10 Dividend Stocks, Covered Calls Trades Still Worth Watching While Markets Correct

The strategy is simple. Pick good under valued dividend stocks. These 10 have active and liquid options that can be used to generate additional income by selling covered calls and puts.

By Donald E. L. Johnson

Cautious Speculator

Dividend and covered calls investors may sell March 18 expirations calls.

For some, it’s time to nibble by buying small positions and selling calls on stronger stocks or on depressed ones.

Others will wait for lower stock prices or a real rally.

It still is not too late to buy under priced dividend stocks and write March 18 expiration covered calls options on them at relatively high delta strikes.

Please click on images and zoom in for better views of the watch list.

But in this correcting market, it may be too early to do trades on this watch list, which I recently published. Please review that article to see the possible covered calls trades.

Selling covered calls at the money (ATM) gives income traders opportunities to collect options premiums and some short capital gains on the 21-day trades. But the risk of having the stock prices sink over the next three weeks is greater than it would be if a trader was selling covered calls in a strong, bullish market.

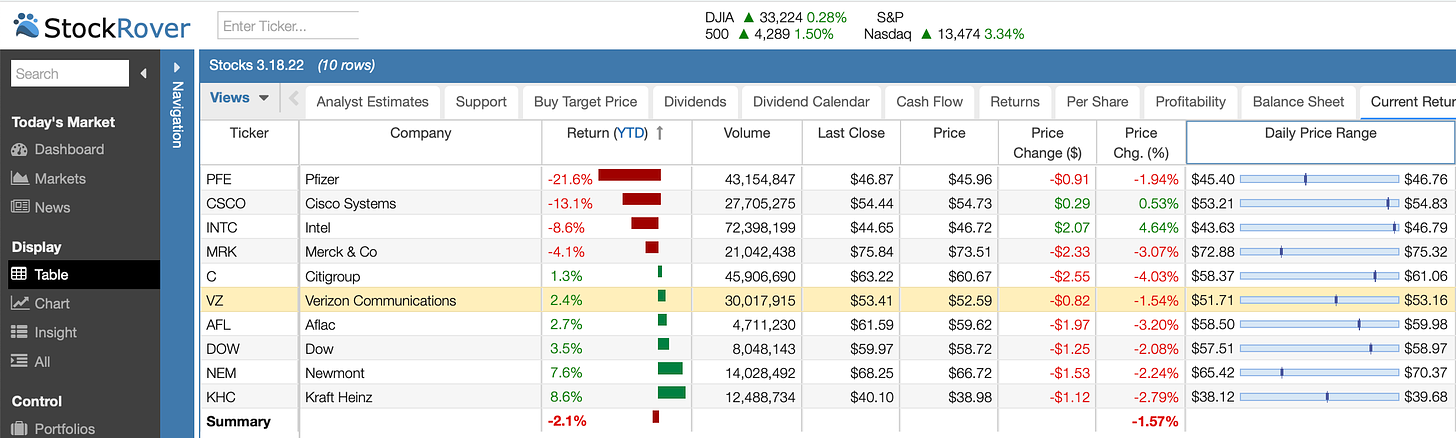

On Thursday, while markets opened sharply lower and closed with a strong rally driven by big tech stocks, the stocks in this watch list closed down an average of 1.87%. They are down an average of 2.1% year to date, which is a lot better than the major averages and most stocks are doing. Futures are basically unchanged at the moment.

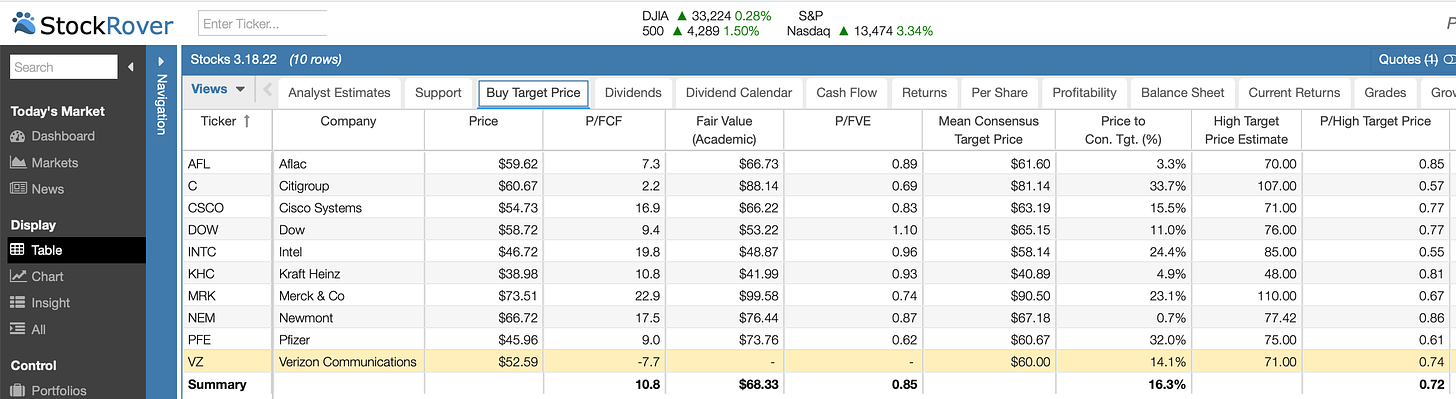

At last night’s close, these 10 stocks had and average price to free cash flow (P/FCF) ratio of 10.8, which is what traders seeking to generate income by selling covered calls and cash secured puts like.

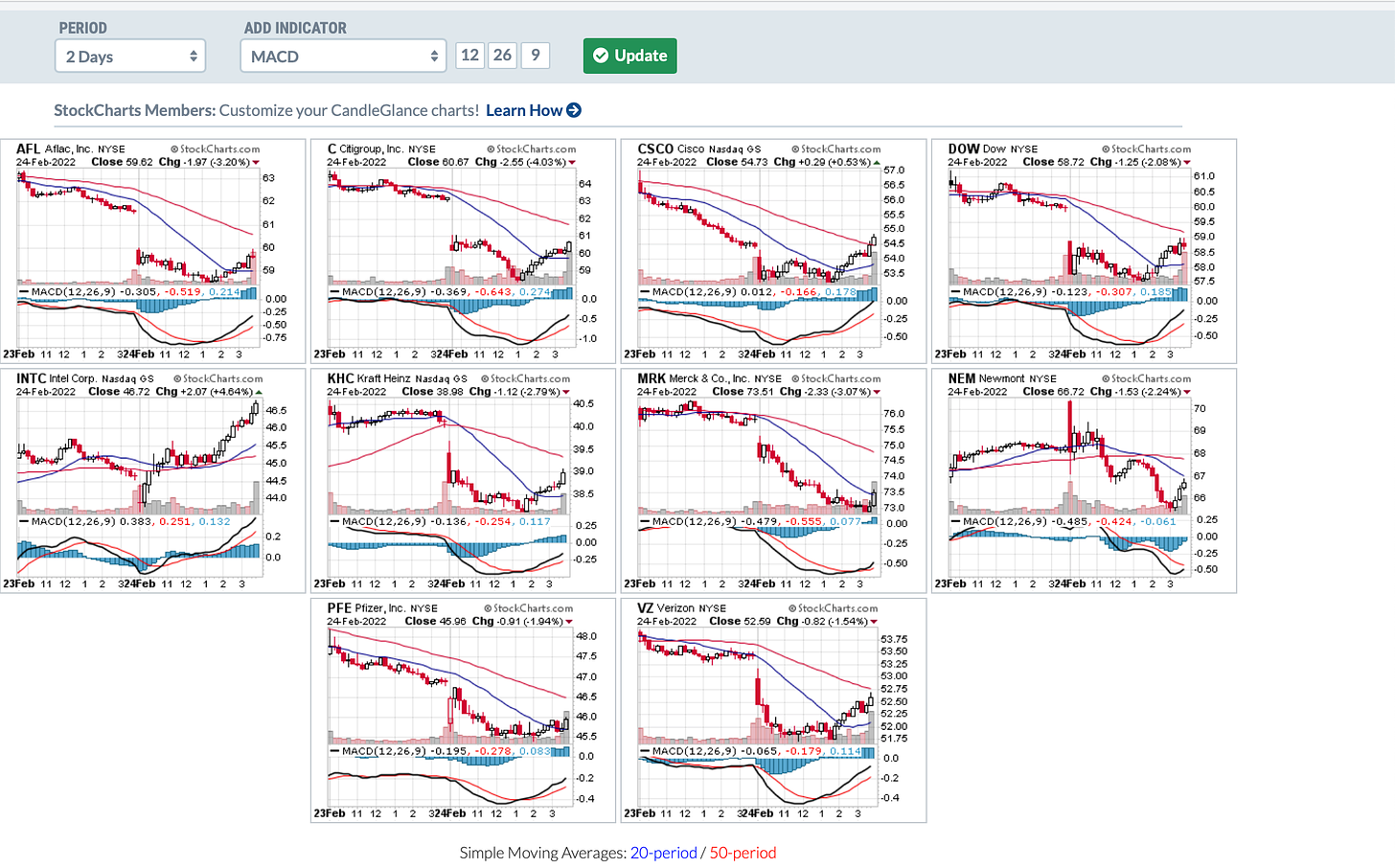

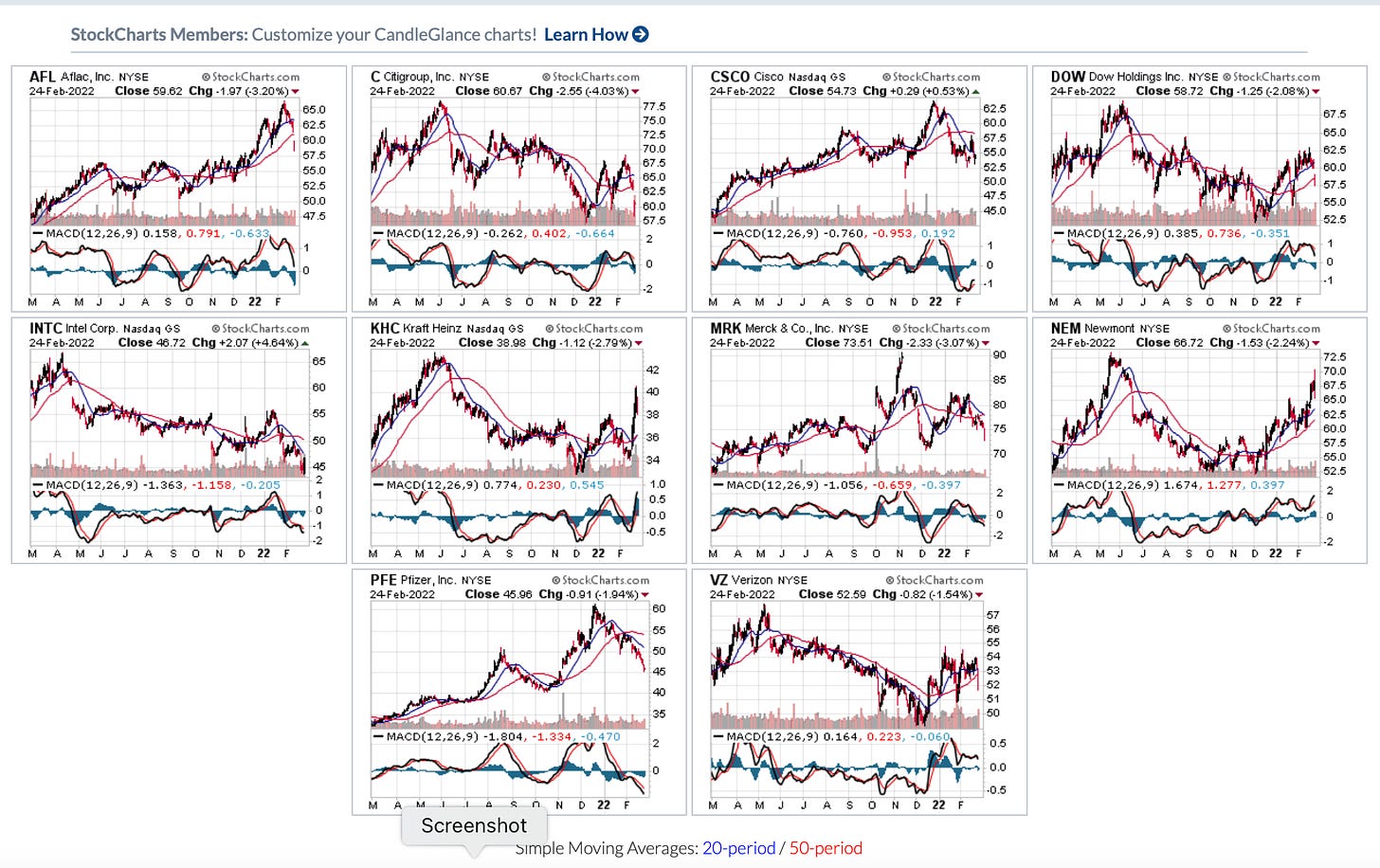

Two-day charts are shown above.

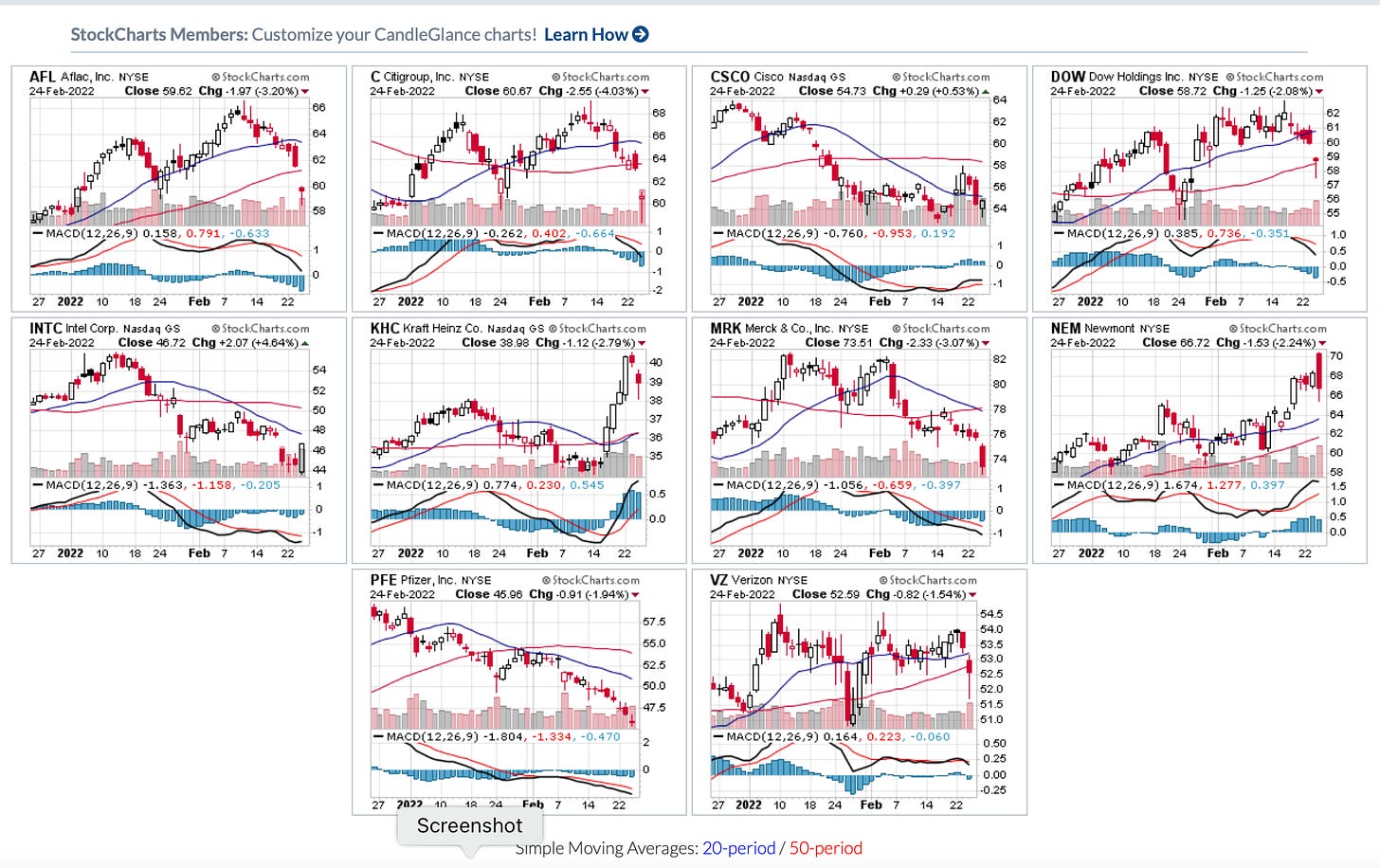

These are two month charts.

And here are one year charts.

It is important to look at charts. They don’t predict anything. But they do give traders a feel for which stocks are performing well, which ones are depressed and which ones look like possible investments, or not. Traders use charts and other technicals when picking stocks and deciding when to enter and close trades.

This week I haven’t done much trading because I’m waiting for lower prices. Several of my covered calls and cash secured puts trades expire worthless today giving me nice annualized returns on risk (RoR) on weekly and monthly trades.

Just before yesterday’s close, I sold WBA 3.18.22 $40 strike puts with a margin of safety of about 12%. That means the stock has to drop another 12% before the options will be assigned. If assigned, I will take the shares and write covered calls on them. I already own WBA.

Every speculator has to decide whether to buy stocks and sell calls now or wait for lower prices or a rally.

Covered calls trades are best done on stronger stocks, but they can be done on depressed stocks with good long-term fundamentals when traders are working the wheel.

When working the wheel, traders buy/write a stock, buying the stock and selling covered calls for dividends and premium income. If the calls are exercised, traders let the stocks go and sell cash secured puts until those puts are exercised. Over the long term, this can generate a good annualized cash flow for the investor.

After trading options on a small group of large, good quality companies with liquid and deep options, a trader becomes very familiar with the companies’ fundamentals and how they move in the markets. This makes doing covered calls and puts trades a lot easier and, usually, rewarding. The key is to manage your risks.

Please subscribe. It’s free.

Question: What questions do you have about this watch list? We can discuss it in comments.

LINKs:

Home Page. See previous articles on other stocks and watch lists. If you read several of these articles, you’ll learn how this strategy is meant to work. No guarantees.

Calls vs Puts Options: What’s the Difference?

If You Buy These 10 Stocks And Sell Covered Calls, Your Premiums Plus Dividends Could Top 10%

10 Dividend Stocks That Look Underpriced; Generate Premium Income By Selling Puts

A video on how to place options trades on Think or Swim.

Beware

Like all investing, trading stocks and options is risky. If you can’t sleep with market risks, you might want to let someone else do your trading. Consider an option trading ETF like XYLD, which I own. I also trade its calls and puts. I’m an active private speculator who trades covered calls and sells puts on stocks for my accounts. I am not a professional analyst nor a financial advisor. I don't take and won't take responsibility for how other people trade. This article is for educational purposes only. It is not advice. The data presented looked accurate at publication time except for intra-day fluctuations, but I can’t guarantee the accuracy. Traders should do their due diligence. I reserve the right to trade any of the listed stocks and options at any time. I own and/or have options positions in DOW, NEM, PFE and VZ.

@realDonJohnson. I’m active on twitter where I tweet about trading and other things and link to tweets about stocks.