13 Dow Jones Stocks Are UP YTD; Index Falls 2.7% Friday, 3.4% Year to Date; Up 3.6% From Year Ago

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculator

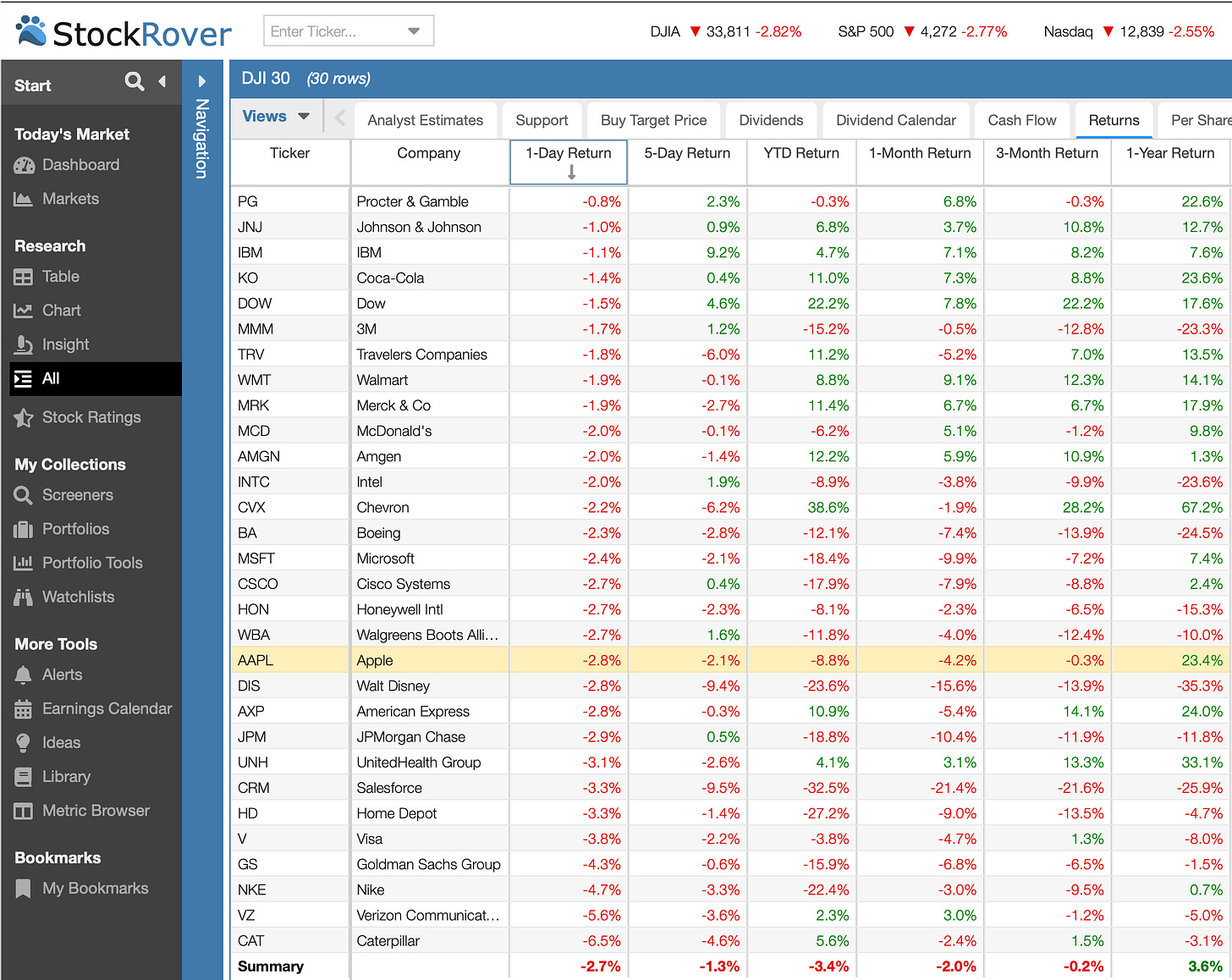

All of the DJIA 30 stocks were down last week.

For a lot of traders, it is too early in the correction to buy stocks and sell covered calls or to sell cash secured puts on them. It is time to create watch lists. Nobody can predict how low this market will go.

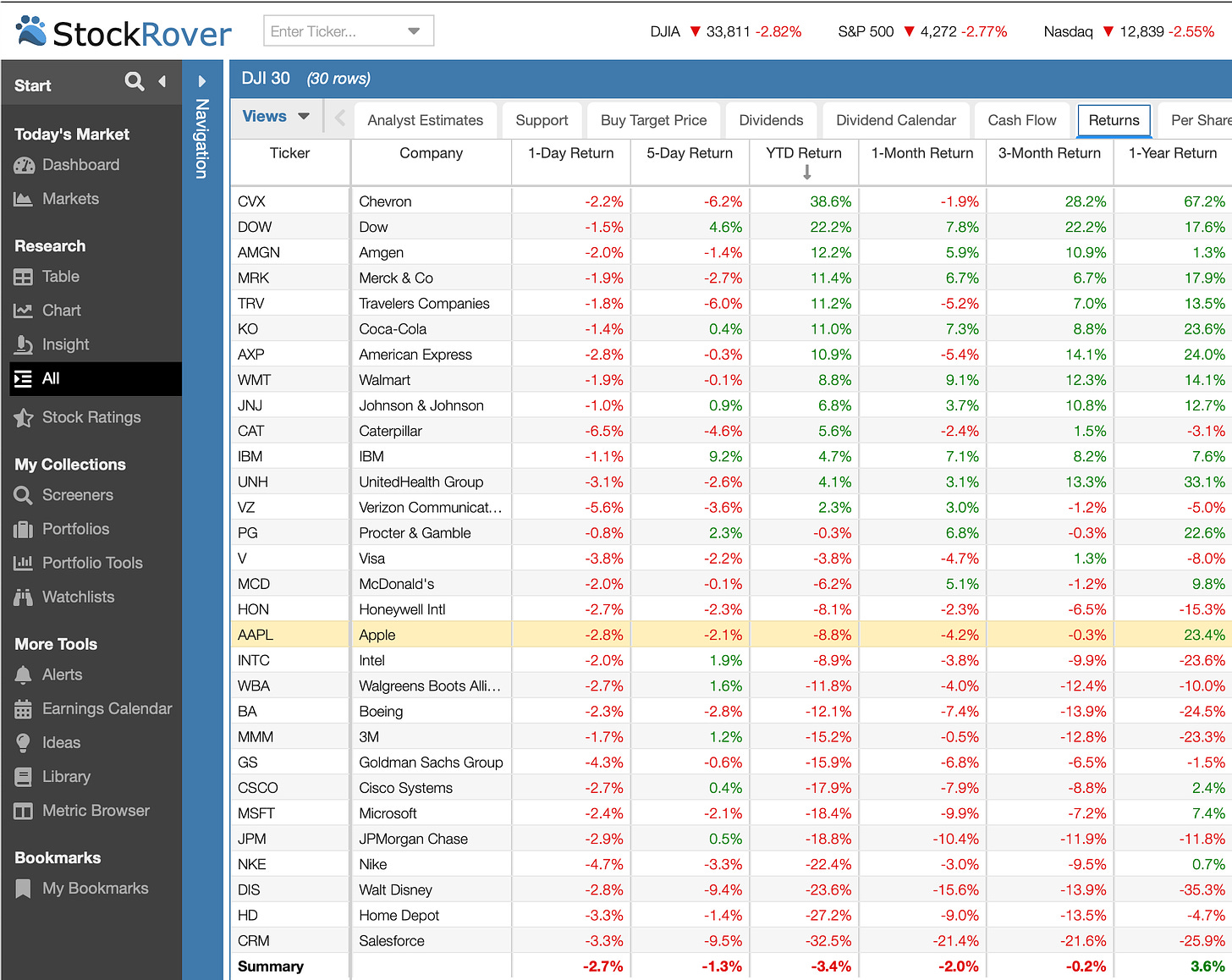

13 of the Dow Stocks are up YTD, which makes them good candidates for buying the stocks and writing covered calls. They also are good watch list candidates.

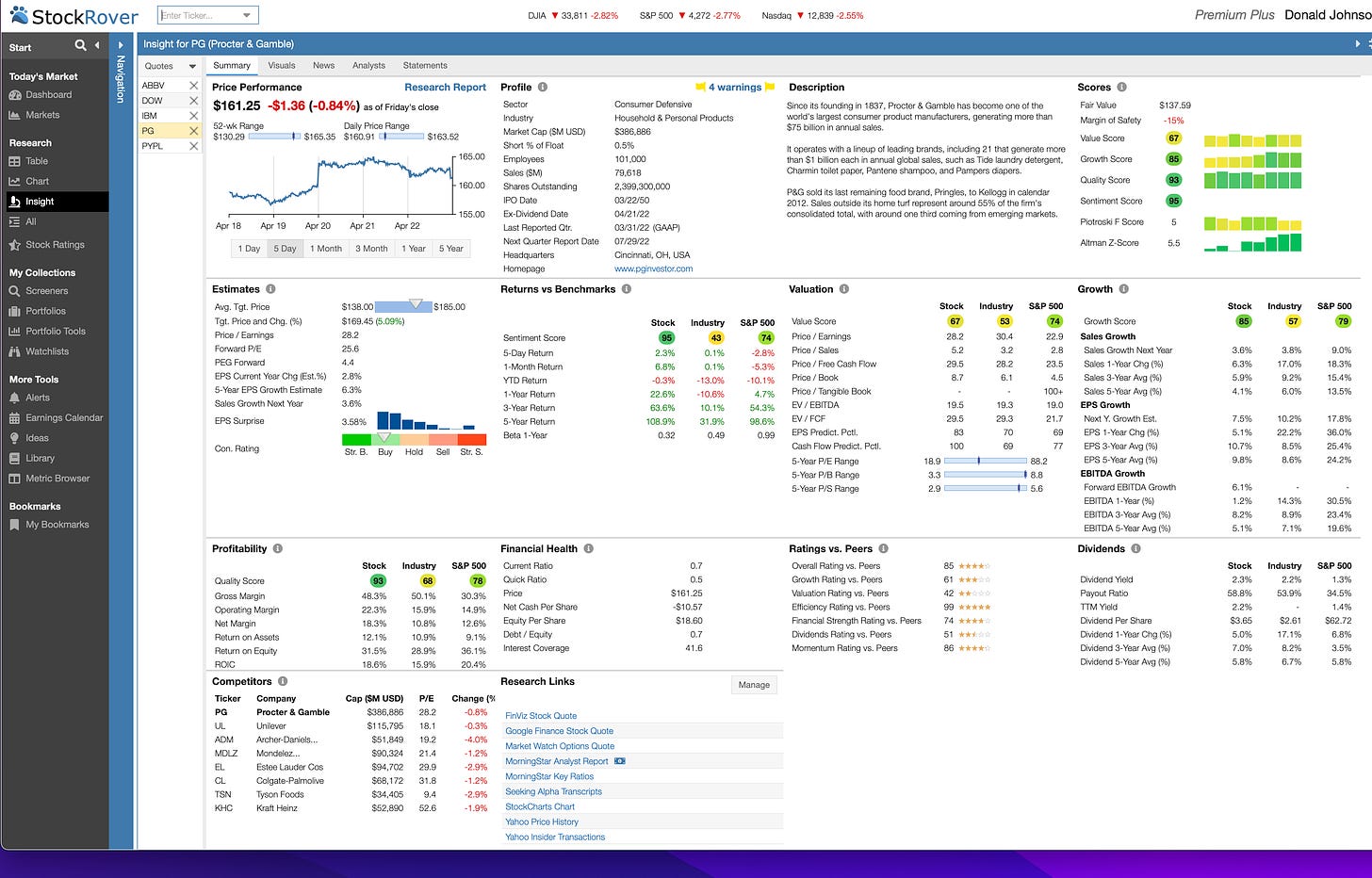

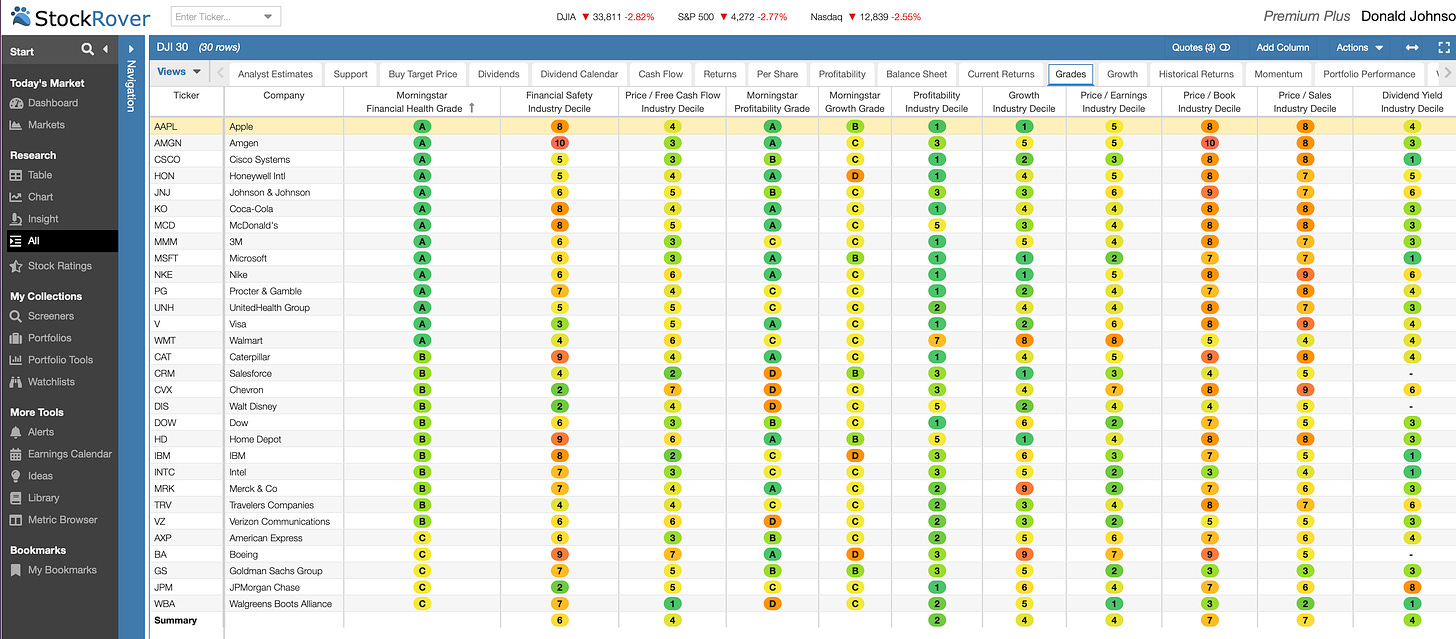

StockRover.com, the Bloomberg Terminal for individual investors and independent financial advisors, offers many ways to look at stocks and ETFs. A few are presented below.

A lot of investors looking for stocks to add to their watch lists after last week’s 2.7% drop in the Dow Jones Industrials Average (DJIA 30), can look at adding the two or three of the index’s 30 stocks that showed the least weakness. They can trade when they think the time to do the trades is right. DIA is the exchange traded fund that tracks the index.

The three strongest Dow stocks last week were Proctor & Gamble (PG), down 0.8% on the day; Johnson & Johnson (JNJ), down 1% and IBM, down 1.1%. I last wrote about the 12 strongest DJIA 30 stocks on March 26.

StockRover.com is a powerful tool for investors who want a lot of data and the ability to create tables that show the valuation and performance metrics that are important to them.

This is Stock Rover’s Insight panel for PG, which reported surprisingly strong earnings last week.

With the Dow looking bearish, fundamentals and earnings are not as important as momentum. And momentum doesn’t help a lot when the ratio of down stocks to up stocks is 9 to 1. Some bulls contend that the 9 to 1 ratio signals the bottom of a correction, but the markets seem to still be adjusting to new concerns about higher interest rates, inflation, recession and Russia’s attacks on Ukraine.

This doesn’t appear to be a good time to buying stocks and writing covered calls on them. And bullish sales of cash secured puts may be premature.

But this is a good time to create watch lists of stocks you might trade when markets look like they are in a real rally.

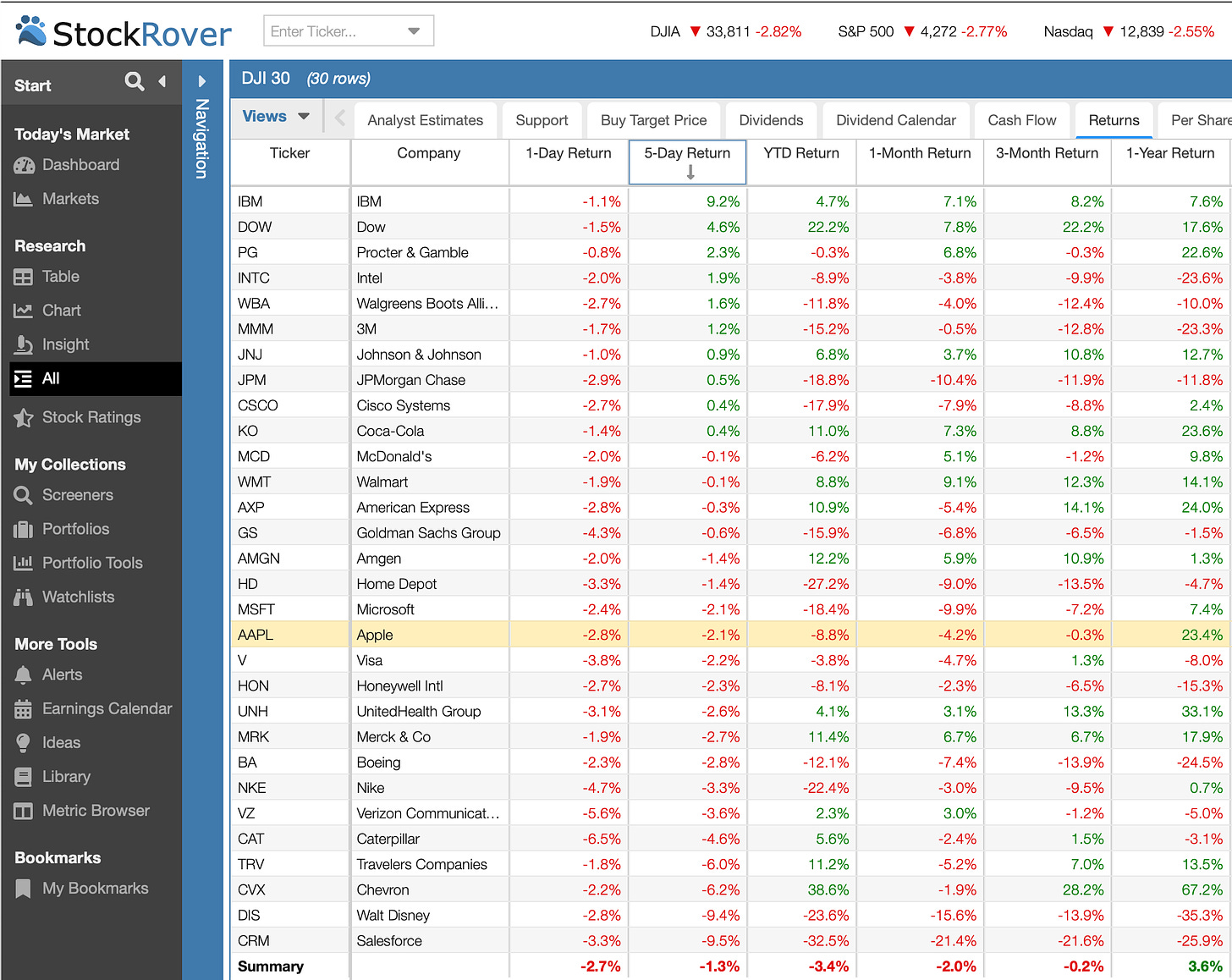

Ten, or a third of the 30 industrials, finished last week higher than a week earlier. They were led by IBM, DOW and PG.

Thirteen of the DJIA 30 stocks are up YTD. They are led by Chevron (CVX), DOW, Amgen (AMGN) and Merck (MRK).

At the end of last week, the average price to free cash flow (P/FCF) on the Dow Jones stocks, a critical valuation ratio, was 22.6 times. The stocks in the index closed at 98% of their fair values, or intrinsic values. On average, the stocks look a bit over priced based on the average P/FCF and fairly priced based on fair value estimates for each stock.

They are priced at 18.9% below Wall Street analysts’ mean target buy prices and at about 74% of the highest target price for each stock. These numbers suggest that several of the DJIA 30 stocks are under priced in the eyes of analysts, if not in the eyes of traders. Analysts are slow to lower their target prices in response to bearish earnings report and guidance, and they tend to be optimistic.

StockRover.com, which is the affordable Bloomberg Terminal for individual traders, also offers grades for each stock. About 66% of the 30 stocks look pretty financially safe. Twelve of the stocks Morningstar.com profitably grades are A. Three are B. Eight are C, and five are D.

Investors who sell covered calls and cash secured puts generally prefer financially safe and profitable stocks that have bullish momentum.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Ways to use StockRover.com to analyze stocks.

XYLD is holding up better than SPY.

Calls vs Puts Options: What’s the Difference?

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and have options positions on CAT, DOW and WBA. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.