6 Bullish Breakouts for Swing Traders, Income Investors

Market may be ready for a correction after big gains; these breakout stocks should do better than weaker stocks during dip

By Donald E. L. Johnson

Cautious Speculator

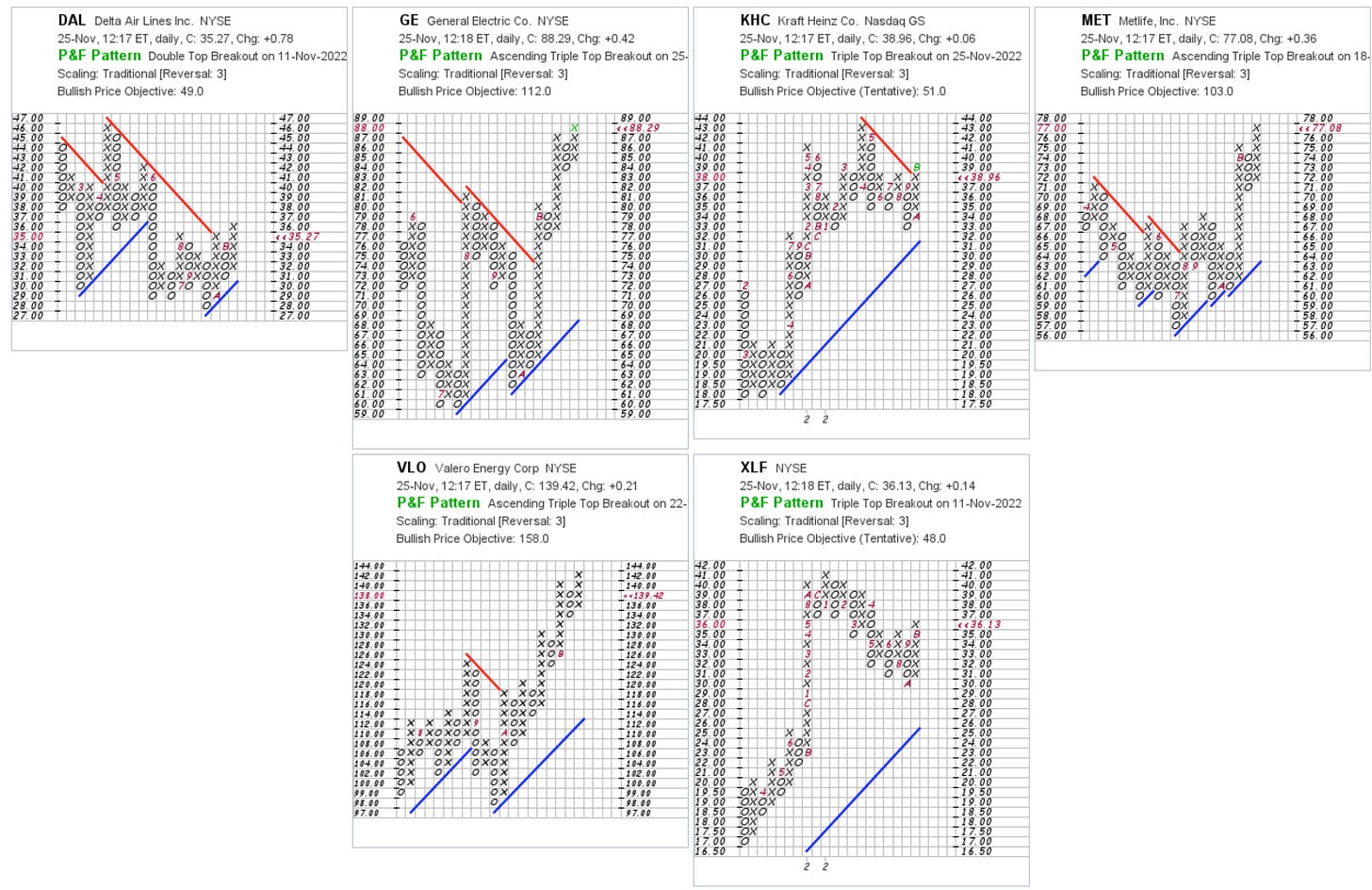

Five stocks and one ETF break out on point and figure charts.

They may appeal to swing traders and income investors.

Investors could sell puts or covered calls on these stocks.

Five stocks and one ETF are breaking out on point and figure charts.

They are shown below. Source: StockCharts.com.

Swing traders may buy these stocks with short 3% to 5% stop losses. They could sell Dec. 16 puts at strikes with 5% to 10% margins of safety. Or they could buy the stocks and sell weekly or Dec. 16 covered calls to generate income.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.