6 Bullish 'Recession Resistant' Dividend Stocks; New Puts Spreadsheet Calculates Potential ROR

A way to "nibble" into new bullish positions is to sell cash secured puts at strikes you want to pay for stocks. Spreadsheets can be used to evaluate and track trades.

By Donald E. L. Johnson

Cautious Speculator

Selling puts on “recession resistant” stocks can be used to generate options premium income while investors wait for the next major rally.

In this market, conservative traders manage risks with out of the money (OTM) puts strikes rather than reach for the highest possible at the money returns on risk.

In a bull market, traders can sell puts closer to or at the money (ATM) to generate higher returns on risk.

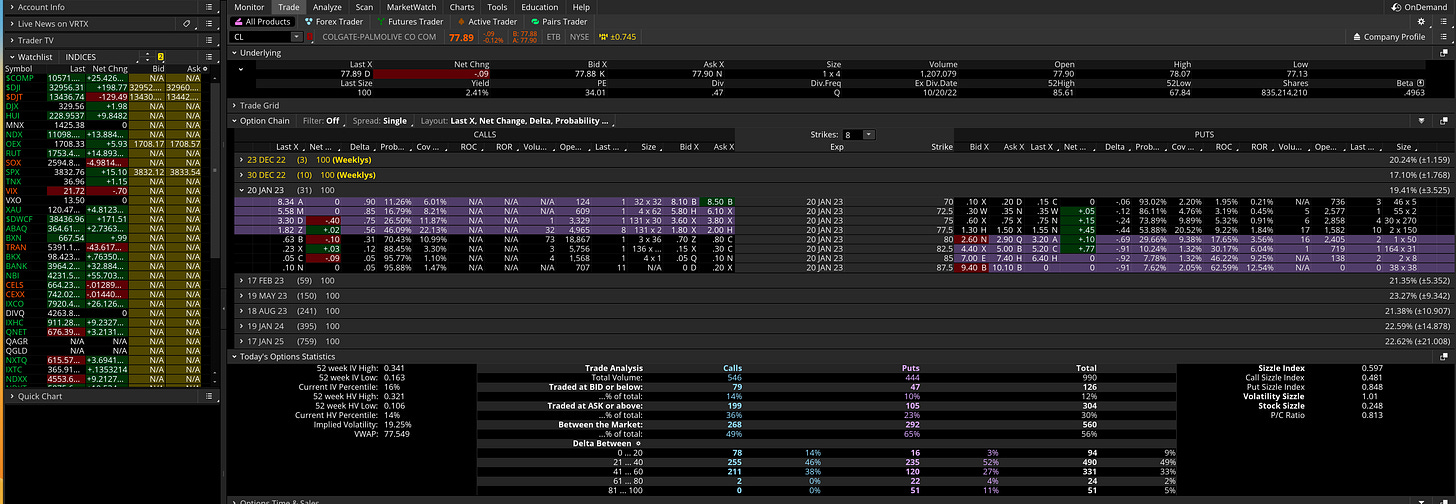

I use my revised and upgraded puts spreadsheet to evaluate and track trades.

Income investors like to trade dividend growth stocks that have relatively liquid puts and calls options that they can use to generate options premiums to enhance their dividend income.

Please click on the images and zoom in for better views. Please post questions and audits in the comments section. We all need editors.

These six “recession resistant” stocks might be the way to go. In a bear market, I like to sell cash secured puts to get income and discounts on the stocks I’m considering buying at lower prices. Last July I wrote about my bear market puts strategy.

l used this puts spreadsheet to evaluate the six stocks. And I’ll use the spreadsheet to track my trades. My goal this year was to make the spreadsheet easier to use. I added columns for the delta, probability that an option will expire worthless out of the money, implied volatility, taxable equivalent returns and cumulative net debit. (I’ll update my covered calls spreadsheet soon.) The algebra and math are very basic.

Net debit is the puts strike price minus the puts premium. The cumulative net debit column will be used when I have done more than one puts trade on a stock during the year. I do several hundred puts and calls trades a year.

RoR is return on risk; ARoR is the rough estimate of a possible annualized return on risk if a trade is rolled forward, or repeated as soon as it expires 12 to 21 times a year. Of course, exactly annualized trades are impossible because prices and other variables change daily.

Data for the spreadsheet comes from my Think or Swim (TD Ameritrade) trading platform, which I set up to show me all of the options metrics I use to evaluate trades. I use the platform’s charts and charts and data from StockCharts.com, Barcharts.com, StockRover.com and SeekingAlpha.com to evaluate fundamentals and charts.

All things considered, these “recession resistant” stocks are doing pretty well compared with benchmark indexes and most other stocks.

The trades shown here have low deltas, which means that the puts are unlikely to be assigned, or sold to me.

The probabilities that the options will close out of the money (OTM) are therefore very high. This is because I prefer to take lower immediate RoR and annualized return on risk while the markets are sinking so quickly.

When the stocks and markets bottom out and start to recover, I’ll sell puts closer to the money and I’ll take more risks that the puts will be assigned and that the stocks will be sold to me. At the same time, I’ll get higher premium returns.

Using the wheel strategy, when puts are assigned, I’ll trade covered calls to generate income until the calls are assigned. Then I’ll sell puts again.

My Trades

One up day doesn’t make a trend. I’m waiting for a couple more days of gains, if they happen, before I sell some puts and possibly buy some stocks.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.