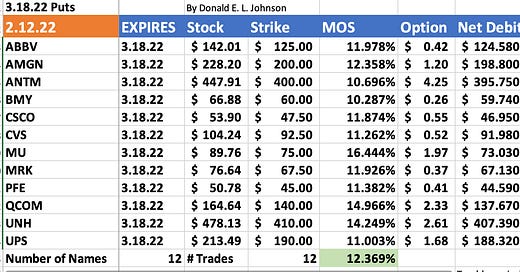

12 Dividend Stocks With Relatively Good Momentum For Selling Puts Options

Bearish market conditions dictate planning for lower prices, selling low-delta puts and waiting to see what Russia does in Ukraine.

By Donald E. L. Johnson

Cautious Speculator

Until Russia attacks or backs off from Ukraine, this probably is not a good time to make bullish puts trades.

With the recent weakness in the markets, holding back on bullish trades probably is wise for all but short-term traders.

This is a good time to plan trades and create a watch list of trades that would expire in March.

A watch list of 12 relatively strong stocks is presented.

With the stock market looking bearish and on edge waiting to see what Russia will do about Ukraine, picking stocks and cash secured puts options that expire in March needs to be done cautiously. Also, it still is not clear whether the Fed will hike interest rates by a quarter or half point when it meets on March 16. If a war breaks out, it might not raise rates.

The 12 stocks picked for the March 18 expiration puts trades sport price to free cash flow (P/FCF) valuation ratios that average about 16.8 and range from 8.8 for CVS Health (CVS) to 26.3 for Micron Technology (MU). In other words, these are not over bought stocks. Please click on the image and zoom in.

Health care stocks dominate this watch list that otherwise would be more diversified in a bullish market. This is because these stocks have been picked both for their strong fundamentals and for their relatively bullish momentum in this market. Selling puts is a bullish trade, and puts should be sold on some of the stronger stocks in the markets. Many traders will buy the stocks and write (sell) covered calls instead of selling puts. Or they sell covered calls and puts on the same stocks, which is a riskier but rewarding trade when it works, as it usually does if the deltas on both legs of the trade are very low and the strikes are 10% to 20% out of the money (OTM).

I’ve also written about selling cash secured puts on other stocks. See the link to my home page below to see more articles.

Because of the uncertainty about Russia’s threatened invasion of Ukraine, most cautious investors are either selling stocks or delaying new trades until Russia pulls back, Ukraine surrenders to Russia or Russia’s war on Ukraine ends, which probably would happen quickly. How America and other Ukraine allies and supporter would respond to whatever happens in Ukraine also is unknown.

Aggressive speculators will trade regardless of what’s going on, but income traders who sell puts and calls for premium income and collect dividends are, for the most part trying to protect their capital while making a living, not betting their estates on a few risky trades.

By the time the dust settles in Ukraine, other stocks may look more attractive for this strategy. So this tentative watch list may and probably will be changed over the next week or so. It’s meant to be seen as an example of how regular traders plan their next week’s trading, not as advice about what to trade.

Without the threat of a war or major policy announcement by the Fed or president, some traders would put this kind of plan together in a few hours on a weekend and do the trades the following week. Others would do some of the trades the following week and and others over the next couple of weeks, depending on their schedules and market conditions.

I spent years as a business owner and trader creating spread sheets and making plans. And I spent years as a business journalist writing about strategic planning. For me, planning is a learning exercise, and all plans change as new information becomes available.

The stocks in this watch list are trading at prices that are between 73% and 112% of their discounted cash flow fair value estimates, according to StockRover.com data. They are at between 6.5% and 21.75% below the average target prices posted by sell side stock analysts. And they are between 54% and 84% of the analysts’ highest target prices for each stock. That is, if the market rallies, these stocks should do pretty well and the puts options will expire worthless, which is what most income traders want to happen.

If a trader sold one contract for 100 shares of each stock in this watch list, the total cost of buying the stocks if assigned would be about $183,593. Traders who can’t or don’t want to make that big of an investment always can pick one or two or more of the stocks out of the watch list and sell puts on them. Traders may buy fewer of the stocks and put the same amount of money–say $10,000 to $20,000–into each stock they trade.

If the trades were done on Monday, the average return on risk (RoR) on the 12 stocks over 32 days would be 0.83%, or 9.4% annualized. That would be an immediate return on 32-day trades of about $1,657, or $18,900 annualized. Annualized is kind of a fantasy or dream number. Because stock and options change by the minute, no trade can be replicated exactly 11 times a year. But if a trader did one or all of these trades 11 times a year, the annual premium income probably would be fairly close to the annualize number shown here.

The risks are that the stocks will sink below the strike prices and the stocks will be assigned (sold) to the sellers of the puts at the strike price. That can be averted by buying back the puts, sometimes at losses. Traders often play the “wheel”. After puts are assigned, they sell covered calls for premium income until the calls are assigned and the stocks are sold. Then they sell puts on the stock again or move on to other trades.

Meanwhile, there is plenty of time to research the stocks and decide whether they belong in your portfolios or not. I’ll be looking for stocks that fit the portfolio and give it better diversity. So this is a work in progress.

Question: What are your questions and thoughts about this strategy and portfolio?

LINKs:

Home Page. See previous articles on other stocks.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own and/or have options positions on ABBV and PFE .

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks.

Hi Patrick. The video is pretty good. Too long for me. But it leads into his pitch for paid courses, which you don’t need and are annoying to my readers, so I won’t link to it. What is the wheel you're trying to do?

Don

Thanks Don. The Wheel Strategy was what I was studying just yesterday.

This guy gives a really good explanation of the wheel in my view. I am trying to replicate this.

https://youtu.be/nBmPCet8fzM