8 Stocks Covered Calls In $25,000 Watch List Can Be Rolled To March Expirations

Last month we showed how to create a diversified covered call options watch list with $25,000, more or less. The stocks are down, the options expired worthless. Time to roll the covered calls trades.

By Donald E. L. Johnson

Cautious Speculator

Last month I wrote about “8 Stocks for a $25,000 Diversified Covered Calls Watchlist”.

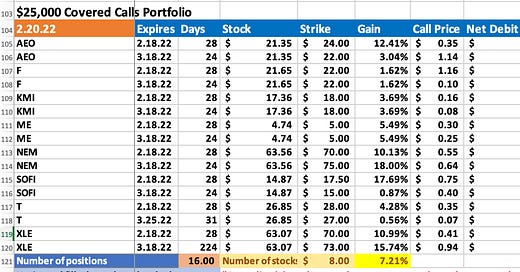

My spreadsheet is my trade calculator and my trade tracker. It shows both the 2.18.22 and 3.18.22 expiration trades for each stock in the watch list. Each trade is for one call option and each option is for 100 shares.

It’s best to do eight or more small trades than fewer and bigger trades. Obviously, these trades can be done over a week or so and they can be done in bigger portfolios with more money invested in each trade.

Every time I roll trades forward or buy back call options, I enter the new trades on the spreadsheet. If I trade calls on each stock 13 to 15 times a year, I will have at least 15 entries on each stock.

That lets me review my wins and losses and calculate my net debits as the year progresses and at year end. My plan is to update this watchlist monthly to give subscribers a feel for how trading can go over time. These trades and my spreadsheet are for educational purposes. They’re not trading advice. My actual trades are on another spreadsheet.

Because all eight stocks closed below their strike prices on Friday, Feb. 18, the covered calls options on those stocks expired worthless.

If anyone did the trades shown in the watch list, they invested a little over $21,000 of the $25,000 in the eight stocks and wrote covered calls options on them for about $403 worth of premiums, or return on risk (RoR). Meanwhile, the stocks are below their purchase prices, and traders have the opportunity to write (sell) a new round of covered calls options on those stocks, which they still own.

If the stocks had closed above their strike prices, they would have been called and sold to the buyers of the calls. That would have given the covered calls traders small gains on the stocks as well as the premiums they received when they sold the calls.

At this point, the owners of the stocks have small losses on them. Instead of taking the losses, covered calls traders can sell covered calls for March 18 or 25 expirations and generate another $400 or so in premiums, plus captured dividends on a couple of the stocks, and possible gains if the stocks bounce back.

The average RoR on the February expiration covered calls was about 2.76%, or 36% annualized. RoR varies as stocks’ volatility rises and falls.

If a trader decides to take a loss or profit on a stock and buy another stock and write covered calls on that, she just inserts a row in alphabetical order, copies the row above the insert into the insert and enters the symbol for the new stock and related variables into the spreadsheet.

In recent years, I’ve traded puts on calls on dozens of stocks each year in response to the ups and downs of the stocks and their options. I seldom trade calls on a single stock all year or every week or month because market conditions change and so does my trading plan. I’m hoping to trade puts and calls on fewer stocks this year. It simplifies record keeping.

This month, I decided to show how rolling all of the trades forward looks. All of the trades still look pretty good, but in the face of the Russian threats against Ukraine and uncertainty about what the Fed will do about interest rates, not everyone will want to buy these or any stocks until they feel better about the market outlook.

Stock markets look pretty bearish at the moment. Buying a stock and selling covered calls on it usually is done when a stock looks like it is in a bullish trend.

But rolling a covered call trade to the next expiration week or month often is done to generate income and reduce the cumulative net debit price of the stock over time. Net debit equals the price paid for a stock less collected dividends and options premiums.

Please subscribe. It’s free for now.

Question: What questions do you have about this watch list? We can discuss it in comments.

LINKs:

Home Page. See previous articles on other stocks.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own and/or have options positions in AEO, KMI, ME, NEM, SOFI and T.

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks.