11 Crossing Wall Street Stocks Have Bullish Momentum; 10 Stocks Have Bullish Price Objectives

7 of 25 CWS Stocks' Momentum Is Bearish; 12 Have Bearish Price Objectives. Call Them 'Value Stocks'.

By Donald E. L. Johnson

Cautious Speculator

CrossingWallStreet.com’s Buy List include current buys and some of Eddy’s Dogs, or value stocks.

Momentum traders go with the current buys. Other speculators buy sinking and depressed stocks.

Most of the 25 Buy List stocks have options for traders of covered calls and cash secured puts. Some of the companies are relatively small and their options are lightly traded, if they have options at all.

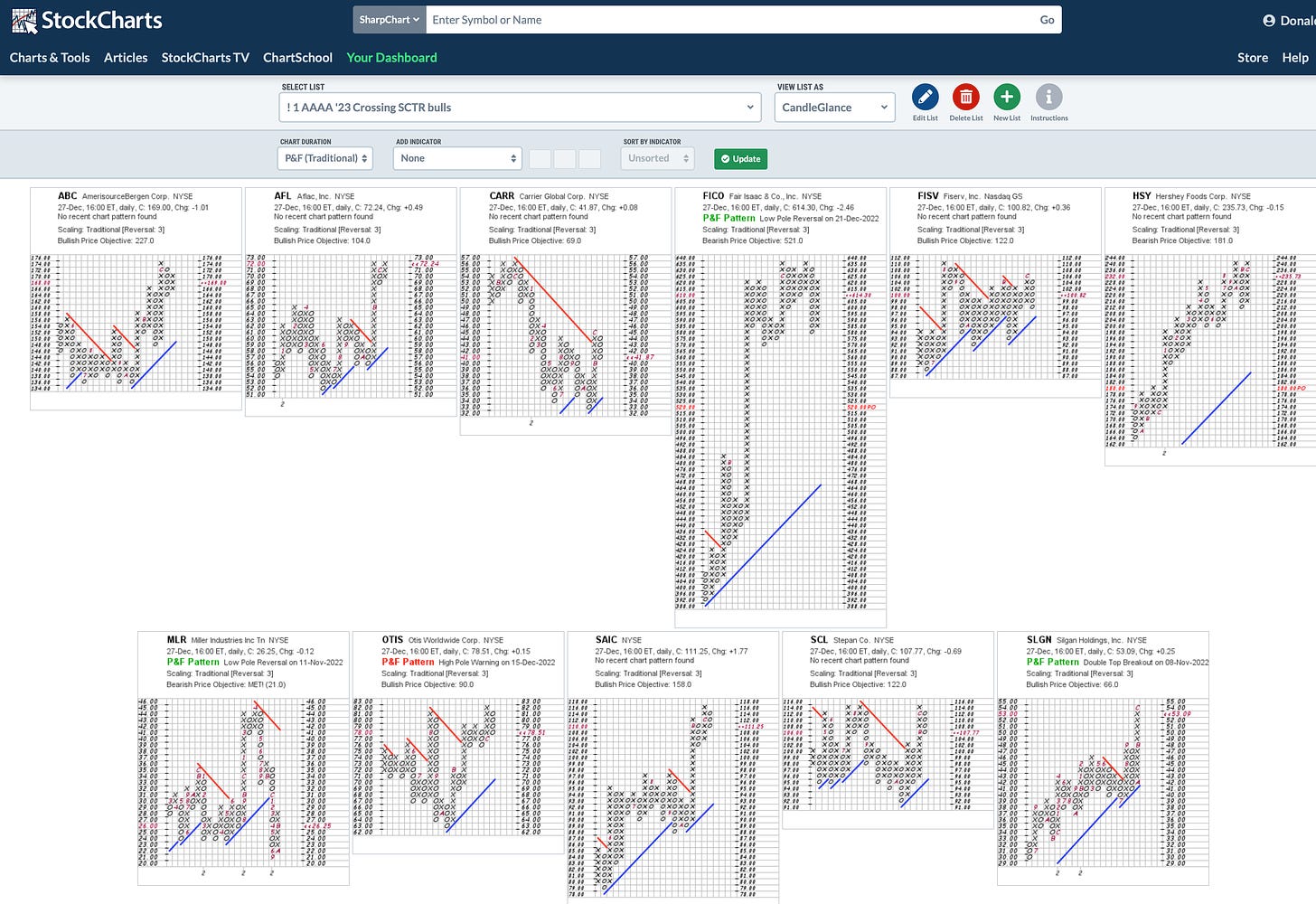

This article highlights the bullish stocks on the Buy List and shows their point & figure charts.

Eddy Elfenbein Tuesday published his 2023 “Buy List” of 25 stocks on his blog, CrossingWallStreet.com. In addition to being a widely followed blogger and a very active mini blogger on twitter, Elfenbein also is the portfolio manager for the CWS exchange traded fund that holds the stocks on the Buy List.

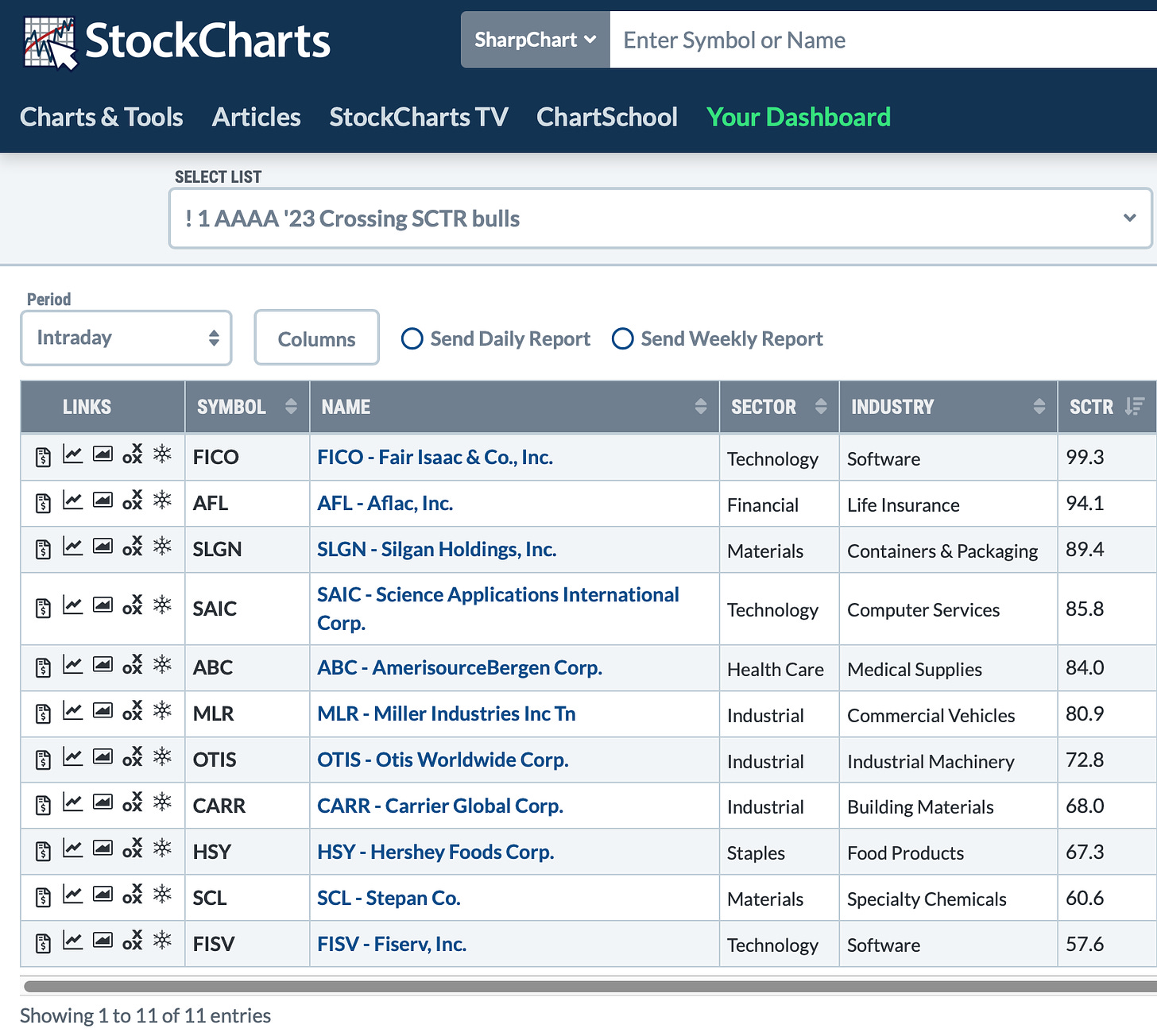

Eleven of the 25 stock on Crossing Wall Street’s 18th annual list are bullish in terms of their momentum as measured by the Stock Charts Technical Ratings (SCTR) published by StockCharts.com.

The metrics and charts shown here are what I use when picking stocks. I don’t know the metrics that Elfenbein uses to pick stocks, but it is clear that he knows the companies and believes in their potential. He has thousands of followers.

Seven of the stocks have bearish momentum. Call them “value stocks”, or Eddy’s Dogs. The Dogs are MCO, PII, FDS, INTU, CE, BR and TREX. Over time and during the year Elfenbein discusses all of his stock picks in detail on his blog.

Stocks and ETFs with SCTRs above 60 are considered strong buys, especially in bull markets. When stocks’ SCTRs are 40 or below, momentum traders see them as sells while the buy the dip crowd may buy them.

Investors who sell covered calls and cash secured puts to generate options premiums that enhance their dividend incomes prefer stocks that are moderately bullish and less risky than more volatile stocks and ETFs.

StockCharts.com also lets subscribers create point and figure charts. These charts show bullish price objectives and bearish price objectives. The price objectives are not price targets nor price guarantees. They simply reflect the flow of funds into and out of individual stocks and ETFs.

Ten of Crossing Wall Street’s stocks have bullish price objectives.

Twelve of the stocks have bearish price objectives. They are ABT, ICE, TMO, MIDD, DHR, MCO, PII, FDS, INTU, CE, BR and TREX.

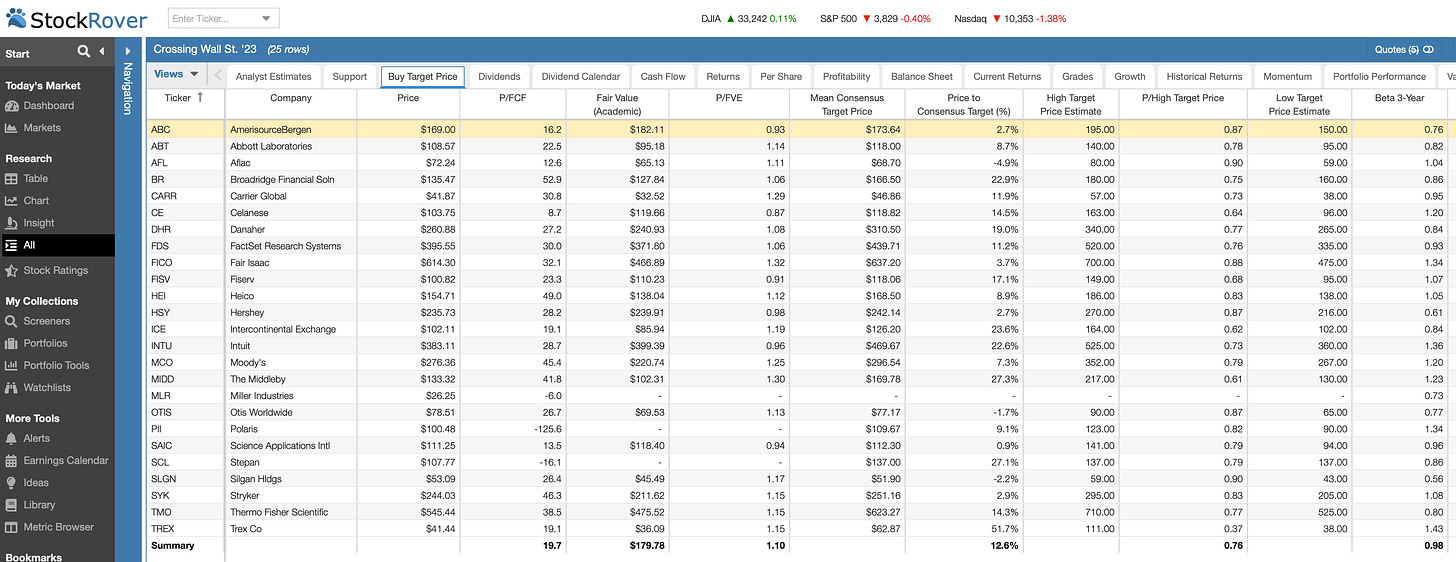

Buy List stocks have an average price to free cash flow (P/FCF) ratio of 19.7, according to my watch list on StockRover.com. They are trading an average of 10% above Stock Rover’s fair value estimates and 12.6% below analysts’ mean consensus target prices. The stocks are trading at about 76% of the average high price target for each stock.

The three-year beta on the watch list is a defensive .96.

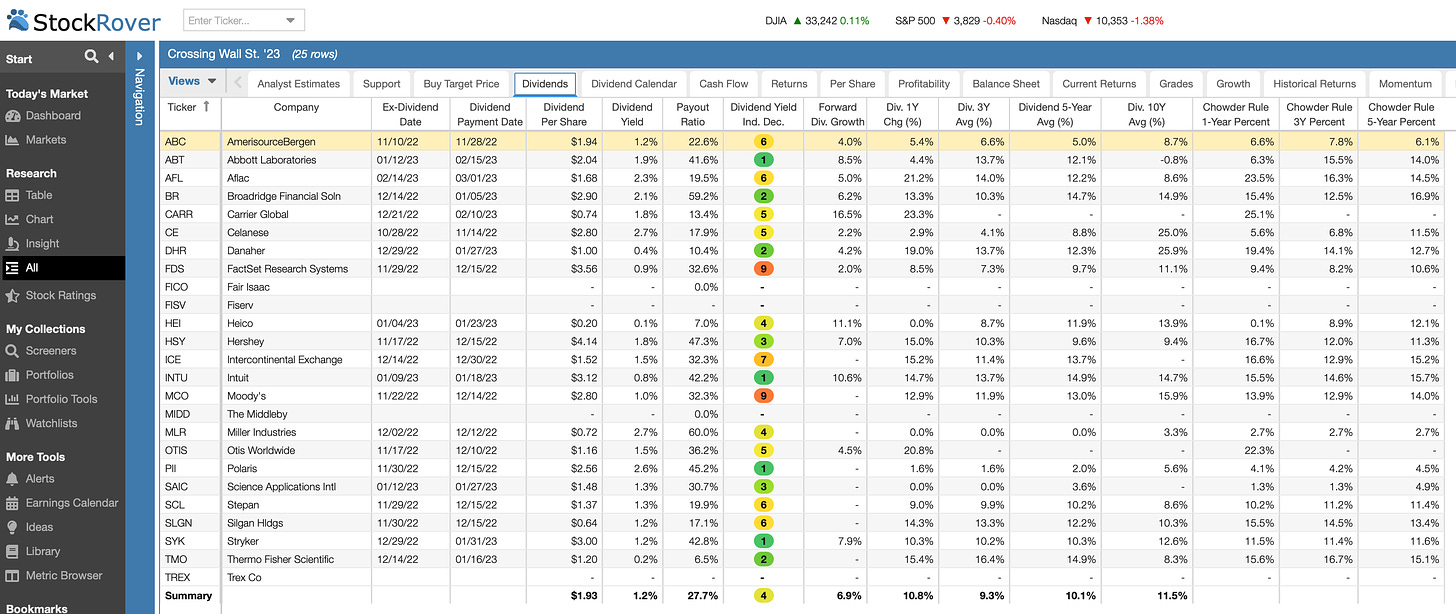

Some of the stocks pay nice dividends while others don’t pay dividends. The average dividend yield is 1.2% and the average payout ratio is a safe 27.7%. Dividend growth, on average, is projected at a nice 6.9% while average dividends grew 10.8% in the latest year.

Many of these stocks have liquid options for trading covered calls and puts. Some aren’t liquid, which makes it difficult to get options orders filled.

As usual, I write this newsletter to help people learn how to enhance their dividend and capital gains income by selling covered calls and puts. Please see the link to the home page and other links to previous articles on picking stocks and trading options for options premium income. I reply to questions and comments posted in the comments section.

LINKs:

Home Page. See previous articles on other trades, stocks and watch lists. If you read several of these articles, you’ll learn how my strategy is meant to work. No guarantees. Links to useful web sites are on the lower right corner of the home page. Scroll down.

Selling in The Money Covered Calls Can Yield Big Annual Returns on Risk. By Donald E. L. Johnson

20 Ideas for Adjusting Your Stock and Bond Portfolio, by Christina Lourosa-Ricardo.

How to Beat Inflation Tax, Bear Market Tax With Dividend Stocks, Covered Calls, Cash Secured Puts, by Donald E. L. Johnson.

Wars Breed Inflation, Rising Interest Rates, Market Turmoil, By Donald E. L. Johnson.

Ways to use StockRover.com to analyze stocks

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.