8 Warren Buffett, Berkshire Stocks Have Bullish Momentum, Price Objectives, Active Options

This doesn't look like a good time to buy stocks, sell covered calls options. Selling cash secured puts is a way to generate options premiums in a bear market.

By Donald E. L. Johnson

Cautious Speculator

Selling 7- to 21-day cash secured OTM puts options on stocks owned by Berkshire Hathaway is risky, but not as risky as buying stocks in a bear market.

8 of Warren Buffett’s stocks have the bullish momentum and price objectives that suggest they might be lower risk puts trades in this market.

Berkshire’s portfolio is a good place to look for a famous stock picker’s bullish ideas.

Hold stocks and options on days companies report earnings and offer new guidance is risky and for professional traders and individuals who are comfortable taking the risks.

Warren Buffett’s Berkshire Hathaway portfolio of publicly-owned stocks is another good source of stock picks that have been researched and are owned by portfolio managers who have been making money in the markets for years.

Please click on the link to the home page to see recent blogs about bullish stocks in the Dow Jones Industrial Average and in CrossingWallStreet.com’s portfolio.

These articles show how I use momentum ratings, point and figure price objectives, valuation and other ratios and analysts’ price targets to find bullish stocks in a bear market. I also use StockRover.com and other resources on brokers’ web sites to study market trends and individual companies’ fundamentals.

My previously published articles show the stocks that I’m trading now. As the year progressives, I will drop some of these stocks and find new opportunities, depending.

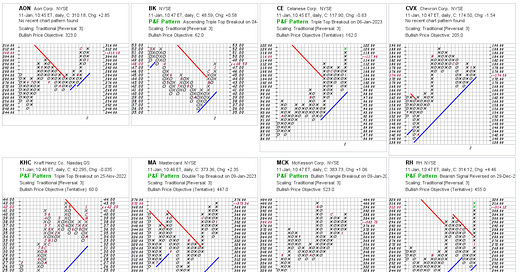

The key to stock picking dividend stocks that support actively traded and active options for selling covered calls options and cash secured puts for income is to find stocks that have bullish momentum (Stock Charts Technical Ratings, or SCTR) and bullish price objectives on StockCharts.com’s point and figure charts.

Eight of Berkshire’s stocks have that momentum and bullish price objectives. Ten more have bullish price objectives but don’t have bullish momentum. Others are bullish but don’t have active options. I don’t have positions in any of these stocks.

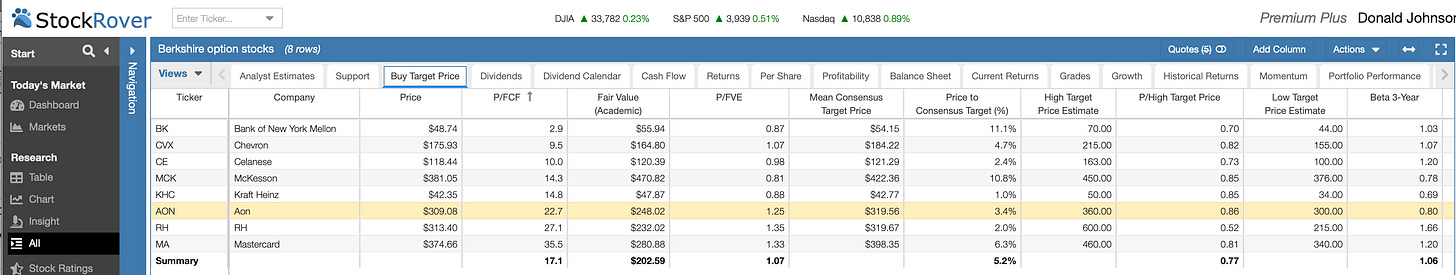

Two of these stocks look over valued with high price to free cash flow ratios that reflect the market’s expectations for those stocks. They are MA (P/FCF=35.4) and RH (27).

The group’s average P/FCF is 17.1. They are trading at an average price to fair value estimates of about 107%. The average stock is trading about 5.5% below analysts’ consensus target prices.

My Trades

My short CAT 1.13.23 $215 puts were quoted at $0 bid, $0.005 ask. So I bought back my puts for $0.01. I sold them on 12.27.22 for $0.56. I thought about selling the Jan. 20 $225 or $227 puts, but the CPI number is due tomorrow morning and some important earnings reports are due in the next few days. So I decided to hold off doing new CAT trades for a few days. CAT reports its earnings and offers new guidance for 2023 on Jan. 26. So I may not trade it again until its earnings are out.

With technicals and credible analysts signaling that the bear market has a ways to go, I’m glad that I’m relatively heavy in cash. I’m not looking to buy stocks, and I just moved some cash to a Schwab money market fund that pays over 4% in interest after a 0.19% management fee.

I think my mostly short-duration cash secured puts will close worthless. A couple might be assigned. With the diversification I have in the portfolio, I’ll make money on my puts and calls this month, I think—and hope.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.