10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

The strategy is simple. Find good under valued dividend stocks. These 10 have active and liquid options that can be used to generate additional income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

A lot of stock picking and options trading newsletters either give readers one or two trades a week or a month, which is not enough to create a diversified portfolio. Or they suggest 50 to 100 stocks, which makes it hard for readers to decide what they want to trade. Many investment newsletters cost $120 to $1,000 a year. This one is free. Please subscribe.

Please click on the images and zoom in for better views.

This newsletter’s mission is to present watch lists of up to 12 stocks that offer potential capital gains, good dividends and opportunities to sell active, liquid and relatively deep puts and calls at attractive returns on risk. Most readers also will cherry pick this list, too. Been there, done that.

It pays to wait for good times to make trades when a stock and the markets are looking bearish as many are today.

Again, this is a watch list. It may have to be watched for quite awhile until these stocks bottom out and look like they are headed higher. That is when you want to sell puts.

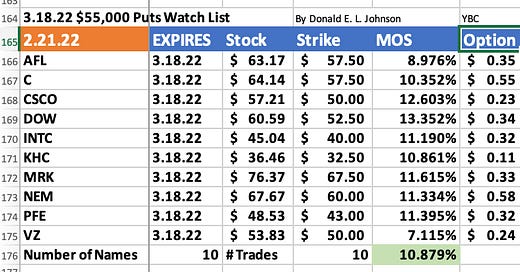

I’ll get to metrics below, but to end the suspense, above are 10 stocks with deep out of the money (OTM) cash secured puts options. At Friday’s closing prices, the net debit, or total cash a trader would put up to secure the CSP trades would be about $50,713. A lot of traders will pick fewer stocks. Some might put, say, $20,000, into each stock, or $200,000, or more.

The margin of safety (stock price minus premium) averages almost 11%. If a trader thinks a stock will drop 11% or more and close below the strikes shown above, she probably won’t do these trades until the markets and stocks look like they are rallying.

The average ROR is 0.578%, or if the exact same kinds of trades were done 15 times in 12 months, the annualized RoR would be about 8.792%. In an IRA or other tax sheltered account, the taxable equivalent yield will be higher.

Puts traders don’t get paid dividends. But puts are sold on stocks that investors would like to buy at the strike, or discounted prices. Therefore, this watch list is made up of stocks that pay a good 3.3% average dividend. Traders who want to collect the dividend sooner than later might buy the stocks and sell covered calls instead of selling puts.

The strikes are at relatively low deltas and 7% to 13% margins of safety, which makes these trades less risky of having the stocks assigned in this bearish market. Normally, puts sellers do these trades in bullish markets. Selling puts is a bullish trade.

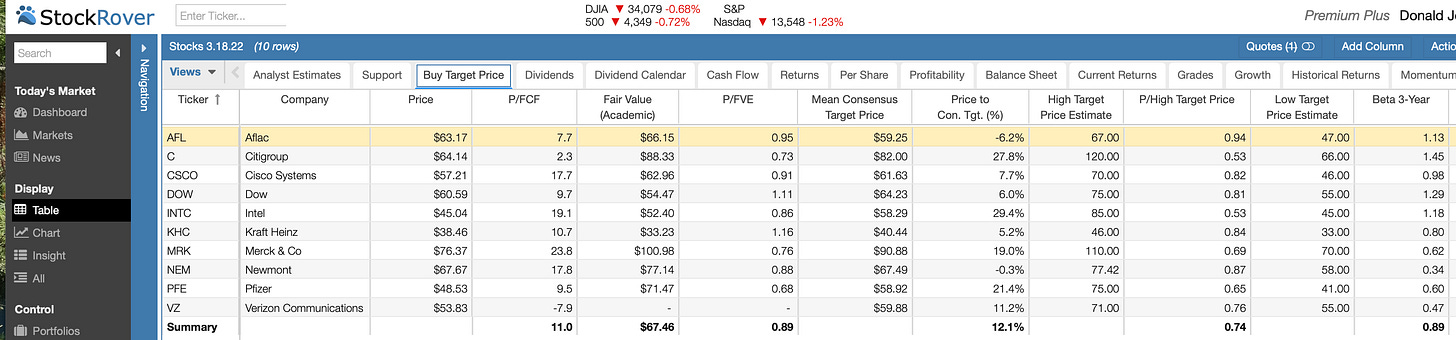

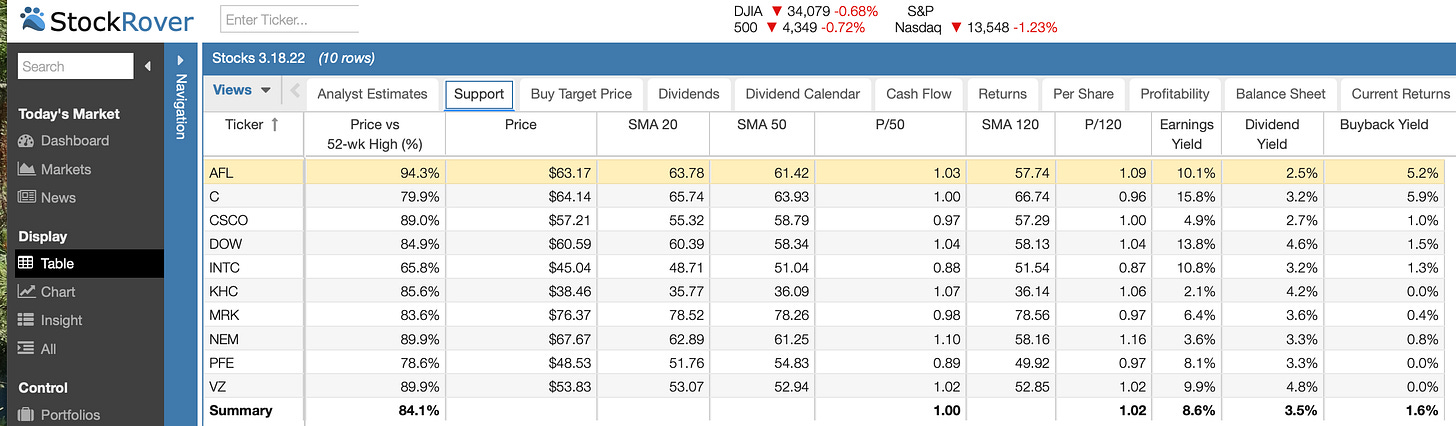

The metrics for this watch list are low price to free cash flow (P/FCF) ratios, prices above or close to 50- and 120-day moving averages, dividends above 2% annualized, prices below fair value estimates and the average target prices posted by brokerage firms’ stock analysts.

These stocks’ average earnings yield is a pretty good 8.6% and the stock buy back yield is 1.6%. The average beta is 0.89, which means the watch list is pretty defensive.

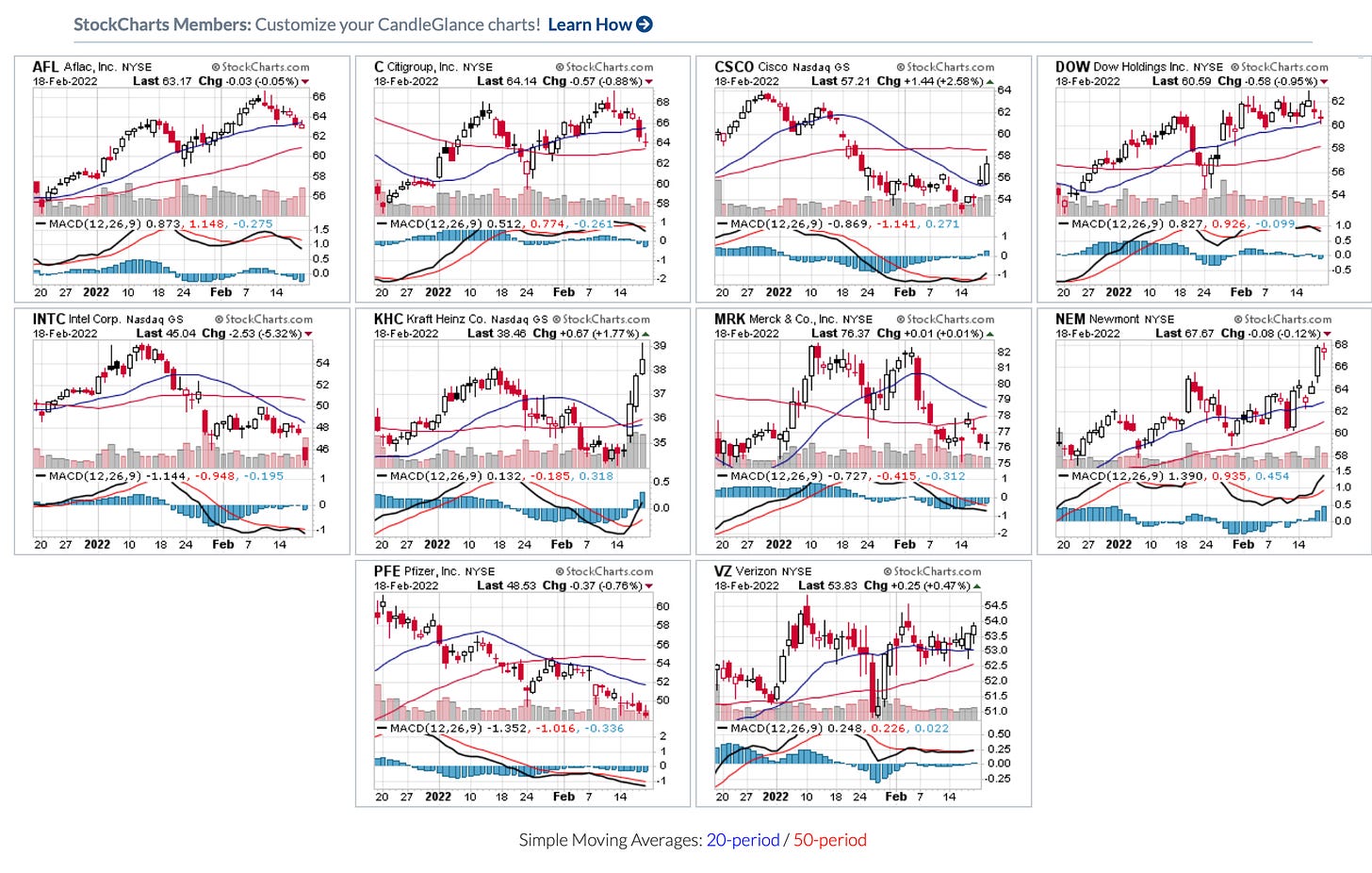

Along the way, we check out the charts and other technicals.

Stocks look bullish when the 20-DMA (blue lineO) is above the 50-DMA (red line). AFL, C, DOW, MRK, NEM, and VZ blue lines are above the red lines. But several of the blue lines are trending lower. CSCO, KHC, NEM and VZ are the most bullish stocks shown above on these two-month charts. CSCO, HKC and, barely, VZ, have bullish MACD indicators.

Please subscribe. It’s free.

Question: What questions do you have about this watch list? We can discuss it in comments.

LINKs:

Home Page. See previous articles on other stocks.

Calls vs Puts Options: What’s the Difference?

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own and/or have options positions in DOW, NEM, PFE and VZ.

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks.