12 Dow Dividend Stocks' Bullish Momentum Makes Them Candidates for Covered Calls, Cash Secured Puts Options Trades and Watch Lists

Pick good undervalued dividend stocks with active and liquid stock options that can be used to generate weekly and monthly income by selling covered calls and puts options.

By Donald E. L. Johnson

Cautious Speculator

Dividend and income investors are creating watch lists of stocks they want to buy at lower prices when the bear market looks like it has bottomed.

The Dow Jones Industrials stocks generally offer dividends, active options and options liquidity, which is good for selling covered calls and cash secured puts.

Most stocks move with the market, even when they’re relatively strong compared with the major indexes.

Doing bullish trades in a bear market is risky, but nibbling at a few shares on the way down is one way to ensure that some of the current bargains are in a portfolio when they and the markets rally.

Good stock picking is critical when it comes to options trading.

Investors looking for dividend stocks that are good candidates for covered calls and cash secured options trades might consider the 12 most bullish stocks in the Dow Jones 30 Industrials Average index (DJIA30). I have written about selling covered calls.

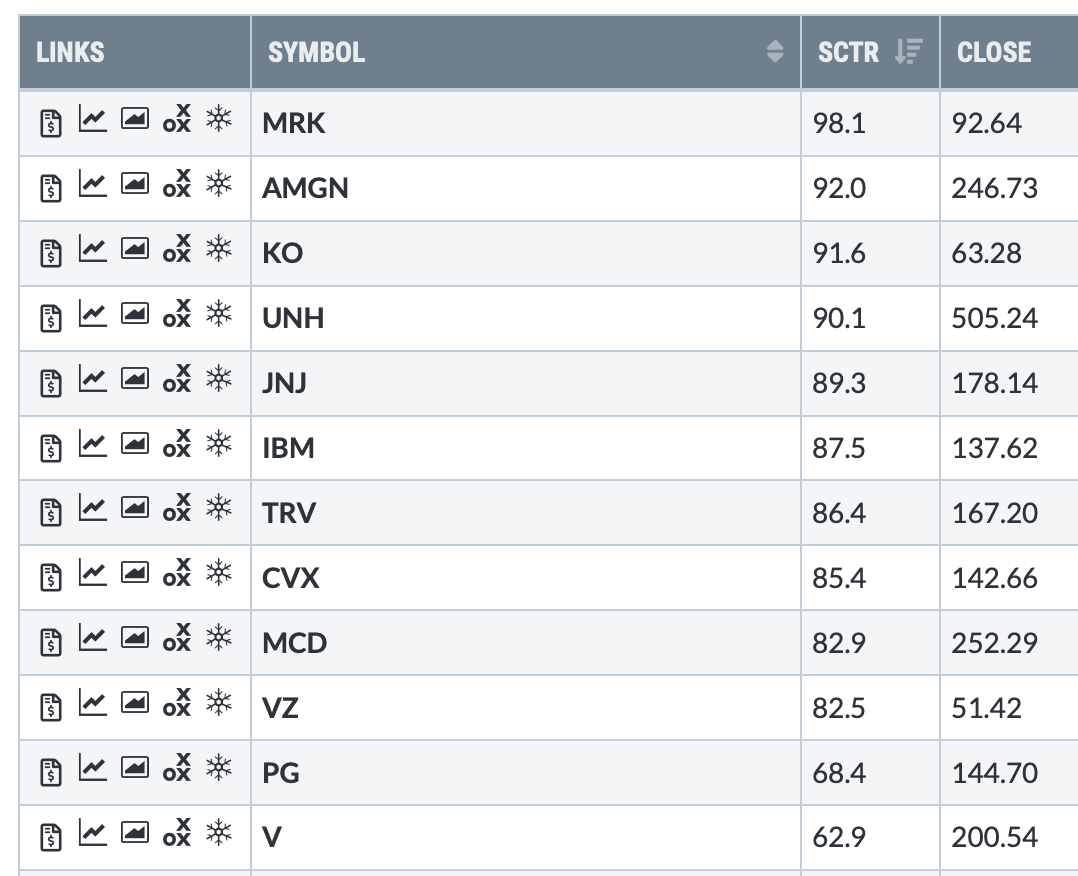

The StockCharts.com Stock Charts Technicals Ranking (SCTR) shows the 12 most bullish momentum Dow stocks:

A SCTR score above 60 is considered a strong buy signal. The closing prices were as of Tuesday, July 5.

Of these blue chips, six have bullish point and figure charts with bullish price objectives.

They are: AMGN ($329 price objective), IBM ($181), JNJ ($211), MRK ($117), UNH ($599) and V ($241).

The bearish price objectives on the other six bullish momentum Dow stocks: CVX ($119), KO ($54), MCD ($181), PG ($123), TRV ($141) and VZ ($37).

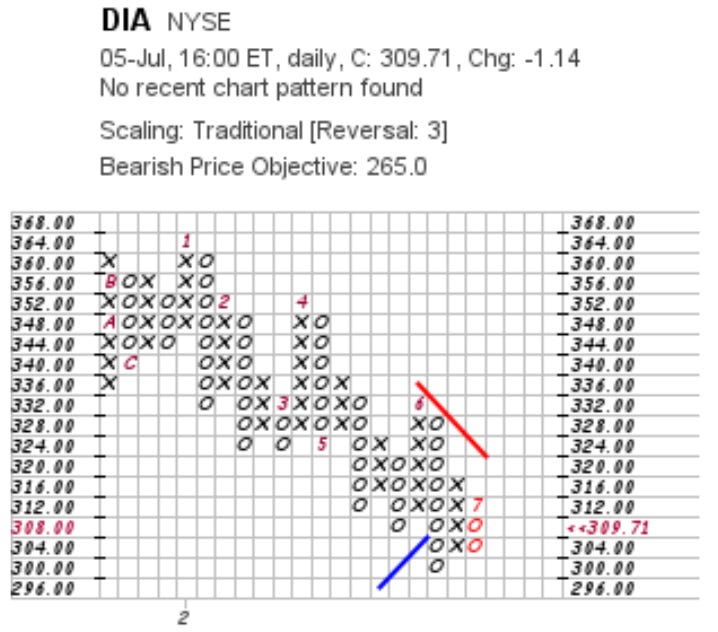

DIA, the exchange traded fund that tracks the DJIA30 index has a 57.3 SCTR rating, which is a buy, but not a strong buy rating. DIA closed Tuesday at $309.71 with a bearish $265 price objective (not a target price).

That DIA and most major sectors are bearish will cause cautious speculators to put DIA and these stocks on watch lists until the markets bottom. Or they will consider selling 10% to 20% out of the money cash secured puts on them to generate some income while they wait for lower prices.

Because we’re in earnings season, cautious speculators also might decide to hold off on buying the stocks and writing covered calls or selling cash secured puts for income.

Stock markets are bearish because speculators are anticipating disappointing earnings surprises and guidance from companies on how well they expect to do during the next 6 to 24 months. Lower guidances lead to lower target prices from Wall Street’s analysts. That causes selling and lower prices.

That the Federal Reserve Board is expected to hike Federal Funds interest rates another 75 basis points near the end of the month also is bearish and will be until the rate of inflation is slowed considerably.

So we’re in the midst of a buyers’ strike on stocks. That makes buying stocks and selling covered calls on them unattractive. We can’t assume anything is baked into current stock prices.

The alternative to selling covered calls is selling cash secured puts. Buying stocks and writing calls is a bullish trade, and selling puts is a bullish trade.

The first rule on selling puts is that you have to have the cash to secure the trade. Then you should sell puts only on stocks you want to buy at a discount, or the puts’ strike price. And, finally, you want to sell puts on stocks that have active options in the month you are trading. You need active trading and liquidity (narrow spreads between bid and ask prices) so that you can buy back the options at a profit or loss easily.

I have written about selling cash secured puts on Apple (AAPL).

A lot of traders are compiling watch lists (buy lists) like the one above while they continue to sell covered calls on stocks they own to generate premium income. At this point, it makes a lot of sense to be in some stocks so you can be in them when they and the markets rally. In the meantime, collect dividends on the stocks you own along with the covered calls premiums.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

Wars Breed Inflation, Rising Interest Rates, Market Turmoil

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I own and/or have options positions on IWM, DIA and other equities. I reserve the right to trade any of the listed stocks and options at any time. I receive no compensation for producing this content nor for any links.

@realDonJohnson. Because I don’t want to litter subscribers’ in boxes with emails, I write only one or two newsletters a day. I’m active most days on twitter where I tweet about stocks, options trades and other topics.

Dear Donald,

I'm new in your blog after reading your interesting comment on SA.

I would like to ask your help - What is the best way to start in your blog?

I didn't find the way or link for "Start here" 😊

Thanks in advance