12 Stocks in Crossing Wall Street Portfolio Have Bullish Momentum; 5 Are Good Options Stocks

Stock picking can be a chore. A way to simplify the process is to look at portfolios managed by portfolio managers with good track records. What they trade is more important than what they predict.

By Donald E. L. Johnson

Cautious Speculator

Crossing Wall Street is a good source of stock picks.

Covered calls and cash secured options traders will like about five of the stocks because they have active options volume.

Two of the good options traders have bullish momentum and price objectives.

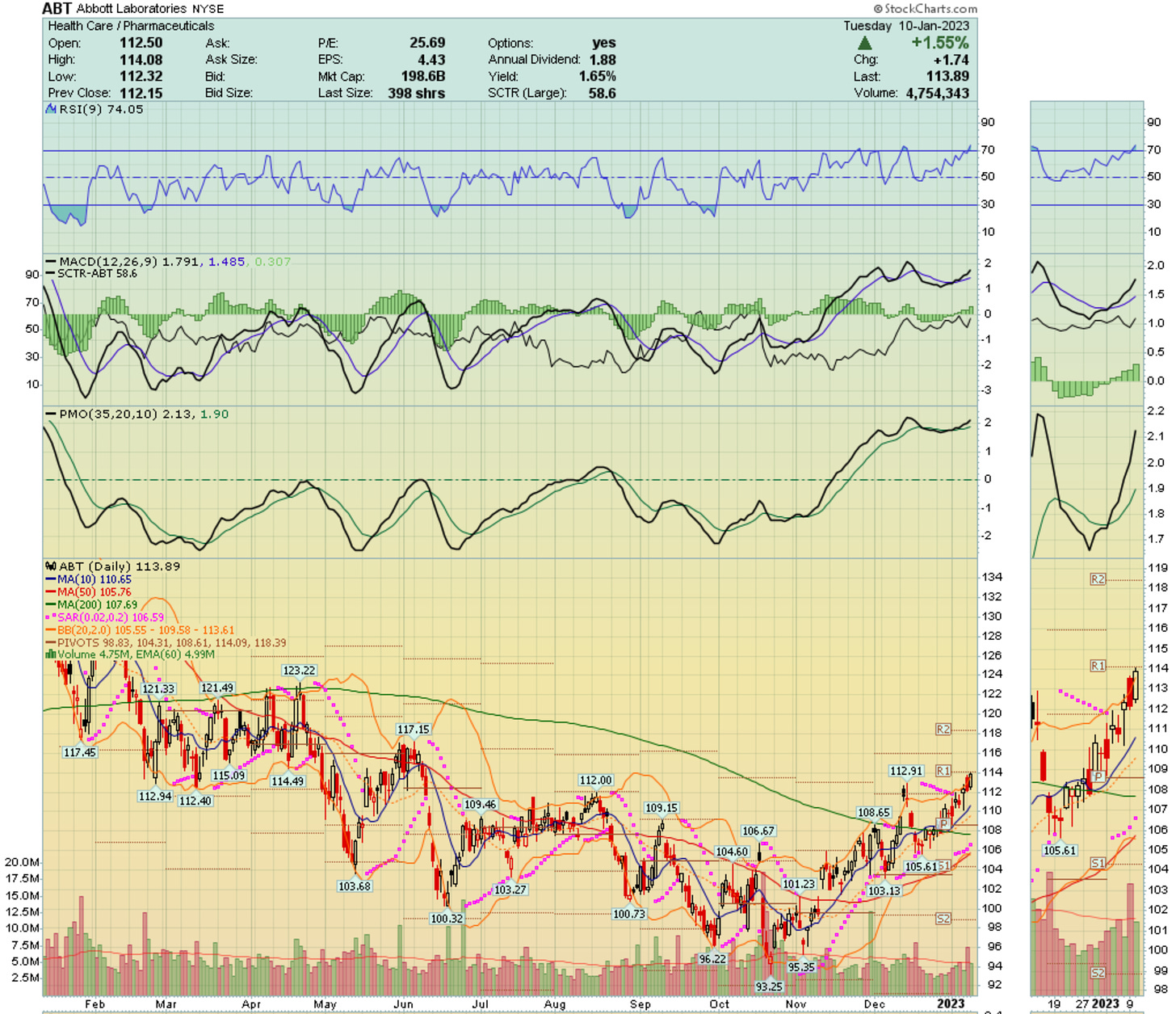

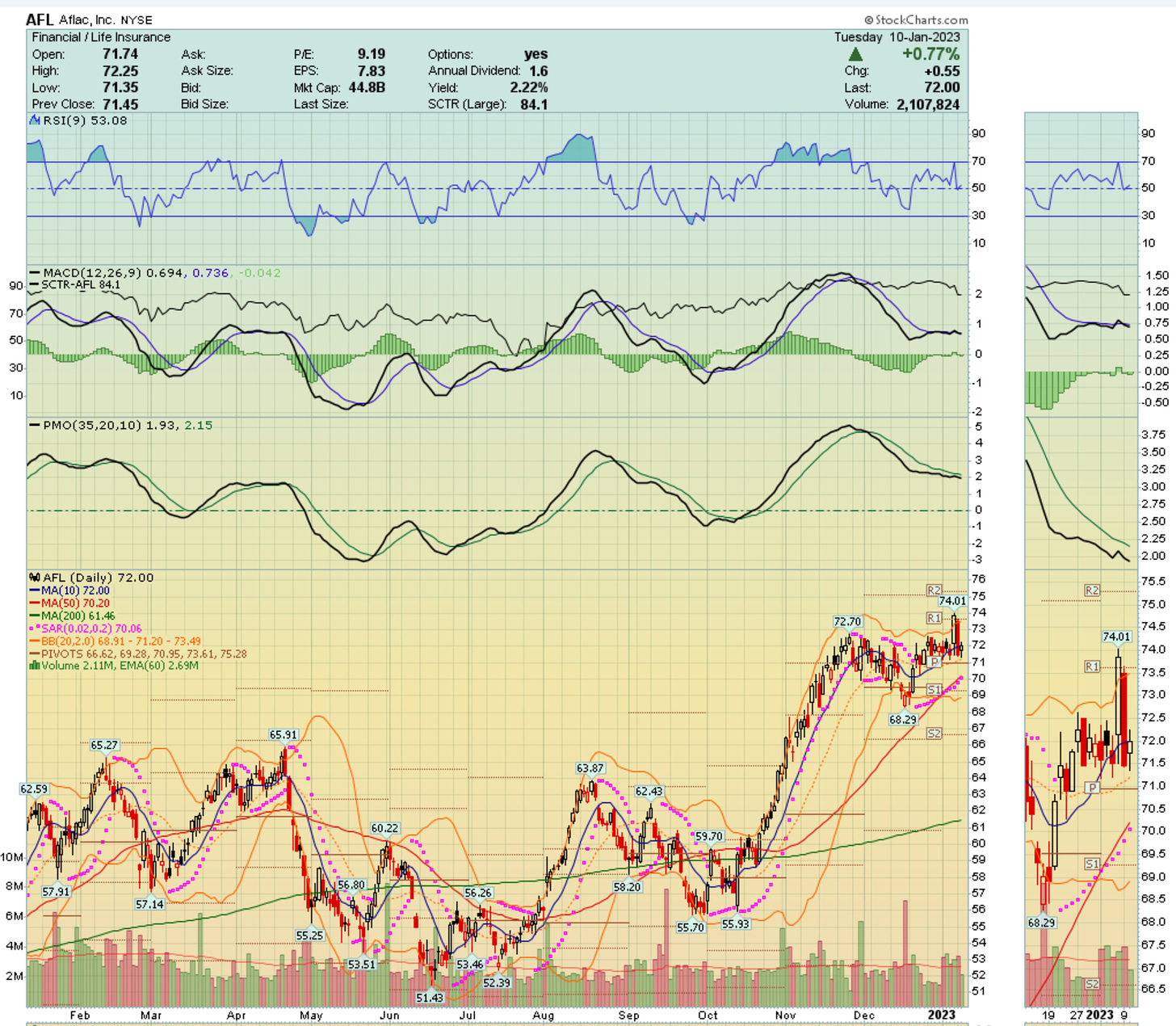

Those stocks are ABT and AFL. See below.

CrossingWallStreet.com’s portfolio is a good source of stock picking ideas. The portfolio manager and blogger, Eddy Elfenbein is in his 18th year of creating and writing about his portfolio.

He manages an exchange traded fund, CWS, which owns the stocks in the portfolio. Buying CWS simplifies buying all the stocks with available trading funds.

Please click on images and zoom in for better views.

Almost half of the 25 stocks in CrossingWallStreet.com’s 2023 portfolio are showing bullish momentum in the first two weeks of the new year. The Stock Charts Technical Rating (SCTR) is in buy territory when it is above 60.

Nine of the 25 have bullish price objectives on point and figure charts at StockCharts.com. They are: ABT, AFL, CARR, CE, FISV, HEI, ICE, OTIS, SAIC, SCL and SLGN. For more information about the stocks in the portfolio, visit CrossingWallStreet.com and click on the Buy List. I wrote about the portfolio on Dec. 27, 2022.

Five, or 20%, of the portfolio’s stocks have enough options trading volume to be attractive to investors who sell covered calls and cash secured puts for options premiums income. They are Abbott (ABT), Aflac (ALF), Danaher (DHR), Intuit (INTU) and Moody’s (MCO).

Of these five, two have bullish momentum and/or bullish price objectives. They are ABT and AFL.

Traders of covered calls and cash secured puts usually prefer to trade the options of stocks with bullish technicals.

My Trades

Today I sold ABT ($113.8) 2.17.22 (38 days) $103 strike puts for $1.03 (delta -.18, OTM probability 79.9%, IV 28.6%.) Return on risk is .905% or about 8.7% annualized if the same kind of trade is done 10 times a year. Crossing Wall Street’s buy below price is $110. The point and figure chart price objective is $144. Margin of safety (MOS) is 9.5%. The Stock Charts Technical rating is 58.6, which is bullish momentum.

I bought AFL for $71.95 and sold AFL in the money 1.20.23 expiration (10 days) in the money $69 strike calls for $3.20 a share on a 100-share contract. If called, the trade will produce an estimated RoR of 0.35%, or 12.68% annualized. If the stock price drops and it is not called, the net debit will be $71.95-3.20=$68.75. $69-3.20, or $65.80. I’ll write covered calls on it. Crossing Wall Street has held AFL for 18 years has a buy under price of $75 on it. The bullish price objective is $104. That makes AFL look under valued.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

On AFL, I made a mistake. I got the net debit by subtracting the option price, $3.20, from the strike price, $69, thinking I was writing about puts. I was writing about covered calls, so the net debit is my purchase price, $71.95 minus $3.20, or $68.75. Thanks, Scott, for catching this.