11 Dividend Stocks in My June Covered Calls Portfolio

The portfolio's potential annualized dividends plus options premiums is about 20%.

By Donald E. L. Johnson

Cautious Speculator

A relatively easy way to generate dividends and options premium income is to sell covered calls every month.

Selling covered calls is a relatively simple and easy strategy compared with trading complicated options spreads. Life is risky.

I discuss my current June expiration cover calls trades on 11 stocks.

Every month I assemble a diversified portfolio of dividend stocks and do monthly covered calls trades on those stocks. This article is for educational purposes. It is not advice.

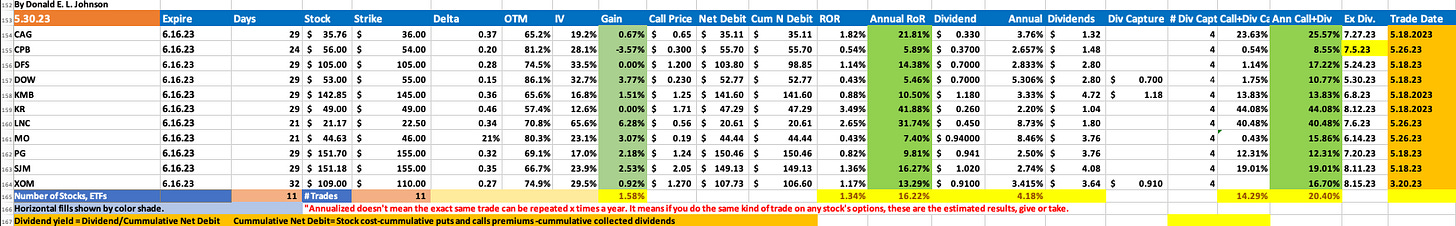

My June covered calls portfolio includes 11 stocks that sport an average annual dividend yield of 4.82%. Most are in income tax sheltered IRA accounts. That means that their taxable equivalent yields are even higher than 5%. Yields are based on the net debit on each stock. Cumulative net debit is stock purchase price less collected dividends and options premiums.

The stocks are: Conagra Brands Inc. (CAG), Campbell Soup Co. (CPB), Discover Financial Services (DFS), Dow Inc. (DOW), Kimberly-Clark Corp. (KMB), Kroger Co. (KR), Lincoln National Corp. (LNC), Altria Corp. (MO), Procter & Gamble Co. (PG), J.M. Smucker Co. (SJM) and Exxon Mobil Corp. (XOM).

I do several small trades on 11 stocks to diversify my risk. And I further diversify my risks by doing the trades 24 to 32 days before the call options expire.

Depending on the prices of the stocks, the cost of buying 100 shares of each of these stocks and selling one covered call option on them is around $90,000. Some traders will put $15,000 ($144,000 to $165,000) or more or less in each stock. Others will trade the three our four stocks that fit their financial situations.

The expected annualized return on risk on the monthly covered calls trades is about 16.2%. Dividends plus options premiums could give me an ARoR of about 20%. If I collect some short-term gains along the way, the total ARoR could top 30%. This assumes that I capture all the dividends before the stocks are called and that I get the same monthly results on covered calls trades every month, or 12 times a year.

Year to date I have done 65 covered calls trades on 32 stocks and ETFs. The ARoR on the covered calls trades has averaged about 15.4%. The average dividends on cumulative net debits, unweighted, has been about 3.3%. I’ve also had a few calls assigned at nice profits.

Because of market conditions, I’ve owned and traded calls on a lot fewer stocks than in the last two years. If the stocks I like to trade start to rally, my covered call trading will more than double. During the last couple of weeks, I’ve bought some stocks in anticipation of a debt limit deal. We’ll soon know whether that assumption will be verified by Congress.

I expect to have some of these stocks called. After the calls expire worthless on the rest of the stocks, I’ll either sell the stocks or roll the covered calls forward into July expiration trades.

On Many 22, I wrote about my covered calls trades on five of the stocks listed above. I expect that by the end of June, I will do several more covered calls trades that expire in June or July. I also am selling cash secured puts on these and other stocks.

Selling covered calls and puts are income trades. Both trades are relatively simple and involve either buying 100 shares per contract for covered calls or putting up the cash it takes to buy 100 shares if puts options are assigned.

Because this strategy involves buying stocks frequently, it requires having cash available to buy the stocks and sell the calls and to secure cash secured puts trades. Fully invested traders who don’t want to risk having stocks called don’t use this strategy.

I’ve written more than 100 articles about selling covered calls and puts. It is a lot easier and less expensive to buy stocks and rent them out by selling covered calls than to buy real estate and deal with tenants, mortgage bankers and Realtors.

The basic strategy is to sell calls and puts on dividend stocks that have liquid options and offer decent annualized monthly options premiums income.

Some of the stocks in the portfolio are trading well under their purchase prices, which is why I trade their way out of the market (OTM) and low delta covered calls strikes.

On new stock purchases, I go for short term capital gains by selling covered calls at the market (ATM) with high deltas, one or two strikes above the purchase price or in the market (ITM) with strikes below the purchase prices, depending on the risks and opportunities involved in each trade. The more experience a trader has in the options market, the easier it is to decide how to do each trade.

Many of these stocks had Barchart.com buy ratings when I bought them. A few didn’t. I bought the stocks for their dividends, which I plan to collect along with covered calls premiums regardless of what happens to the stocks short term. These are among the dividend stocks I want to own when I no longer can trade calls and puts for income.

Over the next two or three years, all of these stocks should be near or above what I paid for them and their cumulative net debits. Nobody can predict prices or interest rates.

Again, these are income trades with some potential small capital gains.

In bear markets, there aren’t many capital gains on these trades. In bull markets, monthly capital gains can almost equal the options trading premiums.

LINKs:

Home Page. See my more than 100 articles on options trading, stocks and watch lists. If you read several of these articles, you’ll learn how my strategies are meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Follow @realDonJohnson on twitter.com and FaceBook.com. Or follow me on Substack Notes where my byline is my handle.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on TDAmeritrade.com’s Think or Swim trading platform.

Today's market shows speculators are worried that the McCarthy/Biden debt limit deal may not get through Congress. The rules committee in the House will give some indication of the deal's prospects. Then we'll wait for the House to vote Wednesday after the markets close. Then the Senate may take until next week to vote. How many traders will play the uncertainty surrounding this nonsense?

The question now is, if the debt limit deal is turned down by Congress, how will stock markets react? Most people expect a big drop. If that happens, puts prices will go up giving sellers of cash secured puts opportunities to sell puts at the extreme bottoms for good premium income and possible good discounts at ATM and OTM puts strikes.

Then, do you sell puts on AI, energy, utility or just some good dividend stocks that you already own?