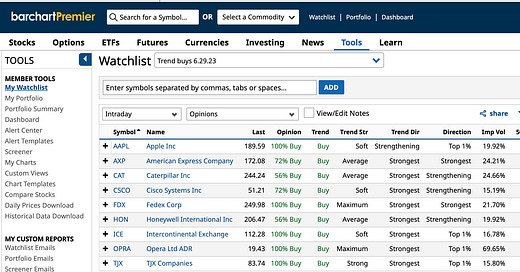

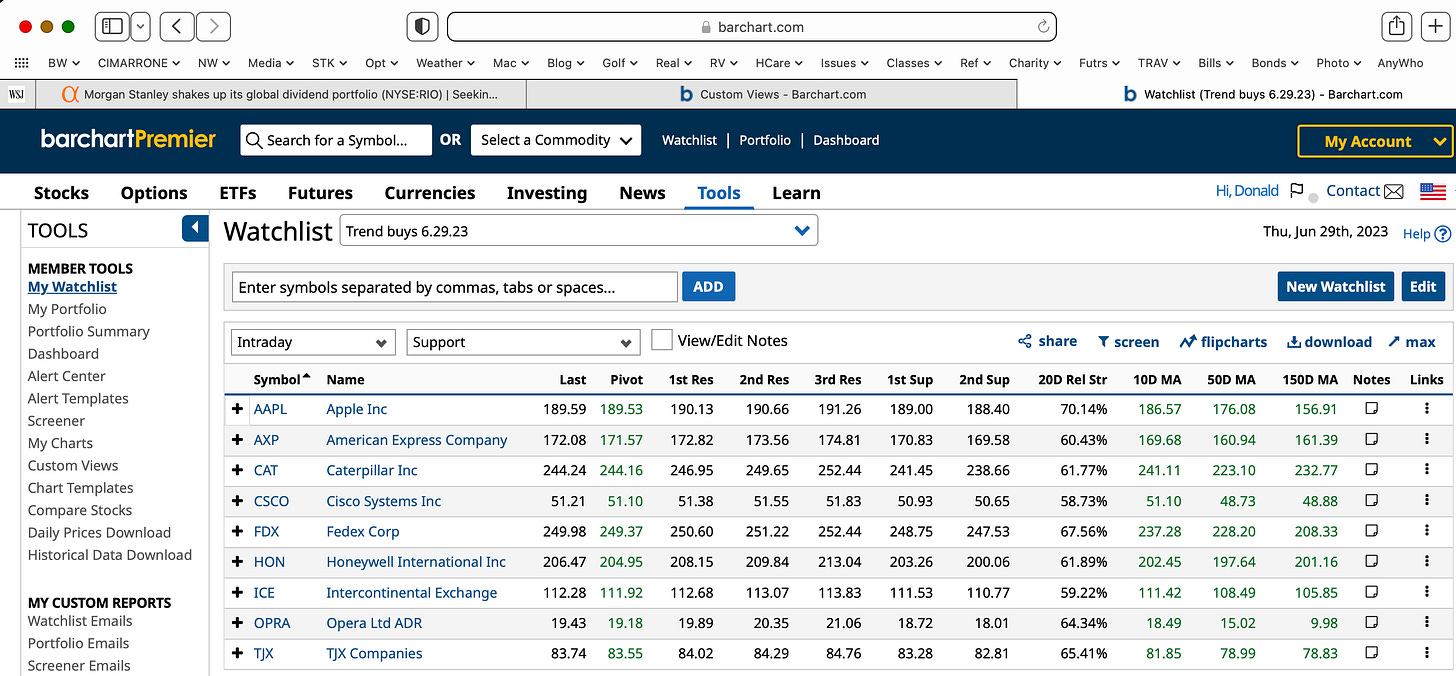

I created the tables shown below so I could search my watch lists for stocks that I might trade.

The nine stocks discussed are in very bullish trends and look fundamentally sound but may correct at any time.

Swing traders looking for strong buys and call options trades might pick a few of these nine stocks. They’re all good candidates for covered calls and cash secured puts trades because of their bullish momentum. But traders may make more money just trading them for capital gains because of their low volatility.

The risk is that these stocks may be over extended and ready to correct on a whim. Thus, these trades probably are best for traders who use technical indicators and close stop loss orders to help them pick points of trade entries and exits. I haven’t done these trades.

The nine stocks are Apple Inc. (AAPL), American Express Co. (AXP), Caterpillar Inc. (CAT), Cisco Systems Inc. (CSCO), Fedex Corp. (FDX), Honeywell International Inc. (HON), Intercontinental Exchange (ICE), Opera Ltd. ADR (OPRA) and TJX Companies (TJX).

All of these companies’ puts and calls stock options are actively traded with good volume, open interest and liquidity.

CSCO’s 3.07% dividend yield is the highest on the list. OPRA is the only company on the list that doesn’t pay a dividend and it has the least debt. Based on its price to cash flow ratio of 59.16, OPRA is the most expensive stock on the list, followed by AAPL with a P/CF ratio of 26.6. The rest of the stocks look fairly valued or under priced, which is why their in bullish trends.

The nine stocks are trading below their resistance level and above their support and 10- 50- and 150-day moving averages. Their 20-day relative strength ratios are bullish.

My CAT $200 strike puts expire today. I don’t have positions in the other eight stocks, yet.

Barchart’s Will Ashworth suggests 3 Unusually Active Call Options To Buy for 1% Down. The same strategy could be used with these stocks.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack.com/Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Analysts rate CSCO a moderate buy. Six strong buys, 2 moderate buys, 11 holds and 1 strong sell. The average analyst rating is a 3.6 based on 20 analysts at Barchart.com. The high target price is $73, mean price target is $55.59 and the low target is 44. At this point, I'd rather own the stock and do covered calls instead of buy calls pr do a bull call vertical spread on CSCO.

I bought CSCO at $51.79. I'll hold it until it goes ex-dividend on July 7. Then I'll look at selling covered calls ATM and selling puts. CSCO yields 3%. It won't take much writing covered calls on the stock to get the dividends plus options premium AROR to 10% to 15%.