7 Puts sales possibilities on bullish stocks

Bullish stocks can offer good puts options premiums. Trading puts is a somewhat risky way to generate options premiums incomes while trying to buy an equity at a discount from its current price.

By Donald E. L. Johnson

Cautious Speculator

The time spent waiting for a big announcement from the Fed can be used to put together a watchlist of stocks that you might trade after the markets absorb the news.

Selling puts on strong, bullish stocks is a good options trading strategy.

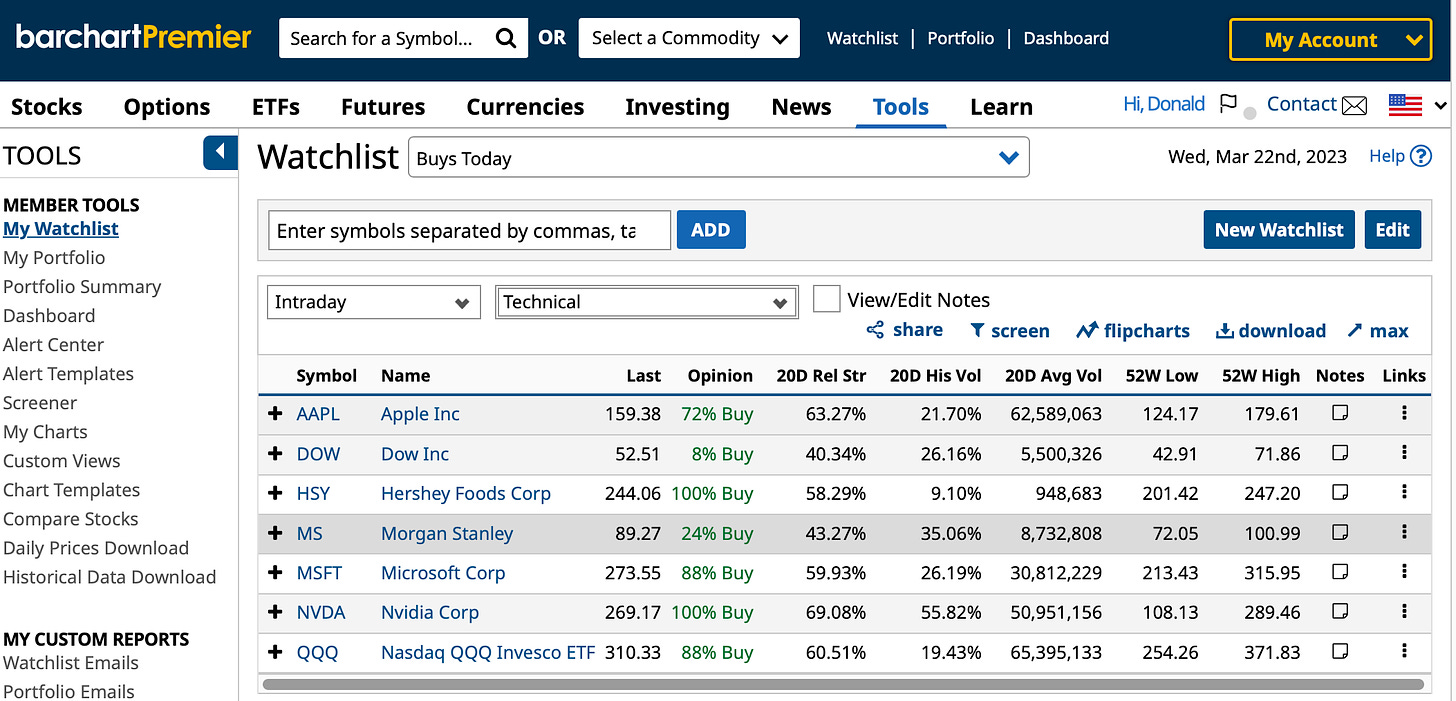

Barchart.com buy signals range from the weak 8% to the strong 100%. The more buy signals there are for an equity, the higher the buy rating.

After the Fed announces whether it is raising the Federal Funds rate a quarter or half point this afternoon, options traders might consider selling puts options on one of these six stocks and the Nasdaq QQQ (QQQ).

Selling puts on stocks and ETFs that you want to own at a lower, or discounted price, is a bullish trade.

They all have buy ratings at Barchart.com, and all but Dow Chemical (DOW) are showing bullish breakouts on point & figure charts. My DOW 3.31.23 $53 puts look like they may be assigned, and I may sell more DOW puts.

In addition to DOW ($52.53), which I’m looking to buy for my dividend stock portfolio, the stocks are: Apple Inc. (AAPL), Hershey Foods Corp. (HSY), Morgan Stanley (MS), Microsoft Corp. (MSFT), Nvidia Corp. (NVDA) and QQQ.

For example, an income trader who wants to speculate on AAPL ($159.46) might sell one AAPL 4.21.23 $155 strike (delta -.33, OTM probability 64%) 100-share puts option for about $2.79 a share. The annual return on risk (ARoR) would be about 20%.

Or a trader might sell deep out of the money NVDA ($269.26) puts. Say, sell one NVDA 4.21.23 $235 strike (delta -.17, OTM probability 79%) puts for about $4.03. The ARoR would be about 17.7%.

The strike is the price that you contract to buy the equity for if the stock expires at a price below the puts strike. Each investor has to decide at what price or strike she is interested in buying the equity. If a stock is about to be put, or sold to the trader, she always can buy the puts back at a profit or loss, depending. Or if a stock takes off and the puts price plunges, a trader can take early profits on the puts by buying them back and rolling the trade forward to a later expiration date and whatever strike makes sense.

The risk in selling puts is that by the time a puts option expires, the stock may be 5% to 10% or more below the strike price. Then you have to decide whether to take the loss or sell covered calls on the stock and spend a few months waiting for a rally back to the strike, or purchase price.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.