11 Dow Industrials 30 Stocks Have Bullish Momentum; 18 of the 30 Have Bullish Price Objectives

In the midst of the bear market, the Dow Jones 30 index is looking very bullish, which is what sellers of cash secured puts and covered calls options traders like to see.

By Donald E. L. Johnson

Cautious Speculator

Brokers, analysts and bloggers are announcing their market predictions for 2023 and promoting their individual stock picks.

The Dow Jones Industrials Average 30 stocks are widely followed and recommended by a lot of people. So they are vetted, well known and good candidates for dividend income and dividend growth investors.

Calls and puts options on these stocks are actively traded and liquid.

Given the fundamentals, investors can use stock momentum ratings and point and figure price objectives for the DJIA30 stocks to find bullish stocks and make informed trading decisions.

I own and trade options on several of these stocks.

Investors planning to upgrade their portfolios for 2023 with bullish stocks that have liquid options for selling covered calls and cash secured puts have to look no further than the Dow Jones Industrials average of 30 blue chip stocks for some promising ideas.

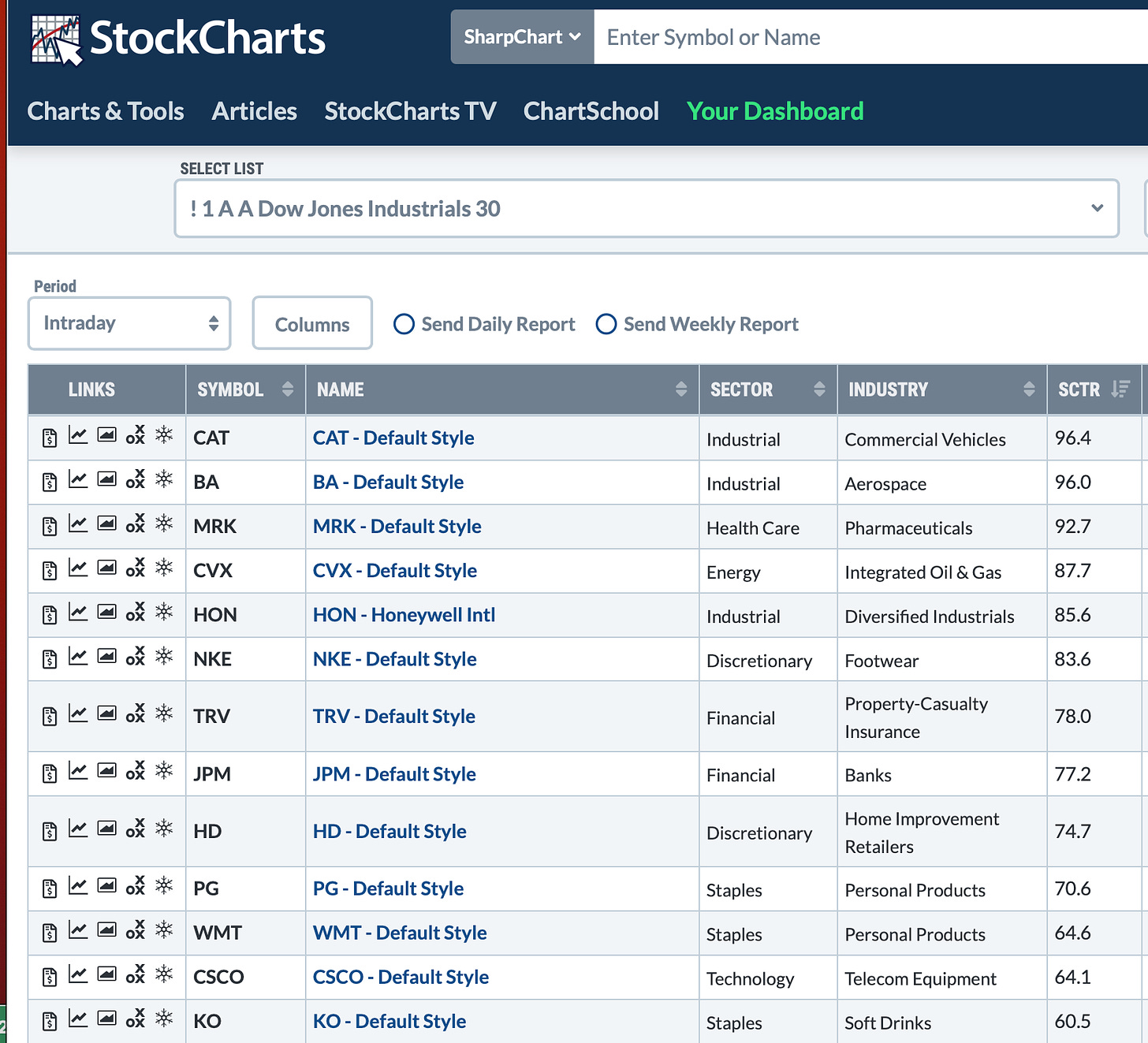

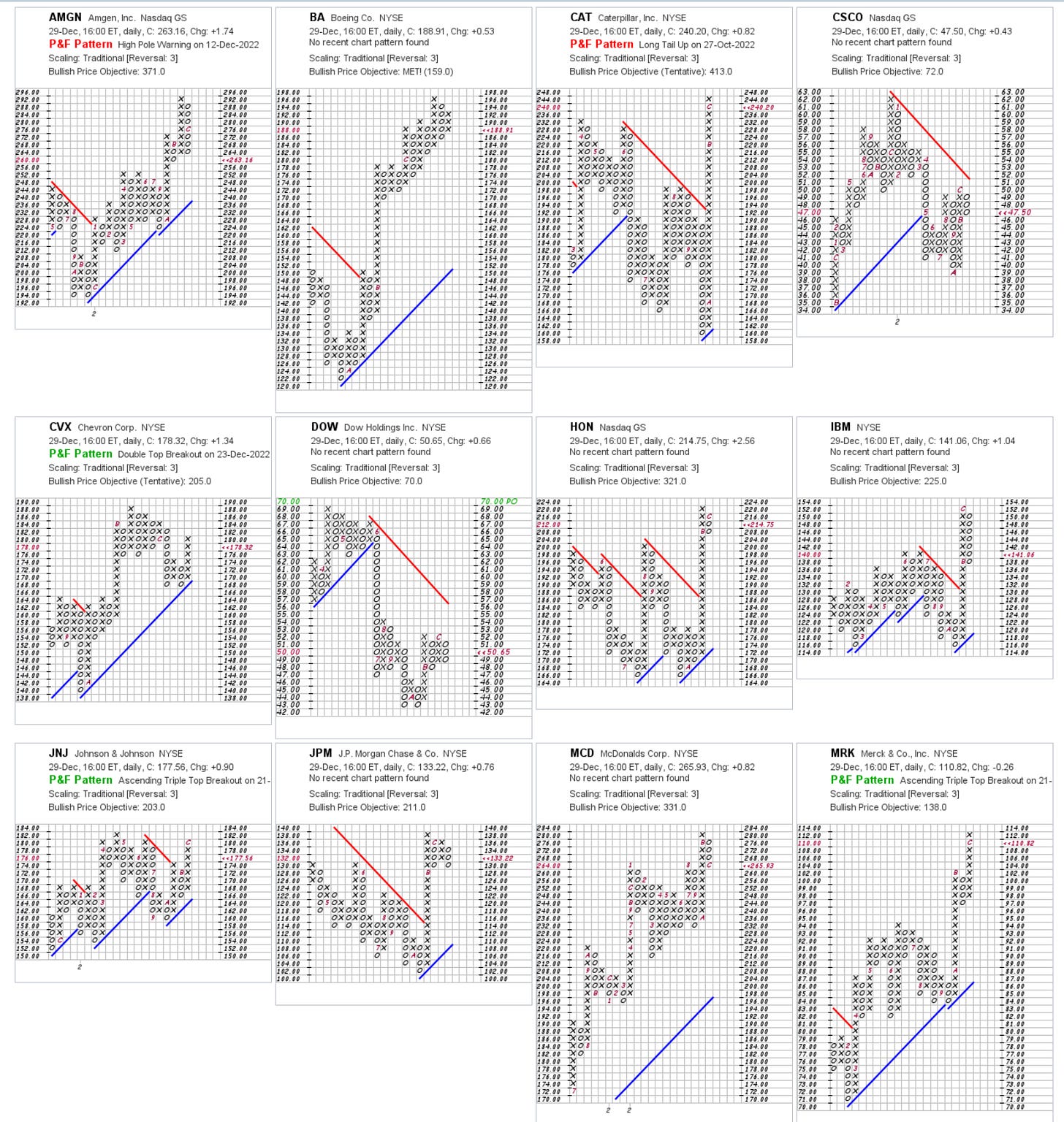

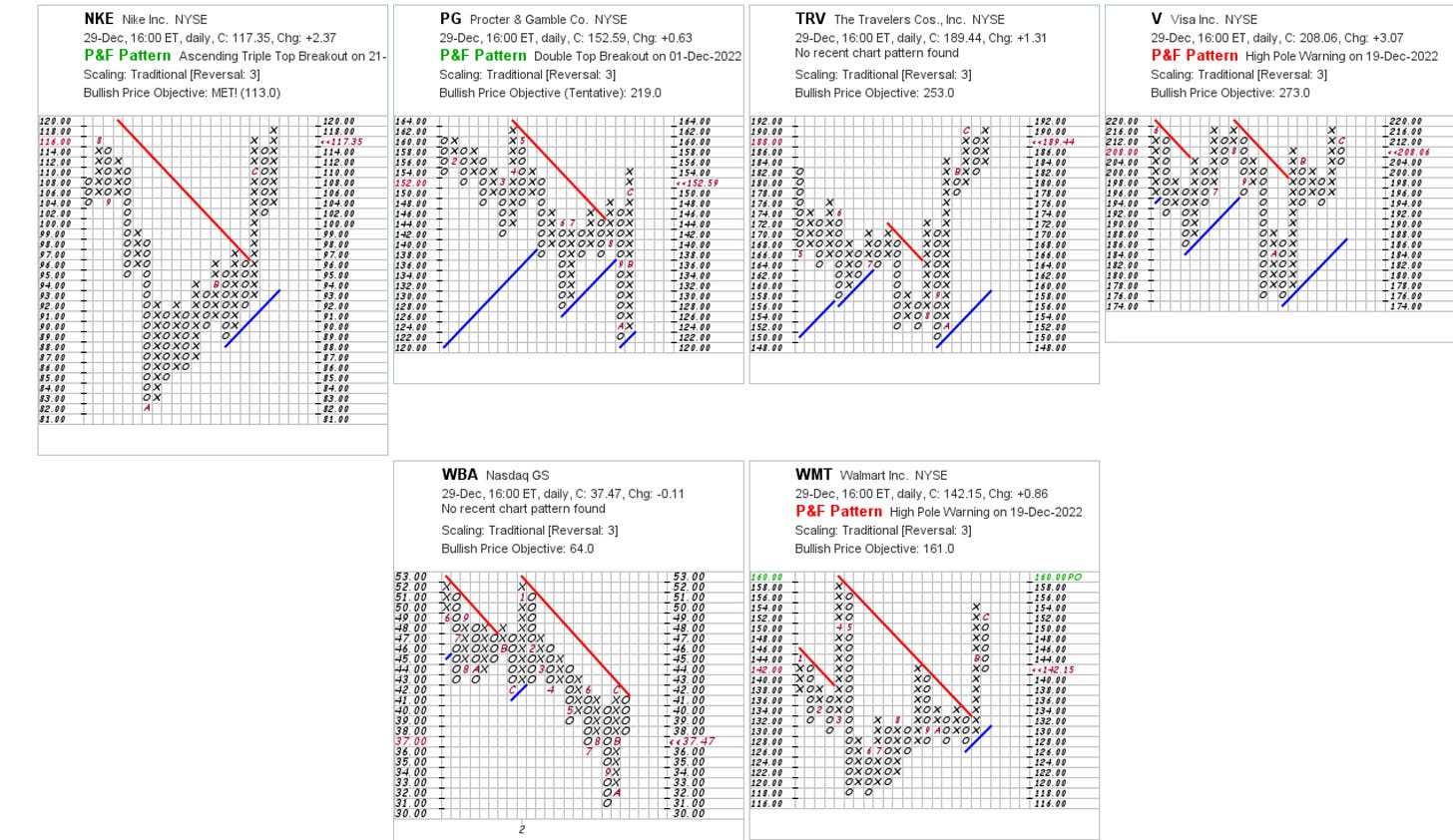

As of the December 29 close, 11 of the 30 stocks have bullish Stock Charts Technical Ratings of 60 or above out of a possible 100, according to my watch list on StockCharts.com. I own Caterpillar (CAT). Today I bought J.P. Morgan Chase (JPM) and Cisco (CSCO) and wrote covered calls on them. (Click on images and zoom in for better views.) I also sold Merck puts, which is a bullish trade.

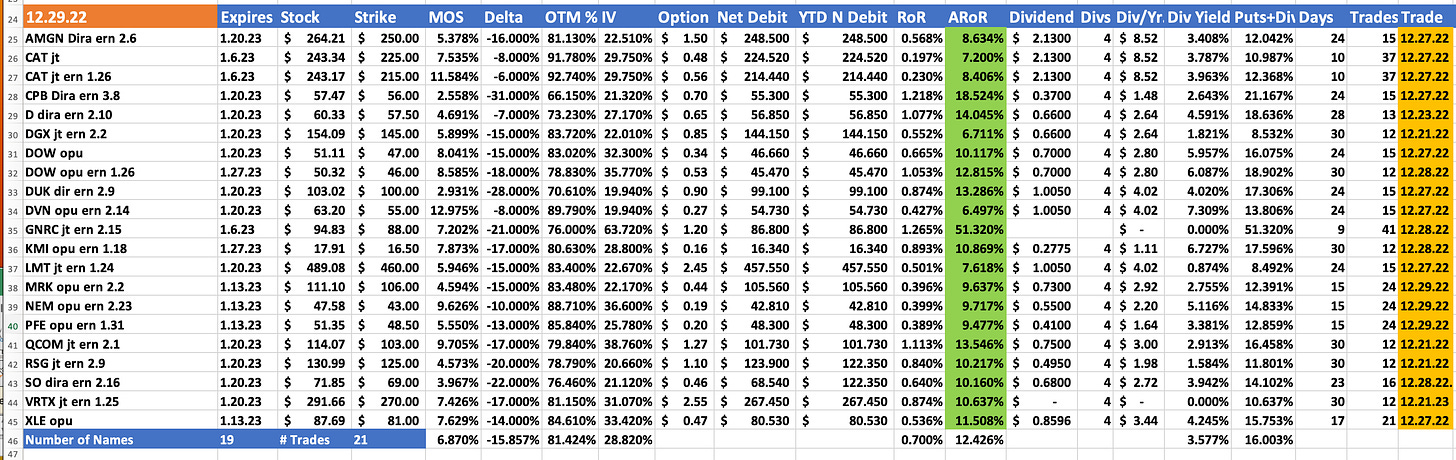

Eighteen of the Dow 30 stocks have bullish price objectives on these charts from StockCharts. Com. As the spreadsheet below shows, I have puts positions on AMGN, CAT, DOW (which I own and have covered calls on it) and JNJ among other stocks.

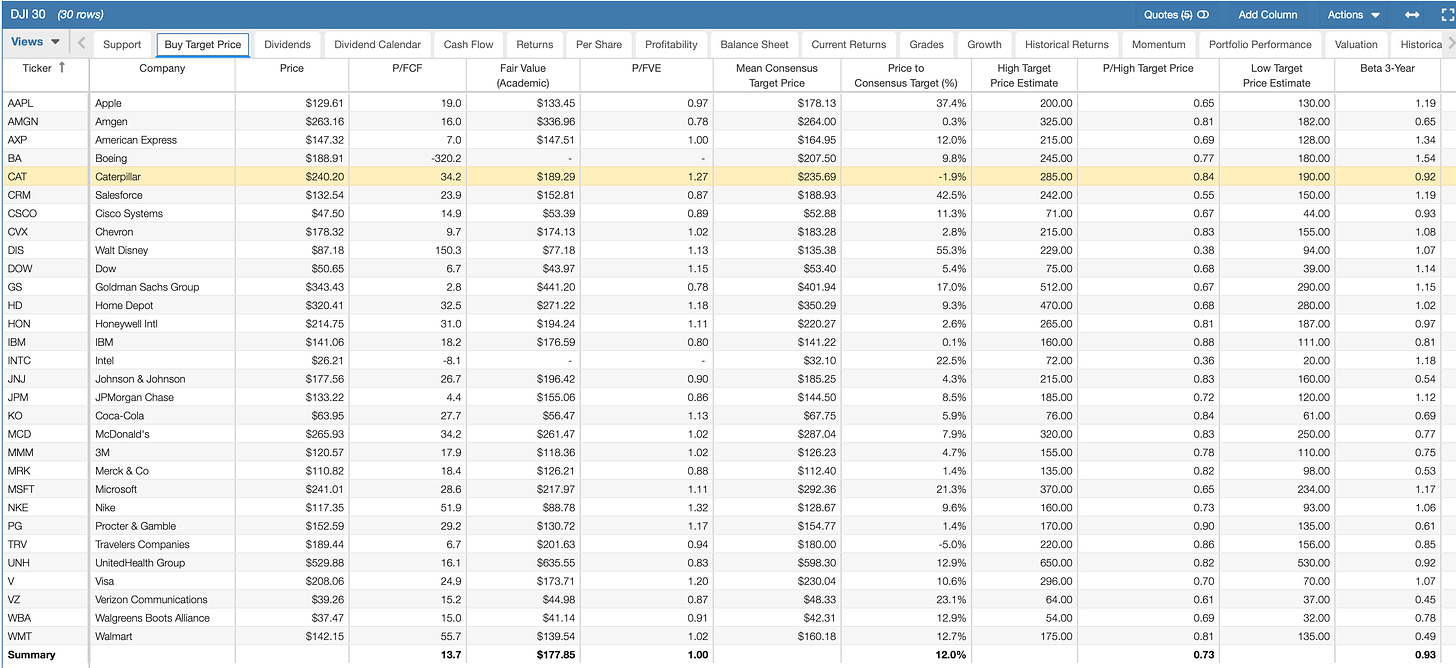

This table, which I created on StockRover.com, shows P/FCF and analysts’ target prices on the DJIA30 stocks.

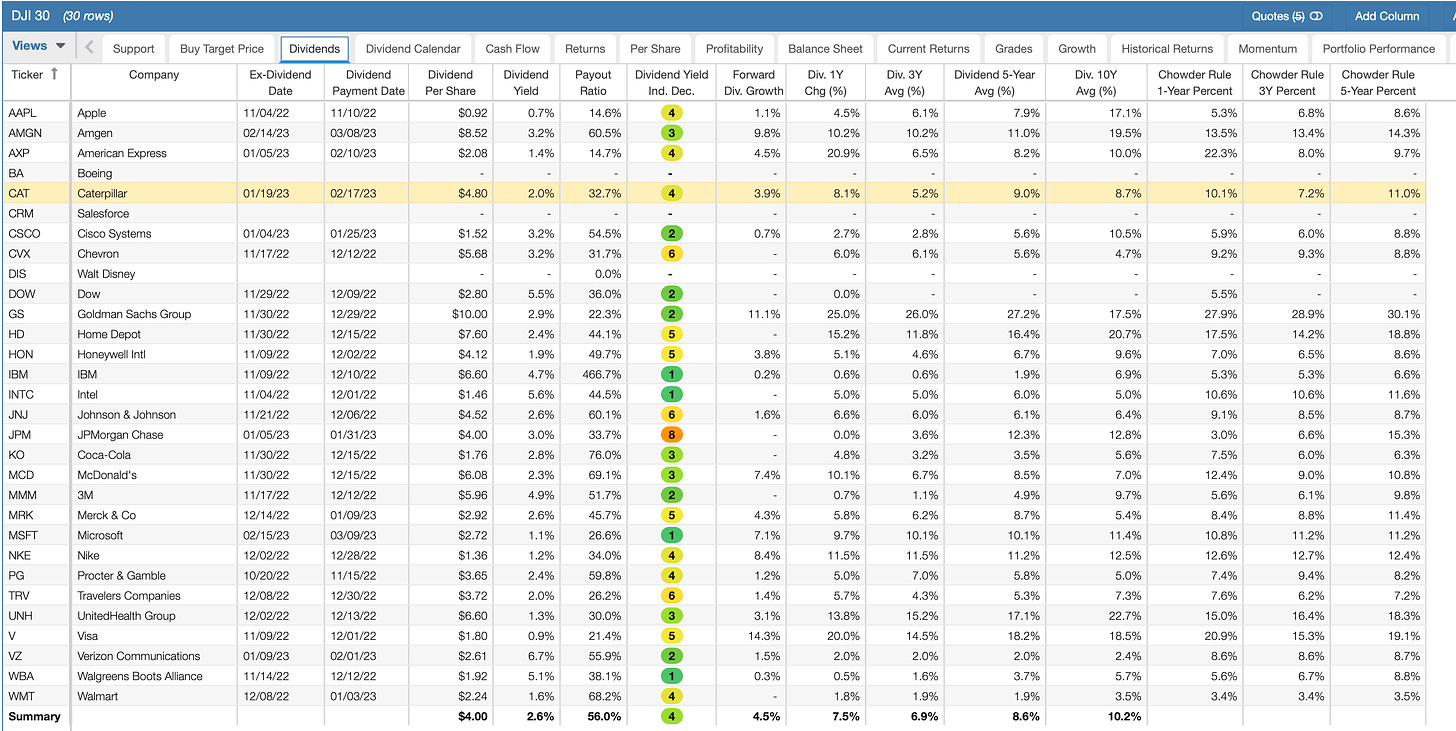

Here are the DJIA30 stocks dividend profiles. Note that they’re expected to grow their dividends 4.5% annually, their average payout ratios are 56% and their average yields are 2.6%.

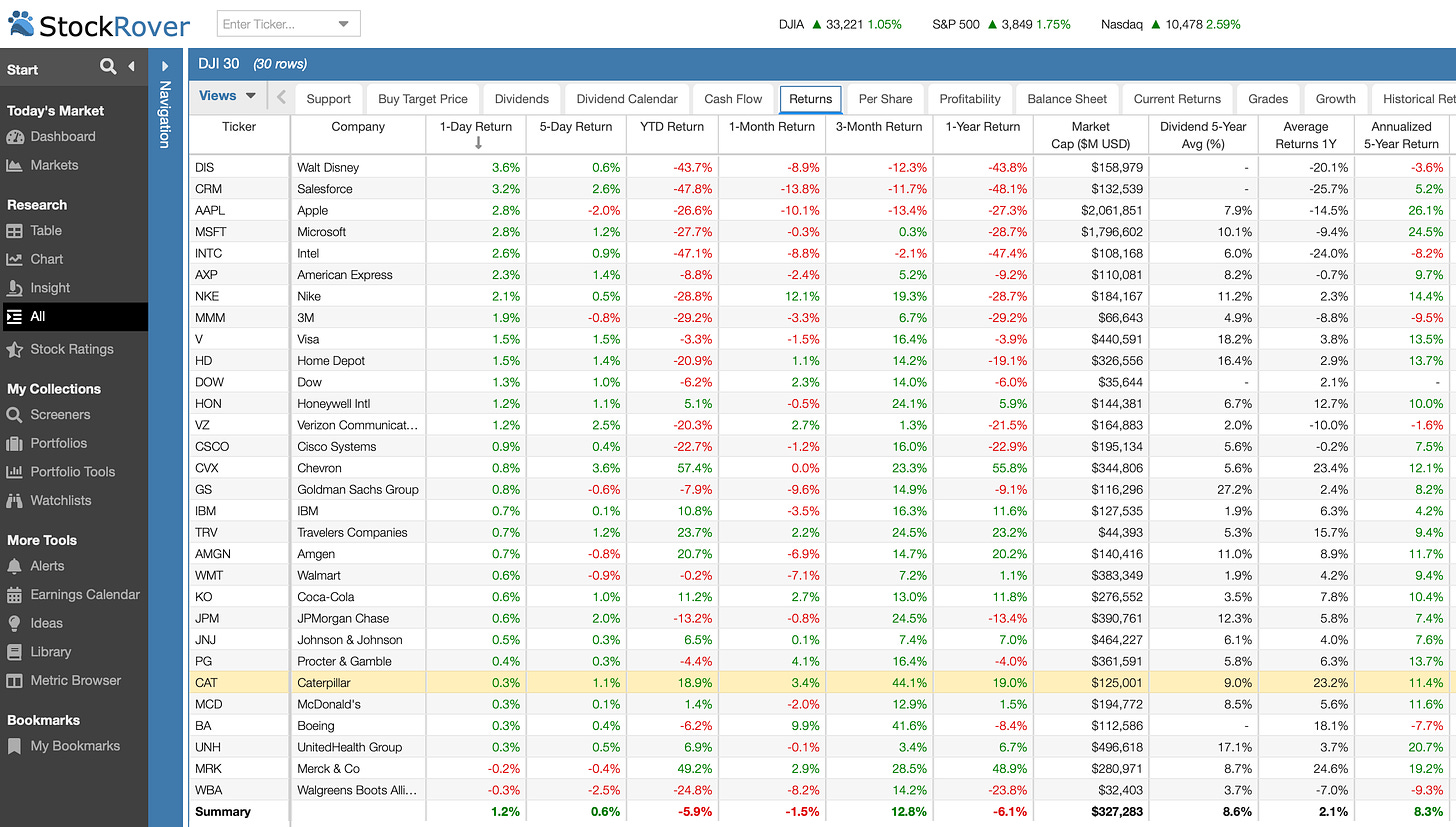

Historical information tells investors little about the future. But here is a returns table from StockRover.com.

My Trades

During the last two weeks I’ve done 21 cash secured puts trades on 18 stocks and an exchange traded fund in taxable and IRA accounts.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.