9 High Quality Dividend Growing Stocks For Traders of Covered Calls, Cash Secured Puts

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculator

High quality dividend growing stocks with bullish momentum usually are excellent stocks to use for generating options premium income by selling covered calls.

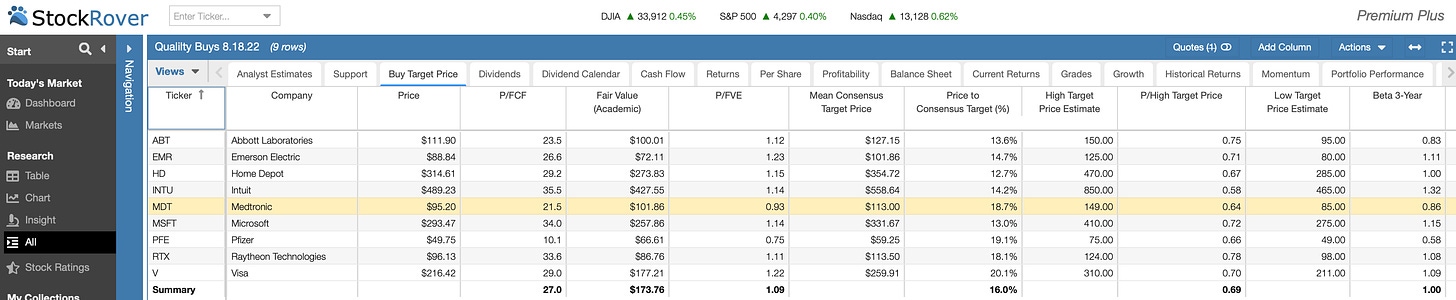

The nine stocks shown in the table below are: ABT, EMR, HD, MDT, MSFT, PFE, RTX AND V.

I use MDT, which I bought Monday, as an example of how these stocks can be traded by dividend and income investors.

Many investors buy only stocks that are good quality dividend growers, and they prioritize dividend growth rates over the actual dividends.

Here are nine high quality dividend growers that are doing relatively well so far this year and still are trading well below Wall Street analysts’ target prices.

What are “high quality” stocks? Check out this article, The highest quality dividend growth stocks in 2022. There are 50 of them.

These nine look like good candidates for selling covered calls and cash secured puts.

I wrote about trading covered calls and puts on Medtronic Sunday.

On Monday, I did a buy and write (b/w) trade on MDT.

I paid $95.40. After that order was filled, I sold MDT 9.2.22 expiration $95 strike covered calls for $2.41, or a return on risk of 2.53% in 18 days. If I could do exactly the same trade 20 times a year, the annualized RoR would be about 51.23%. But prices fluctuate, so the trade can’t be exactly replicated by the time you read this, not to mention three months from now. So ARoR is a guesstimate.

I chose the $95 strike to get a higher premium and RoR.

If the stock closes on expiration day above the $95 strike price, it will be called, unless I buy the option back before it expires. Whether I will do that depends on where the stock is during the last week of the options contract.

Should the stock drop below $95, I’ll get the full premium along with a loss on the stock. In that case, I’ll sell weekly or monthly calls on MDT weekly or monthly until it gets called. Then I’ll sell cash secured puts until the puts are exercised and I buy MDT back at a discounted price. The plan is to ride MDT higher, but that doesn’t always happen.

That process is called the wheel. See the link below. It doesn’t work so well when a stock is called and then takes off or when it plunges and looks like it will never recover. See PYPL, SOFI and TDOC, for example. They’re my bad experiences.

This strategy or similar ones that work for each investor can be used with each of these stocks. Some people will trade them all, some a few and some none. That is up to each investor.

I’ll publish updates on this article in the comments section.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Read about some of the trades that I did last week on the home page.

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Hi Donald. Thanks for the trading ideas. Like you, I am paying the price for my PYPL and SOFI puts which we’re assigned at the market low. They are coming back.